Opportunity Zones: The Tax Efficient Investment Of The Future

2:39 AMWhen I traveled to China in the early 2000s for business, I frequently explored Special Economic Zones (SEZs) that received preferential tax and incentives for businesses. With most of the economic growth centering around Beijing and Shanghai, the central government wanted to spread the wealth. As a result of tax incentives, business streamlining, foreign investment, and technology, SEZ cities such as Shenzhen and Zhuhai are now a couple of the richest and fastest growing cities in the country.

I’ve always wondered why the United States didn’t do the same. Sure, on a state level, governors can provide economic and tax incentives for businesses to set up shop in their respective states. But there was no such program on the federal level, where taxation and regulation are often the highest.

Until December 2017, that is when a new tax law was passed called the Investing In Opportunity Act. The law is designed to lure capital that faces heavy capital gains tax into Opportunity Funds, or O-Funds, which invest in roughly 8,700 Opportunity Zones, or O-Zones. These O-Zones are generally considered struggling cities or towns that are in need of redevelopment.

~8,700 Opportunity Zones

What’s exciting about this tax law is that potentially hundreds of billions, if not trillions of dollars of “smart money” capital could be pumped into our country’s poorer regions. Opportunity Funds would be created to invest in anything from real estate to tech startups to help bring jobs and prosperity to low growth areas.

Over the long run, if the capital can stay in the region, opportunity zones should benefit tremendously.

Tax Benefits Of Investing In Opportunity Funds

Think about investing in an Opportunity Fund like a 1031 Exchange for real estate investors looking to defer their capital gains tax, but with more options. For example, you might be looking to diversify your company stock holdings after it went IPO. Instead of paying a hefty capital gains tax, you can invest the proceeds in an Opportunity Fund focused on real estate redevelopment in what you think will be the next Silicon Valley.

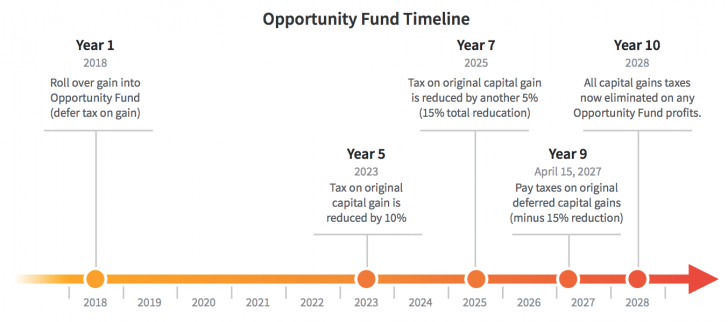

Here’s how the tax benefit would work.

1) Deferral of capital gain. A tax deferral for any capital gains rolled over into an Opportunity Fund. The deferred gain would be recognized on the earlier of December 31, 2026 or the date on which the investment in the Fund is sold.

2) A step-up in basis for capital gains rolled into an Opportunity Fund. The basis of the original investment is increased by 10% if the investment is held by the taxpayer for at least 5 years, and by an additional 5% if held for at least 7 years. In other words, if by December 31, 2026 an investor has held an investment in an Opportunity Fund for 7 years, then the tax on the initially deferred gain will be reduced by 15%, or reduced by 10% if by then held for only five years.

3) No tax on any capital gains from an investment in Opportunity Fund. In the case of any investment in an Opportunity Fund held by a taxpayer for at least 10 years, the basis of such property shall be equal to the fair market value of such investment on the date that the investment is sold or exchanged. In short, after a 10-year holding period, there would be zero federal capital gains tax on profits from the sale of an investment in an Opportunity Fund.

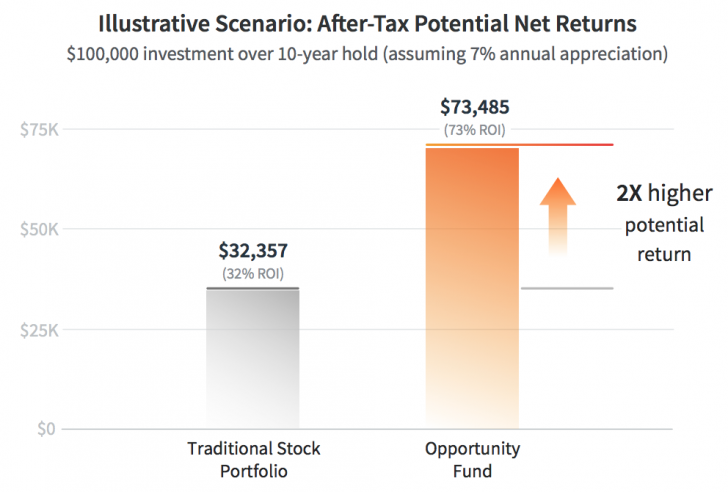

Source: Fundrise

The figure above illustrates how an investor’s potential after-tax returns compares assuming a 10-year holding period, annual investment appreciation of 7%, and a long-term capital gains tax rate of 23.8% (federal capital gains tax of 20% and net investment income tax of 3.8%).

After 10 years an investor would see an additional $44,000 for every $100,000 of capital gains reinvested into an Opportunity Fund on December 31, 2018 compared to an equivalent investment in a more traditional stock portfolio generating the same annual appreciation. Tax efficiency basically doubles the investor’s returns in this hypothetical scenario.

Source: Fundrise

Real Estate Opportunity Fund Investing

Real estate is inherently a long-term asset class, and therefore, one that fits well with an Opportunity Fund’s 10-year holding period in order to avoid paying any capital gains tax.

Because real estate provides shelter, produces income, and is a physical asset, I’ve been much more comfortable investing more of my assets in real estate over the years than I have in the stock market. Unlike the stock market, real estate doesn’t just go * POOF * during a downturn.

One of the fundamental long-term real estate investment strategies is the acquisition of properties at a low-cost basis in an emerging urban neighborhood. As surrounding popular neighborhoods grow and become more expensive, people begin moving into more affordable adjacent neighborhoods, driving new demand and growth.

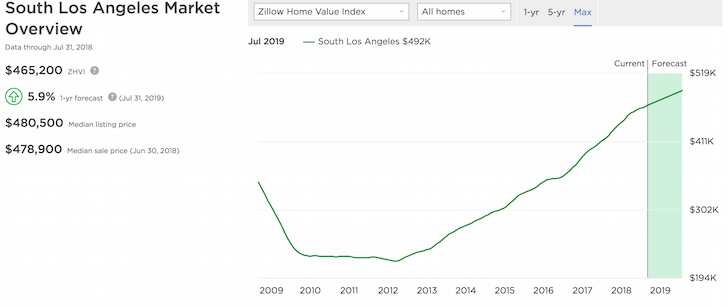

One such example is Los Angeles’s Koreatown neighborhood and South Los Angeles overall. Before doing research for this article, I had no idea an expensive city like LA existed Opportunity Zones. Due to spillover demand, this part of Los Angeles has benefitted from strong price appreciation.

If Zillow’s forecast for a 5.9% increase in South Los Angeles home prices comes true, then having real estate investments in South Los Angeles O-Zone neighborhoods will prove to be a shrewd investment move.

Fundrise Opportunity Fund

The only Opportunity Fund I’m aware of at the moment is the Fundrise Opportunity Fund. Based on the presentation they sent to me, the Fundrise Opportunity Fund intends to acquire, improve, and manage a portfolio of real estate properties based on the following criteria:

- At least 90% of assets must be located and invested in qualified opportunity zone property;

- Properties only qualify if acquired after December 31, 2017

- Qualifying assets must be equity investments, not debt; and

- The original use of such property must commence with the Opportunity Fund, or the fund must substantially improve the property within 30 months of acquisition

Over the coming months, the IRS and Treasury Department plan to release guidance on the implementation of the new program. Interested investors would simply input their e-mail to be placed on the waiting list for more detail.

Here would be the steps to investing in an Opportunity Fund.

1. December 31, 2018: Invest in Opportunity Fund (Day 1)

2. April 15, 2019: Make election on your tax filing showing capital gain rollover into an Opportunity Fund

3. April 15, 2027: Pay deferred capital gains tax 4.

4. December 31, 2028: Opportunity Fund now becomes eligible for tax-free sale (10-year hold)

Pros And Cons Of Opportunity Funds

I love tax-efficient investing, hence why I’ve always maxed out my 401(k) and contribute to my son’s 529 education savings plan. I also enjoy investing a good chunk of change in a long-term fund so I don’t have to constantly think about my investments. Money is best when it’s out of sight and out of mind since it’s only a means to a better life.

I love tax-efficient investing, hence why I’ve always maxed out my 401(k) and contribute to my son’s 529 education savings plan. I also enjoy investing a good chunk of change in a long-term fund so I don’t have to constantly think about my investments. Money is best when it’s out of sight and out of mind since it’s only a means to a better life.

Not only can investors reduce or eliminate their capital gains tax burden with Opportunity Funds, they can potentially make money in new investments, while helping underserved communities. What’s not to like?

Here are some negatives I can think of:

1) The Opportunity Fund manager might make bad investments.

2) Some Opportunity Zones might face structural challenges that will outlast your patience or the fund’s holding period.

3) Opportunity Funds are illiquid and may have unfavorable terms if you want to pull your money out early.

4) The government might change the law and start taxing capital gains again.

5) More investment paperwork come tax time.

No Taxes Sounds Great

Given Opportunity Funds and Opportunity Zones are new, it’s not 100% clear what the final rules will be. But all indications point to favorable tax treatments for investors looking to roll their capital gains to underserved areas of the country.

Finally, in addition to Opportunity Funds, an entrepreneur can set up shop in an Opportunity Zone where costs are cheaper to take advantage of tax benefits as well. It often takes 10 years for a business to become successful. Too bad Opportunity Zones didn’t exist when Financial Samurai started in 2009, otherwise, I probably sell my company in 2019 and ride off into the sunset!

As investors, it’s our job to try and get smart on potential long-term opportunities so that when the time comes to invest, we are able to take advantage of all the opportunities.

Readers, are you aware of any other Opportunity Funds available to retail investors? What are some other positives and negatives of the Investing In Opportunity Act you can think of?

Thanks Fundrise for being a long-term affiliate partner and Financial Samurai sponsor. From their Internet Public Offering to their eREITs, I’m always impressed with their innovation in the space.

The post Opportunity Zones: The Tax Efficient Investment Of The Future appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments