Why It’s Better To Retire In A Bear Market Than In A Bull Market

2:32 AM Living a comfortable retirement life is all about managing expectations. You generally don’t need as much as you think to be happy because the freedom you gain more than makes up for lost income.

Living a comfortable retirement life is all about managing expectations. You generally don’t need as much as you think to be happy because the freedom you gain more than makes up for lost income.

However, if you retire at the top of a bull market, and don’t change your risk profile, you’re screwed. The day you retire will be about as good as it gets.

If you retire at the bottom of a bear market, even if you change your risk profile to be conservative, your financial days will likely only get better. A recovery makes retirement living so much easier.

No matter how good we get at forecasting the future, we tend to extrapolate too positively for too long when times are good. While those who retire in a bear market will likely forecast lower returns than reality.

Retiring In A Bear Market

Let’s say you retired with a $3 million in after-tax investments in 2012 that excludes the equity in your primary residence. Your $3 million is spitting out a comfortable $120,000 in gross passive income each year. 50% of your $3 million is in real estate while the other 50% is in a 50/50 stock and bond portfolio.

After tax, your $120,000 turns into $100,000 and you only spend $70,000 because you’re not 100% sure you’ll be able to stay retired. Besides, when you have no mortgage and no kids to support, $70,000 a year is more than enough, even in a high cost of living city.

Instead of earning a 10%+ return a year as the S&P has done since 2012, you only been able to earn a 6% return given your more conservative stock portfolio and lower leverage in your real estate portfolio.

After 6 years at a 6% compound rate of return with $30,000 a year in savings, your $3 million portfolio grows to $4,800,000. Applying the same 4% withdrawal rate, you’re now able to comfortably earn or withdraw $192,000 a year in gross passive income.

After tax, the $192,000 turns into about $155,000, which means if you stick with your $70,000 a year budget, you can now save $85,000 a year instead of just $30,000.

Clearly, it’s time for you to get more conservative with your investments because your after-tax passive income is 2X your budget. Meanwhile, your net worth is almost 70X your annual after-tax expenses.

Retiring During A Raging Bull Market

Let’s say you’ve decided to retire with $3 million after 10 years of up, up, up in the S&P 500 and real estate market where you own a couple rental properties. 70% of your $3 million is in a 60/40 stock/bond portfolio.

Your portfolio also spits out a comfortable $120,000 a year in gross passive income or $100,000 net passive income. You forecast you’ll earn at least $120,000 a year in gross passive income for the next 10 years because you believe your investments will grow by at least 3%, the current risk-free rate of return.

It’s important for you to continue earning $120,000 gross/$100,000 net in order to maintain your retirement lifestyle and pay for your 8th grader’s college tuition.

Your expenses are a little higher than the previous couple at $90,000 a year versus $70,000 a year as a result. But at least you still have a $10,000 a year cash flow buffer, which equals 11.1% of your annual after-tax spend. Not bad, but not so good when a bear market strikes.

Let’s say within six months after you retire, the S&P 500 corrects by 10%. The only way you could have earned 3.2% is if you invested 100% of your $3 million in to 10-year treasury bonds. But you didn’t with a 60/40 equity/fixed income portfolio. Meanwhile, a tenant vacates and one of your rentals is left empty for four months before you can find a tenant for 10% less than the previous rent. Your after-tax investments are now worth about $2.7 million.

At a 4% withdrawal rate, your $2.7 million portfolio can only produce about $108,000 in gross passive income, or about $88,000 a year after tax. No longer do you have a $10,000 a year cash flow buffer, you’ve now got a $2,000 annual deficit.

But 10% is only considered a correction, not a bear market, so let’s keep going. After tightening up spending to $78,000 from $90,000 since you always want to save $10,000 a year, the S&P 500 and real estate market keep correcting by another 10%. Down 20% is officially the start of a bear market. Your $2.7 million now shrinks to $2.43 million.

At a 4% withdrawal rate, your $2.43 million portfolio can only produce $97,200 a year in gross passive income, or about $80,000 after tax. Now your lifestyle is really getting crunched. You start to wonder whether the declines will ever end.

But of course, a 20% decline in the stock market and real estate market isn’t uncommon. For good measure, let’s model in another 10% decline. Now your $2.43 million portfolio shrinks to $2.18 million, meaning it can only generate about $87,000 gross or $71,000 in net passive income.

With a $70,000 a year college bill (tuition, room, board, transportation, books) just a year away, there is really no choice but to go back to work, do part-time work, or draw down principle. No matter how frugal you get, it’s not enough.

Retiring During Times Of Uncertainty

When I left work in early 2012, the S&P 500 had recovered about 70% of its losses from the financial crisis. The real estate market was still in the dumps, so I still had concerns we’d relapse into a recession.

Instead of going naked long, I used 100% of my severance check to buy a DJIA structured note that provided principal protection in exchange for only receiving a 0.5% annual dividend yield. The note offered 100% upside participation of the DJIA over the next six years.

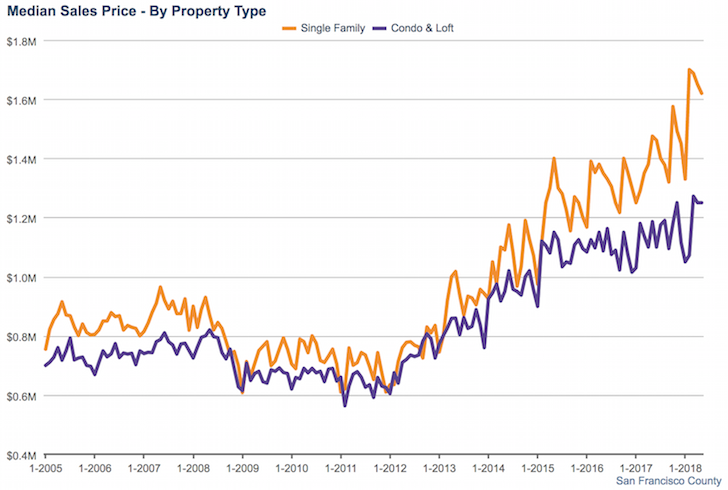

Not only did the S&P 500 do well since 2012, the San Francisco real estate market also began to recover.

Only a fool would be unable to stay comfortably retired if they left work in 2012. Luckily I ain’t no fool.

If you read the FS archives, you’ll know that I’ve been relatively conservative with my public investment portfolio since 2012. I’ve written my goal in retirement is to shoot for a return equal to 2X – 3X the risk-free rate of return. In other words, when the 10-year bond yield was at 2%, I was looking for a 4% – 6% public investment portfolio return.

With a 4% – 6% annual target, I never went beyond a 75% equity weighting in my portfolio since 2012. Further, a large part of my equity investments were in structured notes that had downside protection with sometimes capped upside and sometimes leveraged upside like the one here. My goal was to try and sleep as soundly each night without letting investing FOMO get the best of me.

With an average synthetic equity weighting of around 70% since 2012, my public investment portfolio ended up returning closer to 8.6% compounded. With $0 contribution, my public investment portfolio would be up 65% at that rate of return.

But since 2012, I made several fortuitous moves:

1) Bought and remodeled a ocean view fixer in 2014 that is up about 40% based on a comp that just sold last month. At the time, a large CD came due and I was bored of my old neighborhood so I took some risk and leveraged up another $1,000,000.

2) Held onto my previous primary residence that I tried to sell in 2012. By holding it until mid-2017, it grew at a compound return of 11.3%. Since the property was 55% leveraged on average, the cash on cash return was closer to 23% a year for five years.

3) Stayed consistent writing on Financial Samurai 3X a week. As a result, Financial Samurai has grown at a faster clip than the property I sold because there’s been some lucky breaks.

All of these investments have been heavily boosted by a bull market since I left work. If a bear market struck after I left, the only item that may have continued to perform well may have been Financial Samurai.

Given my content is more measured since I’ve written extensively about the dotbomb period and the 2008-2009 financial crisis, I suspect FS would attract more readers during slow times compared to sites that only discussed the good times. Experience matters during downturns. Further, sales for my severance negotiation book would likely increase as well due to job uncertainty.

If a bear market hit within two years after I left work in 2012, I’d give myself an 70% chance that I would have aggressively tried to find a full-time job again. At the very least, I’d consult for some fintech companies part-time.

Don’t Get Too Greedy

If you are close to financial independence or were able to retire, it’s not worth taking excess risk when you could potentially lose a lot of time and money.

Please do not forecast the good times will last forever. You’ve got to bake in some flat or negative returns when you do your retirement modeling.

You must always stay on top of your risk exposure. If you can continuously save in retirement while doing something to keep you active that makes money, all the better.

Given we’re still considered in a bull market, you might as well keep on milking the good times until a bear market arrives.

If you can retire in a bear market, then your finances will have been thoroughly battle tested so you can remain retired forever. Besides, when times are bad, it’s easier to leave things behind.

In a scenario where you have so much money it doesn’t matter when you retire, then feel free to leave whenever you want.

Readers, at what stage in the economic cycle do you think it’s best to retire and why? At what stage is it easiest to say goodbye?

Related: The Ideal Financial Scenario In Retirement: Low Volatility, Steady Returns

The post Why It’s Better To Retire In A Bear Market Than In A Bull Market appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments