Silver Linings Of A Stock Market Correction

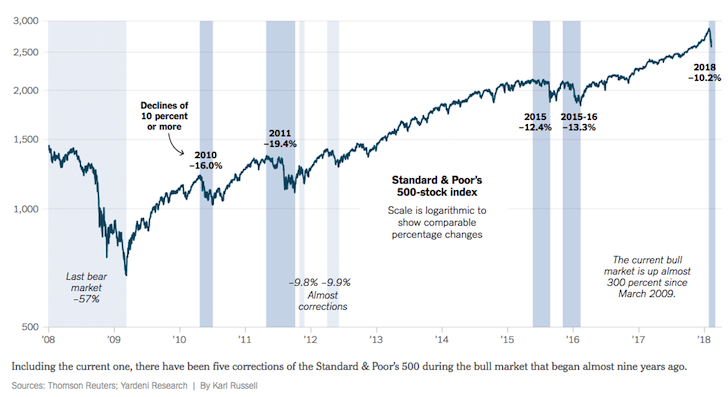

2:32 AMWith the S&P 500 down over 10% from its high in 2018, we’ve officially entered correction territory. If the S&P 500 closes down over 20% from its high, then we will be officially in a bear market.

Whenever the stock market goes through a rapid retrenchment after long periods of stable growth, it always feels bad. Although its never fun to lose money, it’s good to face the situation head on and focus on the positives and what we can learn.

The Positives Of A Stock Market Correction

1) A catalyst to finally learn about risk management. If you’ve only been investing since 2009, the path towards building stock market wealth has been relatively straightforward. I argue its been too easy for the 35 and under generation to build wealth, thereby creating a false sense of security. Being overconfident in your investing abilities can be devastating once you’ve accumulated a large nest egg. See: Recommended Net Worth Allocation By Age

2) The ability to accumulate stocks at lower valuations. The keyword is “valuation,” and not price. If the price is lower by 10%, but earnings are cut by 10%, then you’re paying the same valuation for a stock. But if prices move 10% lower and earnings come out the same, then you’re getting yourself a deal.

The consensus 2018 S&P 500 earnings estimate is ~$155 (+17.8% from 2017). Therefore, at 2,500 on the S&P 500, the market is trading at a reasonable 16.1X. The consensus earnings expectation for 2019 is for earnings to grow by another 10% to $171, or 14.7X 2019 earnings. The trillion dollar question is whether earnings will grow as expected, fall short, or exceed expectations.

Except for the rise in the 10-year bond yield to 2.85%, there was no other fundamental news that wasn’t already out there that could drastically affect earnings. Therefore, at the moment, it looks like investors are getting a valuation discount. And from a bond investor perspective, you’re receiving higher yields.

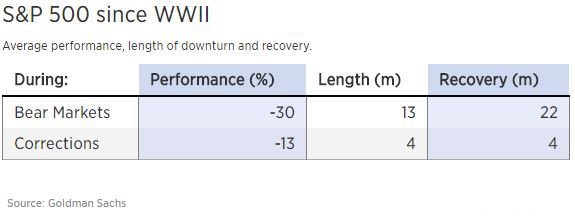

3) It takes time for corrections to play out. According to analysis by Goldman Sachs, since WWII the average correction is -13% over a course of four months. It then takes an average of four more months before the S&P 500 recovers all its losses. In other words, don’t use all your dry powder all at once if the stock market is down 10%+ in just a couple weeks. Rather, leg in through multiple tranches because timing the market is too difficult.

If you have a long-term mentality, you’ll be able to better contain your rush to sell and rush to buy.

4) A return to humility. Every time I write an article about investing, without exception, there will inevitably be someone who comments or e-mails saying how much money they’ve made in the stock market or how they timed a trade perfectly. Over social media, we witnessed a phenomenon of older folks bragging about their $1,000,000+ 401(k) balances. And younger folks love to shout from the top of their lungs how much they make every month online. After a while, this starts to get old.

Financial writers, like yours truly, will also begin to write with more humility. A downturn helps remind me that the focus of Financial Samurai is on learning so we can become better investors, better partners, better citizens, and ultimately happier thanks to the freedom money buys. My finances are used for illustrative purposes only because nobody should give a damn about my wealth except for my family.

As investors, it’s important to constantly remind ourselves that over the long run we are not smarter than the market. We must not confuse brains with a bull market, nor should we confuse stupidity with a bear market.

5) A chance to finally build your long shot. If it wasn’t for the 2008-2009 financial crisis, Financial Samurai would never have been born. Without Financial Samurai, I wouldn’t have been able to have as much carefree freedom as I have today.

The downturn made me fear for my job and my wealth so badly that I finally decided to do something about my fear. We’re nowhere near financial crisis-level panic today, but the correction that began in February 2018 reminded me of the stress I felt 10 years ago.

If you depend on only your job and your investments to keep you financially secure, a violent correction is the perfect time to start brainstorming new ways to make money. Yes, it helps to whip your spouse into working harder and longer so you can just relax, but spouses sometimes also could lose their jobs and investments.

For most people, investments should be considered a tailwind for financial growth. Building a business where you own most of the equity, performing so well at your job that you get regular raises and promotions, and aggressively saving and investing for a long period of time are what really make you wealthy over the long term.

A Refocus On What Matters Most

If you are not careful, money can suck up all your time and make you a little crazy. During one of the -4% days I realized I was already on my computer for 2.5 hours straight watching the markets burn. I was reading everything I could about the why, the what next, and what to do.

Once I realized my glued obsession, I shut my laptop, went downstairs to see my wife and son, gave them both big hugs and kisses and started to play. After all, the point of financial freedom is to not worry about money.

In 20 years, this correction won’t make a lick of difference. Don’t forget to enjoy your life during the process. If you need me, I’ll be finish up my underground bunker just in case the world comes to an end.

Related: Investment Strategies For Retirement Based On Modern Portfolio Theory

Readers, what are some other silver linings due to a stock market correction?

The post Silver Linings Of A Stock Market Correction appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments