What If You Buy A Home At The Top Of The Market? A Look At The Real Estate Cycle

2:37 AM One way to tell whether buying a home right now is a good time or not is seeing what the stock market is doing. The stock market reflects earnings expectations 6 – 24 months in advance. You can investigate further and look at sectors in which your location has large exposure e.g. tech in San Francisco, oil in Houston, and banks in New York City.

One way to tell whether buying a home right now is a good time or not is seeing what the stock market is doing. The stock market reflects earnings expectations 6 – 24 months in advance. You can investigate further and look at sectors in which your location has large exposure e.g. tech in San Francisco, oil in Houston, and banks in New York City.

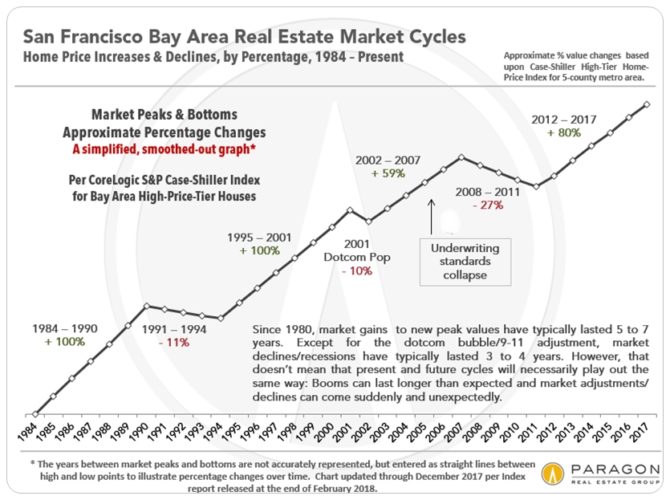

With the stock market seemingly stuck down 10% from its peak, there is a growing chance that you might be buying at the top of the market in 2018. Exactly what that percentage chance is, nobody knows. Maybe the chance is now 50% for expensive coastal city markets, up from 40% in 2017.

Stocks correct swiftly, while real estate corrects slowly until everybody knows real estate is weakening. Then liquidity dries up and the floor drops out. If the stock market is correcting, it’s time to pay closer attention to any investment you make, especially with leverage.

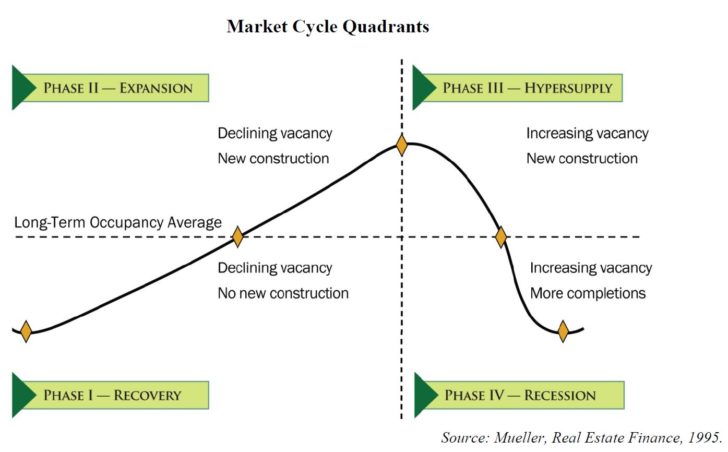

What we do know about the real estate market is that it moves in cycles due to the desire for economic profits i.e. new construction to meet new demand. Peak new construction tends to occur past peak demand, which ultimately leads to temporary oversupply and lower prices. This bust phase usually lasts between 1-3 years before a price floor is found. We are clearly in the hypersupply/boom phase of the cycle now.

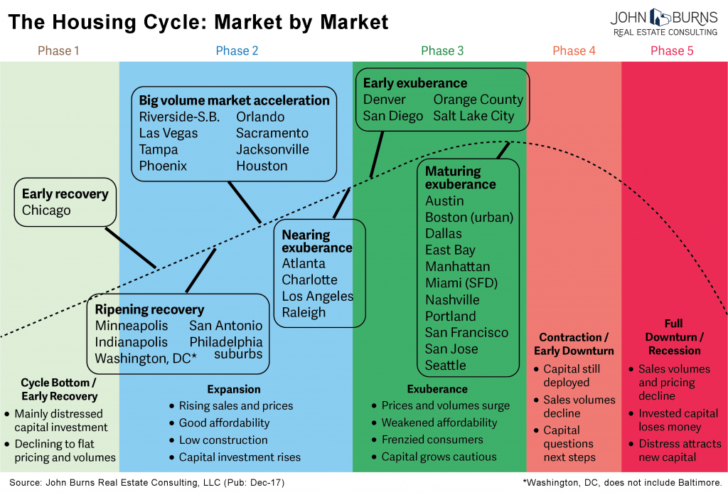

What’s also important to recognize is that every real estate market is at a slightly different phase of its housing cycle. Here’s a nice chart by John Burns Real Estate Consulting which names cities in each phase of the housing cycle.

Given I had three properties in San Francisco with $2,000,000 worth of leverage in 2017, I found it prudent to sell one property and reduce leverage by $815,000 since I feel San Francisco is in the “Maturing Exuberance” stage. Institutional investors have all but pulled out of the California housing market, leaving retail investors fighting for scraps.

Real estate investors can look at the chart above and rationally make an argument that it would be wise to shift exposure from late phase markets to early phase markets to earn more money and protect against downside risk. If you believe in such logic, then you should believe in my thesis of investing in the heartland of America and BURL: Buy Utility, Rent Luxury.

Buying At The Top Of The Market

Let’s say that despite all the signs that the real estate market is at risk of rolling over, you go ahead and buy property with leverage at the top of the cycle. What happens to your mind and to your money? I’ve got first hand experience since I bought my Lake Tahoe vacation property only one year after the peak.

1) You go in denial at first. You will always stand behind your decision to buy at the very beginning. Even if you see a neighboring home on the market sit for longer or drop their asking price, you will justify your purchase by saying your home has a better layout or nicer amenities. You will tell yourself that you bought your home for a better lifestyle first and foremost.

After about a year, the elation of owning your home fades a little bit. It’s similar to the fading elation of buying a new car with a loan. You are thrilled for the first six months, but that thrill dies down while the car payments stay the same. You’ll go online to see the valuation of imperfect comparable home sales to justify your purchase.

2) You begin to accept your mistake. Between 12 – 24 months, you start realizing that maybe you didn’t make the best purchase after all and start telling yourself, “In the long run, things will be fine,” in order to feel better. But the more you look at homes that sell for less, the more you beat yourself up about your purchase.

You start doing calculations on how much you could have saved on the downpayment or on the monthly cash flow if you had just been a little bit pickier or a little more patient. You look at the nicer homes you could have bought with what you paid and kick yourself a little bit. Finally, you tell yourself, “It’s just money at the end of the day.”

3) You start to think worst case scenarios. Due to leverage, a 10% decline in the value of your home is a 50% decline in your 20% downpayment. Just as the stock market can correct 10% in a month, the real estate market can easily correct 10% in a year. Once the momentum to sell begins in real estate, it starts getting scary, especially if you own a condo in a large building.

During a worst case scenario, you start calculating how long you can keep the house before you run out of savings if you lose your job. You also calculate how low the house can go before it no longer makes sense to keep paying the mortgage. During the worst stage of a correction, you may really begin to freak out because you will know friends who have been laid off. You start wondering when you’ll be next.

4) You start to cut out all excess fat from your budget. The great thing about being rational is that during difficult times, all extraneous expenses get slashed and savings rates go up. You might even try and get a second job or work a side hustle if you really start getting worried. Fear of financial ruin in 2009 is what got me to start Financial Samurai. I needed a cathartic outlet to release my fear. I needed something to do just in case I was one of the thousands of people who got fired from the finance industry that year.

During the financial crisis, I didn’t buy anything. I also hustled harder to build relationships with clients who were my only leverage to keeping my job. Instead of buying groceries, I took as many clients out for lunch and dinner to not only build better relationships, but save on food! Yes, I took leftovers home to feed my wife as well. My clients were also worried about losing their jobs and also wanted to save money. When you go through a crisis with someone and survive, your relationship thrives in good times.

5) You either stick with the game plan, or stick it to the bank. If things get really bad where you’re underwater on your home, you will need to make the crucial decision of either staying current on your mortgage or stop making payments. First, you must realize which states are non-recourse states so they don’t come after your other assets after you welch. By short-selling or foreclosing on your home, not only do you ruin your credit and dignity, you also hurt your neighbors who decided to keep paying.

But in America, it’s often every man and woman for himself. You can foreclose on your home like one financial pro did in 2011. He subsequently got hired by The New York Times to write about money advice and even wrote a book about how to improve your finances! This example is one of the reasons why I’m so bullish on America. It doesn’t matter what mistakes you’ve made or who you are, you can always come back.

Nothing Happens If You Decide To Keep Paying Your Mortgage

If you decide to keep paying your mortgage, then life goes on usually as planned. After all, real estate markets tend to recover over time, and few people go into buying the most expensive thing in their lifetimes without a long-term holding plan. The one thing you will run out of is time.

I bought my Lake Tahoe condo after a 12% correction in 2007. At the time, I thought it was nice to save $100,000 from the original purchase price. Little did I realize the value of my condo would plummet by an additional ~30% since so many of my neighbors decided to foreclose.

I felt like a real dummy buying the condo two years later. I started thinking how nice it would be to have an extra $150,000 in cash sitting in the bank. I felt so bad about my decision that I decided to become super frugal for the next five years, work extra hours in order to get promoted and paid, and start Financial Samurai as a potential way out.

More than 11 years later, I’m at peace with my decision to buy a third property as a delusional 29 year old who thought he couldn’t lose. Valuations have rebounded from the depths of despair, the mortgage balance is 40% lower, and the value of the condo has shrunk to a small portion of my net worth. There is also satisfaction that I didn’t welch on my debt.

Now, I cannot wait to take my little boy up to play in the snow. I cannot wait to show him how to jump in the lake off one of the public piers. I cannot wait to make roast marshmallows on an open fire after a rewarding hike. I cannot wait to tell him fun stories under the stars.

When his mother and I pass, I hope he has his own family to take up to the mountains one day. Maybe he’ll even have a picture of his parents on the mantle smiling and watching over him.

Related: Why Real Estate Will Always Be More Desirable Than Stocks

Readers, with the stock market stuck down 10%, what gives homebuyers the confidence to pay peak prices today? Have you ever bought property at or near the top of the market? What happened next?

The post What If You Buy A Home At The Top Of The Market? A Look At The Real Estate Cycle appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments