How We Paid Off $161,000 In Student Loan Debt in 16 Months

4:23 AMHello! Today, I have a great debt payoff story to share from a reader, Kristin Burton. She paid off $161,000 in student loan debt in 16 months, and also just recently paid off her mortgage. Below is her story, enjoy!

In 2016, I finished grad school with $161,000 in student loan debt.

In 2016, I finished grad school with $161,000 in student loan debt.

That six figure debt created more stress than I ever thought possible.

I initially got my first job as a Physician Assistant and was over the moon excited to have my first salaried position.

However, I very quickly realized it would be very difficult to ever get ahead financially with my minimum student loan payment of around $2,000 per month over the next decade.

Even though it is well within societal norms to take out student loans to get a degree, especially a graduate degree, I experienced substantial shame over having it when it was all said and done.

My husband brought no debt to our marriage, so the major financial burden we experienced had all been thanks to yours truly.

Rather than wallow in my sorrows, I sat down with my husband and we crafted a plan to get rid of it.

We decided to pay off my loans as fast as humanly possible.

What we did to pay off my student loans quickly

In order to facilitate that, we elected to live solely off of my husband’s income and use my entire income to pay off the student loans. I initially thought it would take somewhere between two to three years to complete the process, which is still pretty darn fast.

We kept our expenses extremely low, especially our major overhead expenses. We kept driving our old, paid off cars that we drove in college. My $4,000 silver Chevy Cobalt drove me to and from work for years, and looked pretty impressive in the hospital parking lot next to the collection of BMWs and Mercedes. We didn’t travel much, and when we did we didn’t venture much beyond Florida. We didn’t eat out often either.

As the first few high interest loans were paid off, I started seeing real progress. I finally felt a glimmer of hope! I realized that it was actually possible to clear this debt, which I had honestly been unsure about in the beginning.

I became consumed with the idea of getting it done even faster than we had originally planned.

I applied for four additional part time jobs at various places (called PRN positions in the world of medicine) and was consistently working at least 80 hours per week. Each extra job had a different hourly rate they would pay. I would create my schedule by filling up my open days with the highest paying shift options first, and then trickle in the rest to fill in the gaps.

At one point, I worked twenty one 12-hour day shifts in a row (coffee was definitely a necessity!). I would pick up shifts on evenings, nights, and weekends. While I was working a million hours per week, my husband did all of the cleaning, cooking, laundry, and grocery shopping at our house.

We sacrificed free time and what most think of as “luxuries” in life for the short term. 16 months later, $161,000 in student loans was paid off!!! We were over the moon, and honestly couldn’t even believe what we had achieved in such a short time.

Working those hours may seem crazy, but honestly all of that work benefited me in multiple, non-financial ways.

Not only did my income dramatically increase over the short term, but I was able to gain more experience as a new PA in a shorter period of time. The more hours you spend in your field, the faster you develop competency.

On top of all that, I learned to experience gratitude in a way I hadn’t before. When spending money isn’t an option, you learn to find alternatives.

Date night out downtown became cooking at home and drinking wine on the deck.

A night out with friends became game night with homemade pizza.

Somewhere along the way I figured out that the things that brought me joy actually didn’t require much money at all. I still had days where I just REALLY wanted to go shopping and get a pedicure, but I stopped obsessing over it and learned to enjoy the journey.

For us, making the decision to pay off the student loans was an easy one.

The majority of my loans were private loans with interest rates >9% – feel free to audibly gasp. Essentially, we were going to drown in interest payments alone. I did briefly consider refinancing, but ultimately I just wanted to be done with them. Paying for a refinance, just to have them paid off in a few short years, didn’t make sense for my particular situation.

During the time we were paying off student loans, my primary focus was freeing us from a large monthly payment that was dramatically reducing our ability to save and have extra money to do things like travel.

I tended to look at each month as an individual event, and didn’t necessarily have a long-term financial strategy or overall philosophy. I just knew I didn’t want to be a slave to my student loan payments.

My money mentality has slowly changed over our debt free journey and is now quite a bit different, but we’ll save that for later. I started with the mindset of clearing out large monthly bills, and that was precisely what we did.

How we paid off the mortgage

After my student loans were paid off, we turned to reducing our only remaining debt – our mortgage.

We had initially bought our house in 2014.

At that time, we only had one income because I was still in graduate school. We wanted to put 20% down and had limited resources, so we purchased a dump of a foreclosure.

Literally, the house hadn’t been touched since the 1970s. That being said, even for the corn-covered Midwest, we got a steal on a house. As a result, our mortgage wasn’t substantial. We started making quadruple payments early 2019.

We still weren’t paying nearly as much per month to debt as we had been during our student loan journey. I was no longer working 80+ hours per week, but was still working some extra on top of my salaried position. We were investing 18-20% of our income to retirement throughout the process. A portion of our income actually went to fun as well.

We traveled to Italy, Belize, and Las Vegas (pre-COVID, of course).

We also replaced our junker vehicles with still used, but nicer vehicles. We waited to make the purchase until we could pay in cash. I will never forget the day at the dealership that we sat down to buy our first vehicle together – the look on the guy’s face across the desk was absolutely priceless when two twenty somethings said no financing! We had actually briefly considered taking cash in a briefcase to the dealership to feel like ballers, but then opted to be more “normal” and do a cashier’s check.

In addition to extra mortgage payments, we were setting aside money to pay cash for a substantial remodel. We remodeled our kitchen, dining room, and mudroom in the spring of 2020. We previously had not had the money to do the remodeling we wanted to (hello, student loans), so we had done the best we could with some of the less expensive items like new paint and carpeting. I was THRILLED to finally get the stainless steel appliances, vinyl plank flooring, and white brick fireplace I had always wanted. The entire remodel was a little over $30,000. We paid for the entire project in cash, and actually waited to even start demolition until the entire balance was in the bank.

Shortly after the remodel was completed we realized we were actually closer to paying off our house than we had thought. Those automated quadruple payments had paid off – quite literally! We decided to go all in on paying it off by the end of the year. I temporarily increased my work hours again, and at one point worked fifteen 12-hour night shifts in a row (sound familiar?!).

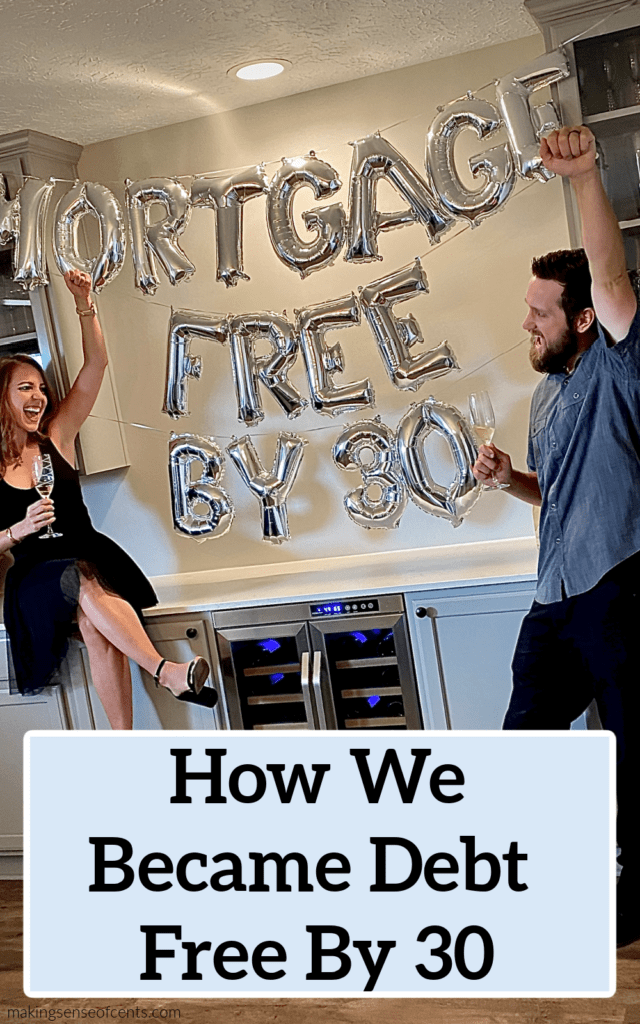

My husband increased his productivity bonuses, and we put all of that extra money towards our mortgage. In August 2020, we became completely debt free including our house! The feeling of peace in knowing that you own every single thing, including house and cars, free-and-clear is unreal. I’m currently still soaking it all in!

The decision to pay off a mortgage early is a personal one, and tends to be a controversial move in the personal finance world. The interest rate on our mortgage wasn’t particularly high. We could have mathematically done better by investing in the market instead.

We elected to pursue mortgage payoff first for a few specific reasons.

- We wanted to reduce our overall financial risk

- We wanted to have almost no monthly bills so that we could invest a large portion of our income moving forward

Because of the fact that we have absolutely no debt, and we have substantial savings built up, we could both simultaneously lose our jobs and live comfortably for at least a year. Especially in this season of massive uncertainty due to a global pandemic, this gives us financial security in a way I never thought possible. In addition to that, we will be able to invest substantially moving forward.

We have committed to investing at least 50% of our taxable income from this point on. This may seem like an unreasonable percentage, but because our only monthly bills now include only taxes, insurance, and utilities it is absolutely feasible moving forward.

Because we are only 29 and 30, we have many decades for these investments to compound and grow to a nest egg large enough to provide us a stress free retirement together.

How my view of money has changed

Over the past few years, my mindset in regards to money has slowly shifted. My primary goal is no longer to have extra money each month.

In fact, my view of money has dramatically broadened beyond any particular month to looking at our overall annual savings rate and tracking our net worth over time. Of course, every month matters because it is a part of the whole. That being said, where I put the majority of my focus had generally shifted.

I have started to read about things like wealth stewardship, financial independence, and consider the underlying purpose of money. I came to the realization that money by itself is neutral.

I now view money as a tool to design a life we love, and so much more than an exchange medium to buy more stuff. The progress we’ve made thus far has given us the confidence that we can achieve any future goals we set. My vision of what is possible is broadening every single day, which is honestly what makes life exciting.

Everyone’s journey with money is different.

After all, personal finance is personal.

Whether you are a fan of paying off your mortgage early, investing early and sitting on the mortgage, or doing something entirely different, I think the core principles of our story can help you succeed.

Get Organized

First things first. For me, financial organization started with a simple budget.

Now, it is a spreadsheet full of net worth tracking, asset allocation, overall savings rate, and income diversification charts. No matter where you are in your process, don’t apply the “ignorance is bliss” principle to your finances.

Track your expenses in a detailed way.

Have short and long term financial goals, and make sure your monthly budget is aligned with them.

Once you achieve something, even if it is a small goal, make sure you celebrate! It doesn’t have to be an expensive celebration, but make sure you are congratulating a job well done along the way.

Pay Off High Interest Debts First

If you have credit card debt, high interest auto loans, etc. it will be extremely difficult to make traction.

This should be the first thing you take care of.

Use whatever means necessary to do it, even if it means sacrifices over the short term.

We used a method commonly referred to as the “debt avalanche” to become debt free. This means we started with the highest interest rate debt first, and then moved down from there.

Other methods, like the famous one suggested by Dave Ramsey, is the “debt snowball”. This method involves starting with your smallest balance debt, and paying debts in order from smallest to largest.

If you have credit card debt, it is my opinion that clearing that debt should be your first priority. Whatever option you choose, just make sure you stay focused and make steady progress each month.

Net Worth Tracking

This was one of my favorite mental tricks to get me through the debt payoff process.

When you’re working 80+ hours a week and receiving large paychecks, it FEELS like you should have a large balance in the bank. During the debt payoff process though, you don’t.

All of your money goes to debt payments.

Money feels like it falls through your fingertips.

In order to combat some of the discouragement that comes with that, I started tracking our net worth fairly early on. Even if your bank account balance isn’t increasing, a reduction in your debt will increase your net worth (calculated as assets minus liabilities). I still remember the day our net worth turned positive!

We were still a long way from debt free at the time, but it was a win worth celebrating nonetheless.

Related: Do You Know Your Net Worth?

Purchase A Less Expensive House Than You Can Afford

As I mentioned, we bought a house that we could afford on one income. In less expensive areas of the country, this is still possible.

We spent months looking for a house in our budget, and ultimately had to buy a “fixer upper” to make it happen. Now that our house is entirely remodeled, I absolutely love it. You would have to drag me out kicking and screaming to get me to move.

We did get approved for a much higher mortgage through a major bank early on. Fortunately, we opted out and stuck with our plan of buying something we could afford to put 20% down on to avoid private mortgage insurance.

If we had gone with a more expensive house, we would have never been able to become mortgage free on this timeline.

Don’t Forget Retirement

Whether you opt to pay off your mortgage early, or leave the mortgage and focus on investing, you need to be saving at least 15-20% of your income for retirement.

The process of paying off a mortgage can be a long and arduous one, especially if you own an expensive home. Missing out on years of potential compound interest for retirement is a mistake you can’t afford to make.

Ensure you are contributing consistently to retirement accounts, and then make extra mortgage payments or do additional investing as you are able to.

Automate The Process

From 2019 on, we were making (at least) quadruple payments to our mortgage.

We had this process automated through our loan servicing company. We set up a recurring payment online of the amount we wanted (make sure you click the box to send the extra to principle). This helped keep us accountable in the months it would have been easier not to make the extra payment.

In today’s technologically advanced world, you can do this for almost anything. Whether you are working on debt reduction, saving money, or investing – automate as much of the process as you possibly can.

Don’t rely on your internal motivation to make the right decision every single time.

Set yourself up for success by creating a situation where the right thing happens automatically, and it actually is more work for you to go in and change it.

This set-and-forget-it approach when left untouched will allow you to look up at the end of the year and see massive progress, without you having to put forth daily effort.

Find Ways To Increase Your Income

Your income is your source of future wealth!

Make sure you consider ways to increase your income on both a short-term and long-term basis.

For me in particular, the short-term version of increasing my income looked like working extra shifts temporarily to hit a debt payoff goal.

The long-term version of this involved changing jobs to a full time position with a higher baseline salary.

This can often be done without obtaining extra degrees or certifications. Brainstorm ideas and be creative.

Now that we are completely debt free, what is next? We are now on the path towards financial independence.

This is the point in which you can live entirely off your investments, and are thus “work optional” or have the ability to retire if you choose.

By saving at least 50% of our take home income, this will be an achievable goal in the next 15 years. I look forward to a life filled with the flexibility to use my time for things that align with my purpose, without a need to emphasize income.

Paying off 100% of our debt will allow us this opportunity.

If you’re at the beginning of your financial journey, be encouraged. It’s not the big moves, but the small things you do every day that make all the difference.

About the author: Kristin Burton is the founder of Strive Coaching, a financial coaching company and personal finance blog. She is a pulmonary/critical care PA, and through her personal experience with crushing student loan debt has developed a passion for helping others with money. Her goal is to fundamentally change the way millennials approach their finances. You can find her on Instagram and Pinterest as well.

Are you trying to pay off your debt? How is it going?

The post How We Paid Off $161,000 In Student Loan Debt in 16 Months appeared first on Making Sense Of Cents.

from Making Sense Of Cents

via Finance Xpress

0 comments