Cash Management Is Really All About Stress Management

2:39 AM At any given time, every investor must always decide three things:

At any given time, every investor must always decide three things:

1) How to invest their new cash flow

2) How to invest their existing cash

3) How to reposition their existing investments if at all

As long as enough money is coming in to cover your expenses, life is fairly good. As our cash hoard grows, there’s also less financial stress because you can more easily cover unanticipated emergencies like a furlough.

In general, having 6 – 12 months of living expenses in cash or cash equivalents is good enough for the average person to sleep soundly.

There might come a point, however, when you will have excess cash. Perhaps you were undisciplined in your monthly dollar cost averaging strategy or maybe you got a bigger windfall than anticipated.

Whatever the case may be, your financial anxiety will be replaced with the fear of missing out on potentially bigger gains in risk assets like stocks and real estate. Given your peers are all getting rich, you will want to follow suit.

If enough greed kicks in, you will end up taking on more risk than you can comfortably withstand, and sometimes bad things will happen. Your financial stress returns once again. Hence, one benefit of following Financial SEER.

No matter how much money you have or how much you make, you will always have to work on managing your financial stress. After all, the more money you have, the more you have to lose! When you are broke, you’ve only got upside.

Money is mental. Psychology is why during market sell-offs, there will be headlines about stocks re-testing Great Depression lows. And during bull runs, there will be headlines about how the sky is the limit and you just can’t lose.

I didn’t do much right financially in 2018 except for continuing to aggressively save. But I did make one move with my existing savings that helped reduce financial stress.

Managing Stress Through Savings

Back in early 2018, I was getting nervous about the stock market. We’d seen an almost 10% pullback in February that jolted me awake. Ever since I left my day job in 2012, I’d been regularly plowing the majority of my cash flow into the stock market and San Francisco real estate market.

After all, my #1 goal is to earn enough passive income so neither my wife or I have to go back to work. With the likelihood of private school expenses coming up in 2022, we have a goal of earning at least $250,000 a year in passive income to stay jobless.

When the correction hit in February 2018, I realized my risk exposure was too high for my comfort. As a result, I slowly started reducing my stock allocation from 70% to 52% as stocks recovered into the summer.

But when you reduce your stock exposure during a rising market, you begin to question your decision because you start getting greedy. You start imagining whether you’re missing out on more gains by being too conservative. I was tempted to take on more risk again.

But when I got an e-mail from CIT Bank that they had raised their money market rate to 1.85% and their 12-month CD rate to 2.25%, I beat back my greed. Just a year earlier, money market rates averaged well below 1%. I still remember only receiving a 0.1% money market rate circa 2015.

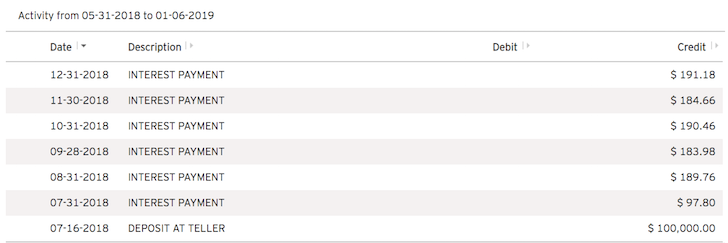

1.85% for a money market rate and 2.25% for a 12-month CD rate seemed pretty good. As a result, I decided to lock in a 2.25% guaranteed return for 12 months on July 16, 2018, instead of investing the money in the S&P 500 or the forever tempting FAANG stocks, which I was already heavily overweight, given I live in San Francisco.

As soon as I bought the 12-month CD, I felt a sense of relief. I remember thinking to myself, “Ah hah! Nobody can take away my money now!” I felt my stress melt away as I could now focus on more enjoyable things in life.

Although I’m only earning about ~$190 a month in interest income, it feels wonderful to know my money is secure. Because I generate excess cash flow every month, I constantly have to figure out where to invest the money in order to at least keep up with inflation.

Locking up money in long-term private investments or illiquid investments like real estate enables me to stop worrying so much about how to reinvest my cash flow.

Stay Financially Disciplined

As an investor, you must not only come up with some reasonable earnings and valuation forecasts, you must also take action based on your forecasts.

My analysis said that 2,800 on the S&P 500 was close to fully valued. We were almost back to the peak seen in January and I told myself if we got past 2,800, I would dial down risk, and that’s what I did in July.

The S&P 500 continued to rise until September when it reached 2,929 as the bull market raged on.

Was I fighting the urge to chase the momentum? Of course. But I still had 52% of my public investment portfolio in stocks, so I was still benefitting, although not to the fullest.

It was also important for me to remain disciplined and look at my overall risk exposure and net worth. I never want to have more than 30% of my net worth in equities. However, I was bumping around that upper limit due to the reinvestment of part of my house sale proceeds in equities.

If I had invested $100,000 in the S&P 500 on July 16, 2018, it would have been worth roughly $104,600 by September 30, 2018. But on December 17, 2018, it would have declined in value to just $86,000.

At the end of the year, the $100,000 would have rebounded to $90,600, but still down a hefty 9.4% since July 16, 2018.

Meanwhile, since opening the 12-month CD, it has thus far earned $1,038 in interest for a return of 1.038%. In other words, the difference between this 2.25% CD and the S&P 500 was roughly 10.438%, or $10,438 from July through Dec 21, 2018. Not bad.

Therefore, the next time you scoff at a money market or CD account rate, don’t. Not only can a money market or CD account drastically outperform risk assets, but they also have the added benefit of giving you incredible peace of mind during a downturn.

All I was thinking during the 4Q2018 meltdown was why I didn’t put more money into a CD or money market account. If I had invested my entire House Sale Fund, it would have earned $3,750 a month, or $45,000 a year with absolutely zero stress.

During 4Q2018, there were many mornings where I’d naturally awaken by 4am because my mind couldn’t rest knowing that another meltdown might possibly be right around the corner. That wasn’t very healthy and a sign that I still had to much at risk.

Time To Lock In Another Win

After such a long bull run, my goal all year is to use ~70% of my cash flow to lock in wins and use the remaining 30% of my cash flow to invest in risk assets when opportunities arise.

After such a long bull run, my goal all year is to use ~70% of my cash flow to lock in wins and use the remaining 30% of my cash flow to invest in risk assets when opportunities arise.

I’m excited I recently got another message from CIT Bank saying they have raised their Savings Builder account rate to 2.45% from 1.85%. That’s right. Their money market account, not their CD account, is paying 2.45%. No 12-month lockup is required.

2.45% is solid because it is almost as high as the 10-year treasury bond yield currently 2.65%. But with the 10-year treasury bond, you’ve got to hold it for 10 years to guarantee yourself a 2.65% annual return. During this time, you might lose or gain principal.

Earning 2.45% isn’t going to make you rich. But earning 2.45% is better than earning a negative 6.4% in the S&P 500 in 2018 (-4.8% with dividends).

There’s a good chance we could see a 10%+ rebound in the S&P 500 in 2019. But I also wouldn’t be surprised one bit if the S&P 500 declined by 10% in 2019 either.

The higher money market rate is a blessing because I’m cashed up looking for a nicer house this year. Given I don’t know when I’ll find the next house, it’s nice to have the flexibility of withdrawing my cash at any time, while also earning a high interest rate.

Take advantage of the Federal Reserve’s rate hikes.

I’m sure there are plenty of other banks, especially online banks, that are now providing higher rates this year. You’ve just got to ask around. There’s nothing wrong with protecting your wealth after making so much since 2009.

As for my financial stress this year, it’s way down from 4Q2018 because not only is my cash earning a much higher return, the stock market has rebounded by over 11% since December 24, 2018. Just like that, it’s back to good times and I plan to keep it that way.

My overall public investment portfolio is up a modest 4% for the year and I’m seriously considering locking in gains and reinvesting all the proceeds in a 2.45% savings account to end the year up a guaranteed~6.3%.

To feel no investment stress for the rest of the year would be amazing!

After all, my theme for 2019 is: live the good life. All I want is restful sleep every night so I have the energy to happily spend time with my family and write.

Doubling my net worth every 14 years with a modest 5% annual growth target is good enough for me.

Related: How Much Savings You Should Have Accumulated By Age

Readers, are you taking advantage of higher savings rates? What type of money decisions did you make in 2018 that saved you from the stock market meltdown? What type of money decisions will you make this year to ensure you grow your wealth?

The post Cash Management Is Really All About Stress Management appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments