Financial Samurai 2019 Economic Outlook And Personal Goals

1:30 AM Happy 2019 everyone!

Happy 2019 everyone!

With my 2018 finishing with 3.8 4.0 out of 5.0 stars, I’ve thought long and hard about how I can make 2019 better. I’ve found a solution.

My 2019 theme is: live the good life. If you live the good life, how can life not be better?

Some people like to tighten their belts during economic uncertainty. I used to be one of those people in 2008-2009. But after a raging bull market since 2009, I feel it’s OK for my family to start spending more on life instead of letting our investments piss away our wealth.

Besides, if panic increases, there will be lots of things going on sale. Let’s first discuss my outlook for 2019 and then I’ll go over my goals.

Financial Samurai 2019 Outlook

Things are uncertain, to say the least. From policy errors by the Federal Reserve to trade wars by Trump to a drastic slowdown in corporate earnings growth (20%+ down to ~7%), we are facing many headwinds in 2019.

Despite the 4Q2018 sell-off in the stock market, JP still wants to raise rates another two times in 2019 to keep inflation at 2%. There’s an old saying on Wall Street: don’t fight the Fed. You will get run over.

If the housing market is weakening, the stock market is correcting, and if the labor market softens given companies are now 20% less valuable on average, it’s baffling why the Fed thinks inflation will accelerate in 2019.

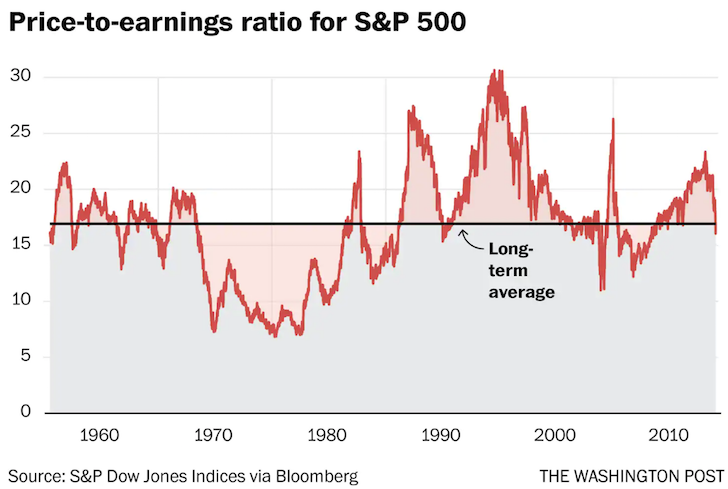

The good news is that 4Q2018 has baked in a lot of the negatives. Valuations are now at around historical averages and expectations have been reset. This doesn’t mean we can’t go lower. And let’s put things in perspective, a -6.2% year for the S&P 500 is not that bad. If it wasn’t for the huge post-Christmas rally, performance would be much worse.

The question everybody needs to ask themselves is whether the equity risk premium is worth taking. If you can get a 3% risk-free rate of return or pay down more expensive debt (mortgage, student loans, credit cards), is it worth taking risk in equities to maybe make a greater return?

My answer is no. Give me a 3% – 5% guaranteed return any day while the world recalibrates. The stress of trying to make perhaps a 10% return in the stock market is simply not worth the premium since there’s probably an equal chance stocks will go down. The peace of mind of a risk-free return should not be under-appreciated, especially if you have more certain ways to make money.

Of course, there are no guarantees. Therefore, my plan is to keep my existing public investments just the way they are (45%/55% stocks/bonds) and use my monthly cash flow to pay down debt and invest in a 70%/30% ratio. At the very minimum, my Solo 401(k), SEP IRA, and son’s 529 plan will all be maxed out. If the S&P 500 gets back to 2,800+, I will be aggressively selling down more stocks.

I’m in the “low interest rates for life” camp. Once again, I don’t see the 10-year bond yield finishing over 3% in 2019. This is a risky call since the 10-year bond yield is not far away at 2.75%, and reached as high as 3.2% in 2018. But this call simply means the yield curve will continue to flatten as the Fed stubbornly continues to raise rates, leading to a recession by 2020.

Given it takes 2-5 years for real estate cycles to play out, I see further weakness all year in expensive coastal city real estate markets like San Francisco, San Jose, Seattle, LA, San Diego, Boston, New York, and Washington DC. Cities with unlimited land for expansion like Las Vegas, Dallas, and Denver are likely going to continue weakening as inventory surges higher. The heartland of America will not be immune to a real estate slowdown unfortunately.

The positive in real estate is that mortgage rates will continue to stay low. With rising inventory and low interest rates, affordability will increase and bring in new buyers. There might even be a refinancing boom again. I don’t see a real estate crash like the stock market crash of 4Q2018. Instead, we’ll see a soft landing as prices slowly decline by another 5% – 10%.

Finally, I predict more people than ever will generate new income sources beyond their day job. Whether it is starting a website or investing in assets that are countercyclical to the stock market, people will no longer take their job security for granted.

Only the misinformed believe a large correction in stocks has no bearing on future corporate employment decisions. You must always be forward-thinking when it comes to investing.

Buckle down folks! If you do not get your finances right in 2019, you might end up losing years worth of time and effort. 2019 is not the time to be a hero. Instead, 2019 is the year to bullet proof your finances by earning more based on what you can control.

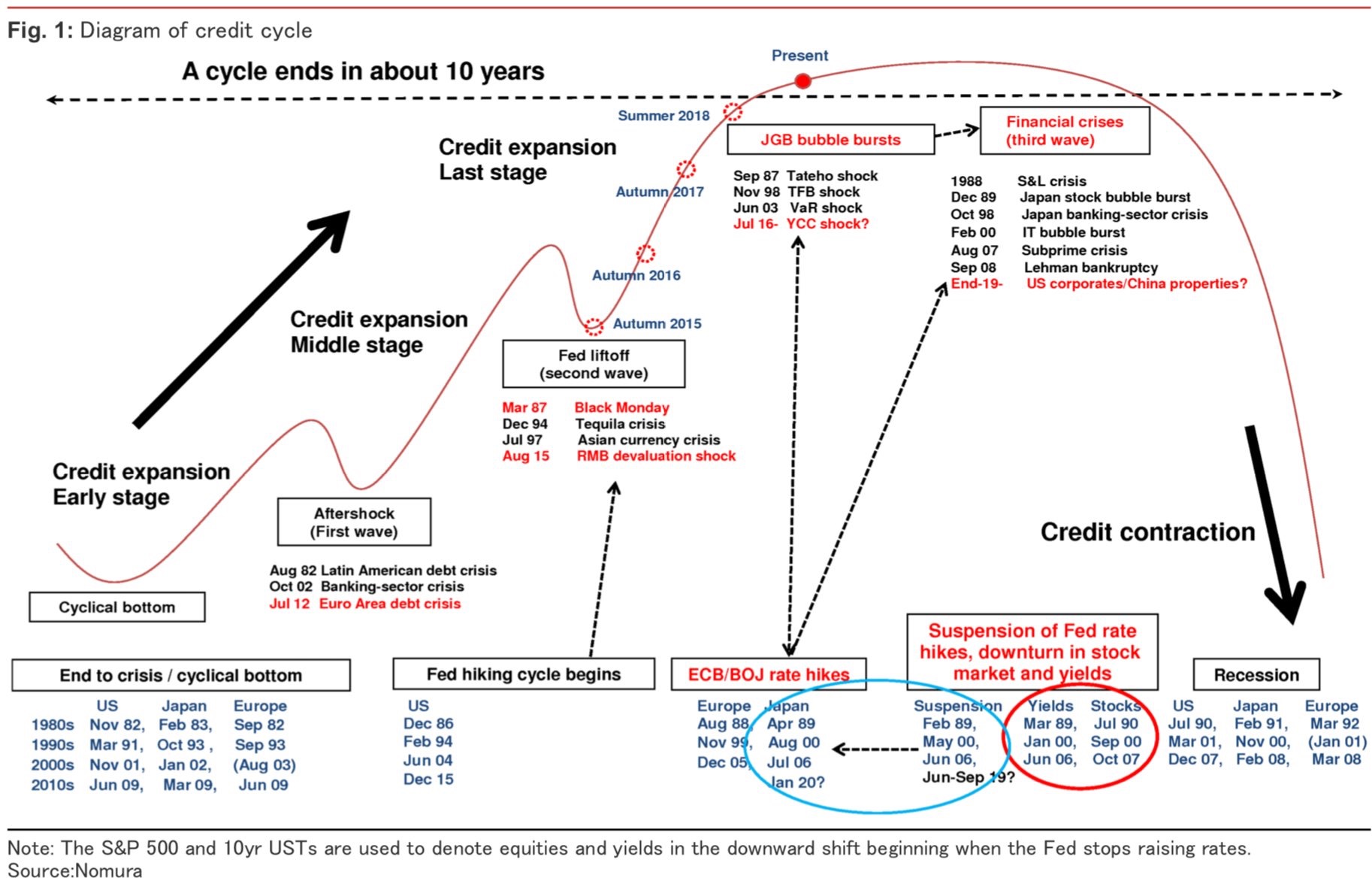

A possible scenario to be aware of by 2020 according to Nomura

Financial Samurai 2019 Goals

1) No gray hairs, no chronic pain. I’ve learned over the years that our body reveals our true stress level no matter what we do or what we say. My goal is to keep things like sciatica, lower back pain, TMJ, grey hairs, wrinkles, hair loss, migraines, and excessive weight gain at bay in order to live longer and feel healthier. Stress is the silent killer of our generation.

Specific activities for the year include: exercising and stretching 3X a week, taking walks with my son 5X a week, incorporating 15 minutes of meditation 3X a week, and eliminating sugary drinks. I will continue to maintain a body weight of between 165 – 170 lbs at 5′ 10″.

2) Remain unemployed until September. My son turns two in April, and I plan to remain a stay at home dad at least until then. Although, I’ve given myself a green light to find full-time work after two years, my ultimate goal is to remain a stay at home dad until he is eligible for preschool in September if he is mature enough to attend. If he is not, then my goal is to remain a SAHD until September 2020 for 3 years, 9 months total.

In order to stay unemployed, I need to make sure my risk exposure is appropriate so I don’t stress out about losing too much money, get out of the house at least two hours a day for some me time, and attend more social functions. Activities include tennis, softball, startup gatherings, Napa/Lake Tahoe getaways, and our first family trip to Hawaii. Of course, if the bull market continues, then staying unemployed will be relatively easy.

3) Hire help for the business. After almost 10 years of running Financial Samurai with only my wife, it’s time to get some help with writing. I’ll be slowly looking for someone who is WordPress savvy, trustworthy, intelligent, reliable, dedicated, believes in my five core principles, enjoys writing and wants to earn some steady side hustle income. The fit has to be fantastic, otherwise, I’ll just continue to operate the site as usual.

I realize many sites my size or smaller have 1-4 people, on average, working to write content and handle some of the business elements. Now that I’ve discovered how great it is to hire help around the house, it’s only logical to hire help for our business.

4) Focus on profits. Since I’m going to hire help for the business, I want to get a return on my investment. To not get an ROI on my capital expenditure would make me a foolish businessman.

I or my new hire will write more review posts, develop more affiliate partnerships, build my blog marketing business, update my severance negotiation book, and maybe create a new Financial Samurai product. I’ll still publish my usual style posts 2-3X a week. There will just be more content all around as there is no limit to how many posts and pages a website can publish.

It’s going to feel great to finally start seriously focusing on monetizing Financial Samurai after 10 years. I already get the occasional flak from readers who criticize my work and don’t pay me a cent. So I now plan to unabashedly take full advantage of my platform to take care of my family, especially if the economy softens.

5) Grow the Financial Samurai Forum. For four years, I was a forum junkie in college. It was one of the best ways I learned about investing and finance. But in order for a forum to grow, it needs to be nurtured. Therefore, I plan to continue posting and corresponding at least 5X a week on the forum to build the FS community.

I have a 5-year plan to grow the Financial Samurai Forum into one of the best financial forums on the web. Specifically, I want to double its traffic in 2019. The forum is geared towards people who fundamentally believe that making more money is a better way to grow wealth than mainly through saving. I want to build a community that is open-minded and always curious about new ways to get better.

6) Help my boy reach the following milestones by year-end. Being a full-time parent is an incredibly rewarding job because you get to teach and witness progress on a daily basis. I’ve discovered that through Financial Samurai, foster youth mentoring, and coaching high school tennis that I enjoy being an educator. Below are some specific goals we are looking to help him develop by 2 years 9 months.

Play and Social Skills

- Sit comfortably in circle time for more than 10 minutes

- Enjoy playing with the piano, guitar, and drums

- Play with toys without mouthing them

- Screw and unscrew jar lids and turn door handles

- Build towers of more than 6 blocks

- Copy a circle with pencil or crayon

- Show affection for friends without prompting

- Be away from parents with supportive and familiar people for 4 hours or more to prepare for pre-school

Coordination

- Walk down stairs unassisted

- Maintain balance while catching a ball or when gently bumped by peers

- Throw and attempt to catch ball without losing balance

- Walk and maintain balance over uneven surfaces

- Use both hands equally to play and explore toys

- Learn to pedal a tricycle

Daily Activities

- Able to self-calm in car rides when not tired or hungry

- Tolerate diaper changes without crying or whining

- Has an established sleep schedule of 10 hours or more a night and 1-2 hours of nap time after lunch at least 5X a week

- Able able to self-calm to fall asleep

- Able to tolerate and stay calm during dental visits

- Able to brush his teeth without whining or crying 3X a day

- Is potty trained before preschool starts in September

- Dresses and undresses self by figuring out buttons, zippers, and straps

Communication

- Is able to consistently use 3-4 word phrases e.g. “I am hungry,” “The garage door is white,” “Walk with daddy,” “Financial Samurai is the best!”

- Uses “in” and “on”

- At least 75% of speech is understood by any caregiver

- Follows 2-step unrelated directions, e.g. “give me the ball and go get your coat”

- Understands “mine” and “yours”

- Says words like “I,” “me,” “we,” and “you” and some plurals (cars, dogs, cats)

- Understands half of what we communicate to him in English, in Mandarin

The next 12 months is going to be a huge challenge due to his growing temper tantrums. Another challenge is staying healthy since we’re all getting sick more often now as he’s exposed to other kids. Luckily, my wife and I haven’t been sick at the same time yet. We’ll finally introduce some screen time to him after his second birthday, which should help keep him occupied during trips.

7) Spend $1,500 more a month on life. We have frugality disease. We are spending less today than we were in our late 20s, despite having a much higher income and net worth. Our estate planning lawyer sessions really made us realize we will likely die with too much.

I’ve been slowly spending more money on things that may improve our lives. For example, the $4,000 large jet tub I bought in 2014 has come in handy for family bath time now. The $15,000 I spent on the outdoor hot tub in 1H2017 was one of the best purchases ever. Further, I have no regrets paying $58,000 cash for a used family car in December 2016 either. Baby steps on the road to lifestyle inflation!

We will allocate the extra $1,500 in spending towards more babysitting help, more massages, bi-monthly house cleaning, and quarterly gardening. We will purchase at least economy plus tickets for all our parents to come visit. Further, if we take our first flight as a family, we will purchase economy plus tickets as well.

We are also going to regularly give to two charities all year. One will be to a center for foster kids and abused youth. Another will be for children with visual impairments. I also like supporting public park tennis initiatives.

Related: Practice Taking Profits To Pay For A Better Life

8) Pay off $200,000 of mortgage debt. Paying off my SF rental condo in 2015 felt wonderful. I don’t care whether it goes up or down in value because I truly plan to own it forever. Selling my SF rental house and paying off a $815,000 mortgage in the process also felt terrific. No matter how much more I could have made investing in risk assets, I’ve never regretted paying off debt.

Our ultimate goal is to be debt free by 2022, when our boy is ready for kindergarten. Paying down $200,000 a year in extra mortgage debt will accomplish this goal. In a bear market, it feels great to earn a guaranteed return. But it’s also important to have lots of liquidity to take advantage of opportunities as well.

9) Aggressively search for a larger house. I dodged a bullet in 2018 by not buying a larger house for more money. I wrote two offers for San Francisco homes that both got rejected. I was seriously going to try and buy this one expensive SF house in a great neighborhood, but by the time I was going to put in an offer, they had accepted another offer on November 1 for asking. If I had bought the house I’d be feeling nervous today since the stock market corrected by 20% soon after. It’s not unreasonable to assume to house is now worth $200,000 to $400,000 less today.

Meanwhile, the seller of the house in Honolulu I’ve been eyeing since 2016 gave up trying to find a buyer in 4Q2018 and rented out the house from Oct – January to short-term tenants. The original asking price was $4.7M in 2016. Today, I think there’s a good chance they will accept $3.5M – $3.7M.

I want a bigger house in SF so my parents, in-laws and sister can come visit for a longer period of time. One more bathroom and 500 sqft more of space would be ideal. However, if I move to Honolulu, I won’t need a bigger house since my parents have their own house.

I anticipate there will be many more deals in 2019 given inventory will likely be up 50% – 150% in San Francisco and Honolulu. I suspect the IPOs of Uber, Lyft and others will put a -10% floor on SF prices.

10) Be a voice for at least 50% of the population. Due to the high cost of living, there are very few personal finance bloggers who live in an expensive coastal city. This makes rational sense, especially if you are a FIRE blogger. But a full 50% of the national population lives in expensive coastal cities and other big cities around the country that face slightly different challenges. Therefore, I have an opportunity to establish Financial Samurai as a go-to resource for big-city audiences.

It’s going to be fun tackling topics such as: private grade school tuition, the feasibility of retiring early with a family in a HCOL area, forsaking wealth and prestige, the dangers of creating multi-generational wealth, featuring diverse cultural backgrounds, and more. My goal is to convince big media to provide a more diverse perspective on financial independence since not everybody can or wants to move to a low cost area of the country.

11) Be more forgiving of myself. No matter what project I undertake, I always run through the finish line. Financial Samurai’s finish line is July 1, 2019 after I made a promise in 2009 to publish 3X a week for 10 years. After that, who knows the future.

The funny thing about this finish line is that it is completely arbitrary. There is absolutely no need to put pressure on myself to produce so much content, especially if I’m having a rough week or sick. Financial Samurai surpassed my expectations long ago. Therefore, I’m going to give myself four weeks where I’ll just publish one post plus I’ll take it easy the entire month of June, when traffic is slowest.

By giving myself a break, I hope to sleep in more regularly until 6am. For the majority of 2018, I was naturally waking up by 5am after going to bed around 11pm. But during 4Q2018 and after daylight savings, I started naturally waking up as early as 3:30am to get my writing done before my wife and son woke. This crazy early time must have been due to increased anxiety from the stock market collapse.

With more sleep and less stress, I hope to improve my overall mental health and happiness. My desire to constantly grind stems from mistakes made in high school, plenty more rejections as an adult, and an indoctrination since I was a kid that I need to try harder as a minority to get ahead in America. I know I have a really good thing going now, so I want to do my part to not take my good fortune for granted.

12) Celebrate big and small wins. To make the hustle more worthwhile, we will celebrate all our achievements as parents, writers, and entrepreneurs. A celebration can be as small as opening a nice bottle of wine. These celebrations will also help us fulfill our goal of spending more.

Every evening I will highlight something specific I appreciate about my wife so she always feels recognized and loved. She is an incredible full-time mom who launched the FS Forum, finalized our revocable living trust, registered How To Engineer Your Layoff and Cutie Baby with the Library Of Congress, and is responsible for all ongoing business accounting. It’s clear I haven’t done a good enough job appreciating her efforts over the years, which is why I’m committed to do more for her in 2019 and beyond.

Steady As She Goes

If we can grow our net worth by just 5%, I’ll be happy. I’m willing to foregoe upside investment potential to help ensure our net worth goes up in 2019. Despite our public investments accounting for only about 30% of our net worth, it gave me the most stress in 2018. This will change.

I still have hope the Fed will slow down its rate hikes. If they do, I’m confident the economy will chug along at 2% – 2.5% GDP growth and not enter into a recession. However, there are no exciting positive catalysts on the horizon except for a trade agreement with China by end of 1Q. 2019 will likely be another volatile year.

The last two years working on FS and being a SAHD has worn me out. Given we save most of our after-tax business income by living off our passive income, I’m excited to live it up more in 2019 and use my “vacation credits” to take it easier.

If you have any tips on how to smartly inflate your lifestyle without feeling guilty, I’d love to hear them. I also want to learn how to inhale the roses more often without feeling the need to always be productive.

What are some of your goals for 2019? How do you see the stock market and economy unfolding?

The post Financial Samurai 2019 Economic Outlook And Personal Goals appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments