Why I Sold My Rental Home: Had To Live For Today

2:34 AMAfter hearing direct feedback from about 80 of you through social media, my private newsletter, various post comments, and a poll with over 1,500 votes, I decided to sell my Marina, San Francisco rental house I bought in early 2005. I lived in the house from age 28 -37 and had some wonderful memories there. But after three years of being a landlord, it was time to move on.

The decision was incredibly agonizing because I believe it’s best to hold onto a property forever. When I finally sold the house, I didn’t feel joy, but disappointment. I sat in the lounge area of a bank branch looking at the largest check I’ve ever seen in my life and feeling like I had failed my son, myself, and all of you. I’m long-term bullish on San Francisco property, but I felt I had to start living for today.

20 years from now when my son asks how I could have sold the house for so cheap, I’ll point him to this post as I’ll have long forgotten all the details by then. Hope you can forgive me dear boy.

Why I Decided To Sell My Rental Home

77% of you said sell

Back when I was 27, I decided I no longer wanted to live in a two bedroom condo even though it was perfectly fine. Unfortunately, average single family homes in the northern part of San Francisco cost about $1.8M or more back in 2004. But one rainy December afternoon, while I was parking to look at a $1.2M three bedroom condo for sale, I stumbled across a handsome single family home that nobody seemed to want.

The listing agent was from out of town and all she had was a messy home and a flimsy one page black and white flier. To contrast, most homes in this price range have multi-page colored brochures. The house had been sitting on the market for two months and she told me if she didn’t get an offer by Christmas, she was taking the house off the market and re-listing it in the Spring.

Knowing that selling during the holidays is a sign of desperation, I sat down with her to learn more about the seller’s story. The seller was a newly retired couple that hailed from Texas. They had wanted to relocate to San Francisco, but after a knee operation, the wife decided she didn’t want to live in a house with two flights of stairs. As a result, they never moved in and kept renting back the house to the previous sellers. Then I came along.

The listing price was a “more reasonable” $1.55M. It truly was since other homes of similar or smaller size sold for $250,000+ more. Besides not being marketed properly and the incessant winter rain, the main reason why the house wasn’t selling was due to its location on a busy street next to one of the busiest streets in all of San Francisco. We had our concerns too, so we parked outside the house multiple times for 30 minutes each session to see if we could stand the road noise.

The overall market in SF was still strong for properties under $1.5M in 2004. But I discovered that as soon as I crossed the $1.5M threshold, demand fell precipitously. Here was an open market opportunity to buy a single family home below asking, instead of constantly get outbid. I decided that with the installation of double pane windows, the road noise would be bearable. I proceeded to make an offer $25,000 below asking in December 2004.

When they accepted, I felt instant dread. Should I have offered $1.45M instead? But deep down, I felt the house could easily be worth $2M within 10 years, so I went ahead and dumped my life savings into the house and got a two month bridge loan from my grandfather for part of the 20% down payment. My year end bonus got paid out every February.

After purchase, the house continued to appreciate for two and a half years, but the financial crisis came and knocked its value right back down to where I had purchased it, if not $100,000 less. With a $1.2M mortgage, I wasn’t feeling that good about my financial future anymore.

A Recovery And Another Chance

After almost losing my shirt during the financial crisis, the market finally stabilized and miraculously, after more than seven lay off rounds, I still had my job. I remember telling myself that if the housing market ever rebounded where I could eek out a profit, I would sell and never take on such massive debt again.

So in 2012 right when Facebook went public, I decided to list the house, thinking surely someone would be interested in buying a 3 bedroom, 2.5 bathroom home with an unwarranted room and bathroom on the ground floor. The listing time also coincided with me leaving Corporate America and losing a healthy salary. The mortgage was still about $1,000,000 and I worried whether I had made the right move to leave a job so young. During a time of transition, having more liquidity seemed prudent.

After one month of no interest, I decided to do something cheeky and raise the asking price from $1,695,000 to $1,780,000 and then to $1,789,000 (see picture). My ego was bruised and I wanted to show strength. But after another 28 days with no interest, I decided to remove the listing. Destiny wasn’t cooperating with my plans to sell, so I didn’t force the issue. Instead, I refinanced my mortgage to save ~$400+/month and focused on traveling around the world and growing Financial Samurai.

Nobody wanted to buy my house in 2012, thank goodness.

The Transition To Something New

In 2014, we bought a fixer on the western side of SF because we wanted to experience a new adventure in a different part of town. We were *this* close to relocating to Honolulu, but decided if we could bring Honolulu to San Francisco in the form of a house with ocean views, we’d stay for several more years.

Finished building a deck in my new house in 2016

Instead of trying to sell the Marina house again, this time we decided to rent it. To our surprise, we found tenants willing to pay $8,500 a month in rent, so we accepted. The four guys and a dog ended up being a PITA to manage, but $8,500 was way higher than we thought we’d get so the aggravation seemed worth it.

This initial set of tenants only stayed for one year. My next set of tenants were five guys who were willing to pay $8,800. They were the best candidates I could find at the time, largely because families with small children were worried about being so close to a busy street. Either that, or they simply bought. I accepted a $17,000 rental deposit and prayed everything would be OK. For the most part, everything was OK. But there was constant roommate turnover, late rent payments, and maintenance issues (leaky roof, broken kitchen faucet, broken fridge, holes in walls, cracked tiles, damaged kitchen doors, noise complaints, and lawn neglect) that finally made me cry uncle.

Related: Being A Landlord Tests My Faith In Humanity

In addition to dealing with all these issues, I was also busy project managing my new home remodel. Remodeling an entire home is already stressful. Add on rowdy tenants and life begins to become unbearable, even if you don’t have a job to go to. Thank goodness we have been able to resolve these stresses and focus on the birth and care of our new son. As prospective parents, we didn’t know what to expect, but we did know from lots of feedback that raising a baby is way harder than what people say (so true). We wanted to free up as much time as possible to prepare for this new chapter in our lives.

Renting out the Marina house for three years wasn’t a great experience, but at least I gave it a go. The ~$60,000 in net rental income enabled me to finally achieve my long term passive income target of $200,000 a year. But like Anthony Scaramucci, who was fired just 10 days after being named White House communications director, my $200,000 a year in passive income didn’t last very long.

I held onto the Marina house in 2014 because it was tough to let something go after so many good memories. I also didn’t want to be embarrassed again. Besides, I was bullish on SF real estate. Financially, I had a $400,000, 7-year CD come due that provided for the downpayment of my new home. Further, my online business continued to grow.

But after vacating it for almost three years, I no longer had a strong attachment to the Marina house because by then we had made amazing new memories in our new house in Golden Gate Heights. When you remodel every inch of the house, you naturally get more attached to it. I also remember the first night we brought our son home at midnight. It was a magical moment.

Property Prices Rise

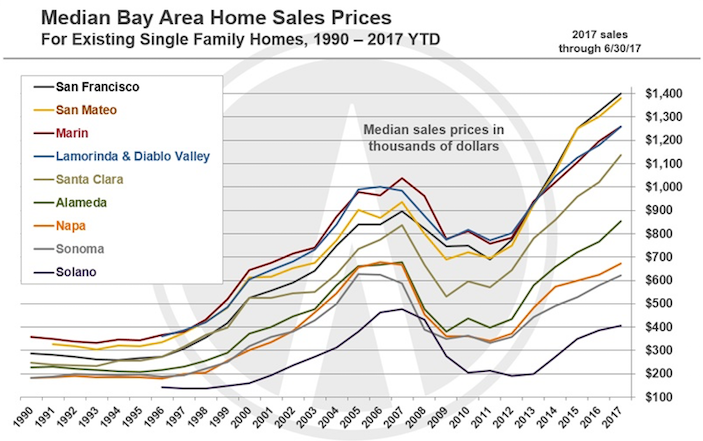

SF median home price rises above $1.4M in 2017, way above the 2006-2007 peak

From a financial point of view, we got very lucky. Because nobody wanted to buy our house in 2012 we’ve been able to double benefit with leverage from a ~20% appreciation in the Marina rental house and a ~35% appreciation in my primary residence.

It’s funny to see how quickly sentiment can change. Most people generally have to sell to buy another house in SF, but I took some risks and leveraged to the hilt. For some time, as the bull market kept on going, I felt stymied by an earlier decision to lock up $300,000+ in a 4.1% yielding 7-year CD . But as it turned out, it was the expiration of the CD and the availability of that money that enabled me to buy my new home.

Further, I had thought there would be a two or three year slowdown in property prices starting in early 4Q2015 when many private companies had their valuations slashed. While the market did slow down for a couple quarters, by the Spring of 2017 it had recovered and was as hot as ever for single family homes. The condo market, on the other hand, is definitely cooling due to a surge in new supply.

By early 2017, after the 8th time my tenants were late paying rent, I started thinking maybe I could get $2.3M or $2.4M for the house (from $1.7M in 2013). And if I could, I would sell. I was texting back and forth with my neighbor to give him the first look, and he said he’d be interested in buying my home via a private transaction for $2.1M. I passed, even though it would have been nice to save on all those fees. I remember feeling vindicated, however, that finally, my home was worth what I thought it could be worth all these years later.

May 2017 offer from my ~35 yo neighbor who has been living for free in his parent’s building since graduation

Then, unexpectedly my tenants gave me an opportunity to test the market by informing me of their intention to vacate on May 8, 2017. I set up a race like I did in 2016 when my condo tenants vacated. In one lane was me in charge of finding suitable tenants within 30 days. In the other lane was a realtor in charge of finding a buyer off market within the same time period for $2,500,000. I decided on $2,500,000 as a stretch price because I was reluctant to sell. Whoever found the client first would win!

Unlike in 2016 with my Pac Heights rental condo, I lost. I couldn’t find my ideal tenant, someone who would take care of my property and stay for at least a couple years. One single mother of four children offered $7,500, but I passed because she was a highly unprofitable startup founder. Another family of 6 offered $7,800 and I passed due to too much wear and tear and such a weak offer. It is much harder to find a $9,000/month renter versus a $4,200/month renter.

Meanwhile my realtor was able to identify a buyer who had lost in a bidding war for a comparable property in my neighborhood. One thing led to another and I received an offer for $2,600,000 just nine days later! It’s worth noting that I had already been looking for tenants for 30 days already before the race began given I received a 30-day move out notification.

Analyzing The Offer

I was astounded by the $2,600,000 offer because another highly experienced realtor had told me that if I put in $50,000 worth of work painting the house, updating the light fixtures, changing the master bathroom tub, and replacing the kitchen floor I *might* be able to get $2,500,000 or so. She was a top producer with 30 years of experienced and visited my house twice to come up with her assessment.

Another realtor I interviewed said that if I put $30,000 into staging, painting and modernizing the light fixtures, I’d probably get around $2,300,000. I was not impressed. But I understand it’s important to manage expectations and surprise on the upside.

I went with my realtor because in 2016 she had sold a neighboring home in Golden Gate Heights for a massive premium. I was impressed with her professionalism when I corresponded with her and most importantly, with her results. The aforementioned house was a dump, had to go through probate, yet finally sold for $150,000 more than I thought (10% over).

My realtor firmly believed I could get $2,500,000 without having to do any further work since I had already painted a couple rooms and refinished the floors. My house is 2,070 sqft plus about 230 sqft of unwarranted space. If you slap on the average price/sqft of $1,171 in the Marina, you get $2,423,970. But my house should trade at a discount due to the location.

The average price/sqft in the Marina neighborhood is $1,171

Even with a surprising offer of $2,600,00, because of commissions, I wasn’t completely convinced I should sell. I was able to negotiate the total selling commission down to 4.5% from 6%, but that was it. In this day and age of the internet, a 4.5% commission is still egregious. That said, the previous realtor who I used in 2012 for a 5.5% fee hadn’t found me a buyer for $1.7M after 28 days. So at least my latest realtor had something for me to consider.

The Counter Offer

We had several other realtors come with their buyers, but nobody made us an offer. The road noise and traffic were always the main deterrents. For some reason, these buyers didn’t mind the noise and were charmed the aesthetics of the home.

Given I didn’t need to sell, I decided to counter at $2,788,000 to cover my commissions, transfer tax and then some. Why not try and test the upper limits without losing the buyer? After several days of hemming and hawing, they came up to $2,700,000, saying this was the best they could do because their purchase depended on bank underwriting.

I was tempted to accept because now I was $200,000 – $300,000 higher than what I hoped to get. But, my realtor kept encouraging me to reconsider the price because she knew I was on the fence.

I countered $2,750,000 firm with a lovely letter about how much they would enjoy living in a single family home with a toddler, instead of in a condo. I wrote about all the upgrades we had done over the past 13 years to make the home perfect. I gave them an Excel spreadsheet of all the things we did and the cost of each item to make them feel like they were getting a good deal. I also showed them pictures of all our work.

After another several days past my acceptance deadline, they acquiesced! $2,750,000 is a significant number because it is a full $1,050,000 more than what I would have sold it for just five years earlier. Being able to earn $210,000 a year in equity while also collecting $100,000+ a year in gross rental income the last three years blew my mind.

It felt like I may have won the lottery!

I write “may have” because the buyer wasn’t the commonly cited cash buyer all sellers hope for. Instead, the buyer had to not only take out a $2,000,000 loan, he had to take out another $300,000 loan at a much higher interest rate because he only had about $400K in downpayment.

Three years earlier, he had bought a $1.5 million condo in the same neighborhood before he had a son. Based on his finances, the max the bank would allow him to buy was $2.6M. The sellers admitted they had been hunting for properties in the $2.3M – $2.5M range when they heard about my house.

Dining/living room of rental home

Things Started Getting Dicey

When the deadline to remove the financing contingency arrived two weeks after accepting my counter, nothing happened. His bank was making him jump through more hoops so he wanted to keep his financing contingency because if he removed the contingency, and the loan didn’t go through, he’d be out $82,500 (3% earnest money downpayment).

With no other rental offers, I decided to extend the deadline several more days after already extending the inspection contingency deadline by four days. But after five days of not getting any sort of update, I began to worry. Worry turned into frustration, so I decided to aggressively look for more renters again! Each day the deal didn’t go through was another day of lost rental income in my mind.

I kept on telling myself that I would regret selling the home 20 years from now due to the robust job engine here in the SF Bay Area. So after a 15 day respite, I marketed my property hard again to find a group of tenants. After a week, I found a group of five guys (girls don’t exist in San Francisco) who ironically all worked at my old employer! It was destiny!

They all made about $80,000 – $95,000 base salary each as first or second year financial analysts. I thought it would be hilarious to write in a future post that even after getting paid for five years after I left thanks to my negotiated severance, I would still get paid by my old employer for at least another year! It would feel absolutely fantastic, so I decided to go with them.

There was only one problem. Instead of offering the $9,000/month that I wanted, they offered $8,300. I countered with $8,500 and told them they could start one month later on July 1, instead of on June 1. They were originally asking to move in on July 16, but I felt that leaving my property empty for that long while also having an outstanding offer to buy was too much.

They finally agreed on the terms, but they bailed the Saturday morning we planned to meet up! They told me they found another property and thanked me for my time. In other words, the true market rental price for my house was not $8,500, but closer to $8,000 a month or maybe even less given two parties offered even less.

Now it was time to panic again because I had sent a document to my buyer to reject the offer and release him of his $82,500 earnest money deposit. Now I had NOTHING. Using my Buy Utility, Rent Luxury framework, someone was offering me 28.5X – 30X my gross annual rent compared to the 20.5X average for the SF Bay Area and I rejected him! What was I thinking?!

But thankfully, the buyer didn’t know everything that was going on, on my end. After I sent the recision document, they told me they were working as hard as they could with the bank to get the loan finalized, and that they still really wanted to buy my house. They said that by Monday or Tuesday, they should be able to remove the contingency and for me to please wait several more days.

Given I had nothing, and nothing could be done during the weekend, I told my realtor to tell the other realtor that I was OK to wait, but no promises. I wanted to them to feel a tremendous sense of urgency to get their loan done since they were already a couple weeks past the deadline. Meanwhile, I was mentally preparing to just keep my house empty for the next 22 years because I was so sick and tired of dealing with renters.

That’s right, I was willing to pay $22,000 a year in property tax, $2,000 a year in home insurance, $5,000 a year in random maintenance costs totaling over $600,000 after 22 years just to hold onto this asset nobody seemed to want to buy or rent. My pride was speaking again.

All signs pointed towards the deal not happening.

Nail Biter Until The Very End

I was stressed, annoyed, and anxious during this 45 day process. Remember, I was getting very little sleep taking care of a newborn who would wake up very 30 minutes to 2 hours. I was running on adrenaline. Then I was running on fumes. Then the fumes ran out so I decided to settle on leaving the house empty forever.

When the buyers were finally ready to remove the financing contingency, I had to make a decision to tell them to go ahead with writing a new offer or telling them I had moved on. By this time, I was too tired to negotiate any longer because they were also holding me to about $35,000 in immediate weather proofing work that needed to be done after the inspector found leaky windows and dry rot. I had disclosed to them one of the light wells leaked through the dining room during the recent winter storms. They were rightfully concerned, and so was I since all I did was get up on the roof and spray the crap out of the roof with FlexSeal.

In the very end, we agreed to a price of $2,740,000. I gave them a $10,000 discount to address the inspection report so they would finally remove the financing contingency and get on with it. The final price/sqft came out to be $1,323, a 13% premium to the average price/sqft in the most expensive part of the town.

I’m happy for the buyers because their loans went through and they’ve now got a great home to raise their son for the next 10+ years. I just hope his new business venture goes well and the economy continues to chug along.

$810,926 of debt was paid off in June

This piece of real estate served us well, and now we no longer have a use for it because we have a new home and more powerful streams of semi-passive income.

In 20 years, I’ll have wished I held onto the property. But I just have to remind myself about all the time and stress I will save by not owning. The older you get, the more valuable time becomes because you have less of it. Besides, I’m just thankful nobody bought the house for $1,050,000 less in 2012.

Dear son, if you got through this beast of post, well done. The bottom line for selling is that I wanted to simplify my life so I could spend as much time with you as possible.

Related:

Every Factor To Consider Before Selling An Investment Property

Debt Optimization Framework For Financial Freedom

Anybody sell their property recently? If so, how did you come to the decision? If you have a harrowing property selling experience, I’d love to hear it! When do you think the real estate market will finally go down?

The post Why I Sold My Rental Home: Had To Live For Today appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments