Things To Consider Before Selling Your Business (Baby)

11:20 PM One of my luckiest investment decisions was not selling anything during the 2008-2009 financial crisis. I just held on for dear life, continued to max out my 401(k) and squirreled away anything left into an online savings account or CD.

One of my luckiest investment decisions was not selling anything during the 2008-2009 financial crisis. I just held on for dear life, continued to max out my 401(k) and squirreled away anything left into an online savings account or CD.

In 2012, I got lucky again by receiving zero offers for my SF primary residence. Facebook just went public, but nobody wanted to buy my home. As a result, I held on, paid down more of the mortgage, earned some rental income, and then finally sold it five years later for 68% more.

In 2015 and in 2018 I passed on selling Financial Samurai. To sell before realizing my goal of writing 3X a week for 10 years would have made me feel like a quitter. Then in August 2018, Google had a large algorithm update that has since boosted organic traffic by 50%. That was an unexpected upside surprise, especially since the site has been around since 2009.

It sure seems like the secret to creating wealth is to consistently save, invest, grow, hold and build for the long-term. Almost every significant wealth event in my life has taken at least five years to stew.

Things To Consider Before Selling Your Business

We know there are three main sources of wealth: 1) your job, 2) your investments, and 3) your business. Most people erroneously focus just on their job. Savvier people focus on one and two.

But to really build next level wealth it’s worth doing all three. Start a business, own as much of the equity as possible, grow the business, and reap all the rewards.

Being an employee is fine. It’s just that without equity, it’s really hard to get very wealthy. You’re essentially working to make someone else rich.

You don’t have to build a big business. A small one that provides joy and boosts your overall income by just 10% is fine too. Over time, you just never know how large your business might grow if you stick with it.

If you’ve started a successful business and are thinking about selling it, here are some questions and considerations to go through before letting go of your baby. I’ve shared my thoughts as well as I consider retiring for a second time.

1) An attractive valuation. You must consider the valuation multiple compared to the overall S&P 500 and companies in your space. You must also consider the payback period and your likelihood of lasting beyond the payback period if you don’t sell. The stronger your expected future earnings growth, the higher the valuation multiple you should demand.

Wise public companies buy promising private companies at lower valuations. If a public company is trading at 20X earnings, it should buy private companies trading at lower earnings multiples with higher growth rates all day long. If it does, each acquisition will automatically be earnings accretive.

My thoughts: I don’t want to sell Financial Samurai because I think valuations are too low for private media businesses. Let’s say I’m offered 6X operating profit. This pales in comparison to the average 22X multiple for the S&P 500.

After six years of simply maintaining operating profit, I will have covered the entire purchase price. But every year after six years would be pure gravy. The payback period when all is recouped is also the point of serious regret for many entrepreneurs who sell.

Further, if I can actually grow operating profit instead of let it stay stagnant, it makes even more sense to hold on.

For illustrative purposes, let’s say someone offers me $6 million based off 6X operating profit of $1 million. If I can grow operating profit by 20% a year, the operating profit will have grown to $2.49 million after five years. In other words, I would have ended up only selling my business for 2.4X operating profit, which would be like getting mugged in a dark alley! And if I ended up selling for 6X operating profit five years from now, I could get $14.94 million instead of just $6 million.

The only way I’d ever sell is if someone offered me at least 12X operating profit due to consistent earnings growth and my ability to keep on going for at least five more years. You’ll have to make an assessment on what’s the right valuation for your business.

2) Cash generator or money loser. You either have a business that is losing money, but hopefully growing at a fast pace or you have a cash generating business that is usually growing at a more steady pace. If you have a money-losing business that isn’t growing, then you need to sell ASAP.

Money-losing business are unsustainable over the long term unless the business can continuously raise money from outside investors to fund operations. Uber, is a great example of a fast grower that lost $1.8 billion in 2018. Yet, because they are able to raise ~$9 billion from its IPO, the company should be able to fund its operations for at least five more years given its losses are shrinking (lost $2.2 billion in 2017).

If you have a cash cow business, then selling in a low-interest rate environment as we have now is a much harder decision to make. The reason is because a much higher capital amount is needed to generate a specific amount of income.

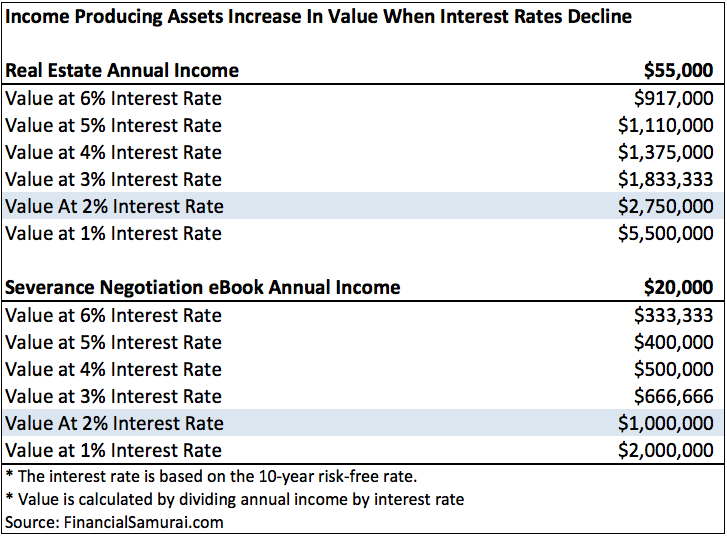

Look at the chart below. It shows the different amounts of capital needed to generate $55,000 and $20,000 in annual income at different interest rates. By a significant margin, cash cows are much more valuable today than they would be if interest rates were higher.

My thoughts: The core costs to run Financial Samurai include server cost, e-mail software cost, random website maintenance cost, and my time. Depending on how I value my time, operating my website results in 70% – 98% operating profit margins. In comparison, Apple’s operating profit margin is roughly 28% and Microsoft’s operating profit margin is roughly 31%.

Huge operating profit margins is one of the main reasons why everybody should start their own website. There is little downside if you fail, except for your time and maybe a little ego bruising.

It’s not like you have to come up with a million dollars to start a restaurant to pay rent, remodel a space, buy food, and hire staff. A website is just you and your own creativity.

Given I believe interest rates will stay low for the rest of my lifetime, the value of owning a cash cow should also stay high for the rest of my lifetime.

10-year bond yield has been coming down since the late 1980s

3) Your personal goals. Do you want to sell for a profit or build a legacy? If your desire for maximum profits is strong, then selling your business may make more sense if you get the right offer. If you desire to build a long-term business because it gives you purpose and joy, then selling your business makes less sense. Decide what your personal goals are for your business.

My thoughts: I didn’t start Financial Samurai to make money. I just needed an outlet to address my fears during the financial crisis. Instead of smoking or drinking heavily, I decided to write. I think you can tell that I enjoy writing, otherwise, I wouldn’t author practically all of Financial Samurai’s content. If I hated writing, I would hire a bunch of freelancers to write lots of product review posts to try and maximize my revenue. But so far, I haven’t.

My purpose for Financial Samurai is to have a creative outlet to share my thoughts on a weekly basis. It feels good to get thoughts on paper and hear different perspectives from the community. To be able to formulate an idea, put it in writing, and releasing it to the world is very gratifying.

A new goal is to run Financial Samurai long enough to teach my boy about online media, communication, and entrepreneurship. As an overrepresented minority at top universities, I assume he will get discriminated against. I assume he will get discriminated against in the workplace as well do to an underrepresentation of minorities in leadership positions. Therefore, it’s nice to have an insurance policy to skip university and the matrix all together.

He might have zero interest in learning about online media, but at least I can talk to him about the importance of creativity, consistency, and work ethic. A small business has many of the same departments as a large business e.g. finance, marketing, sales, production, etc.

Finally, what a wonderful way to communicate with family and friends long after I’m gone. I remember replaying over and over an old voicemail recording of a middle school friend who shockingly passed away in a car accident. If I were to die today, at least my wife and toddler will have hundreds of recordings and thousands of articles to go through.

4) Your view of the future. Do you see your business growing or fading? Can you create different products or revenue streams due to the strength of your brand? What are some new technologies that might disrupt your existing business? Are you capable of adapting?

Businesses fade away all the time. The murkier the future, the more you should consider selling.

My thoughts: I’ve always believed that if you can build a brand, your business will do even better in the future. Think about how many different business lines Virgin is in. Richard Branson has built an incredible, edgy brand that has enabled him to get into music, transportation, hotels, and more.

Financial Samurai is a fierce brand in the personal finance space that digs deep into the numbers and provides no BS analysis and answers. Everything is written based on firsthand experience because money is too important to be left up to pontification.

By establishing a brand that goes against the status quo (e.g. engineer your layoff vs. quit), plenty of new products can be created to leverage the brand. With only one book, I’ve barely gotten started on the business aspect of things. Now that my brand is established, I truly believe the opportunities are endless.

I envision a future where the consumption of online media via mobile devices only continues to grow. I see opportunity for Financial Samurai to expand internationally, especially in Asia and Europe.

Written content will never go away. It is by far the fastest way to consume information. Audio and video will continue to grow, and these are mediums I can easily utilize.

5) Will the money change your life. You can’t fault someone for wanting lots of money. If the sale of your business can significantly change your life for the better, then selling is absolutely an attractive decision. If the financial windfall doesn’t do much for your life, then you will likely feel a great let down because doing something mainly for money tends to feel empty.

My thoughts: The money received from selling Financial Samurai won’t change our lives. The only thing I might do is buy a bigger house. But I’ve already done the analysis on a larger house before, and it doesn’t feel worth it. Instead of feeling joy, I feel my headaches of owning a larger property with a $55,000 annual property tax bill would only multiply.

With the windfall, I’d give more money to a foster youth organization I volunteer at. I’d pay for a luxurious cruise for my parents. If my parents wanted, I’d also pay for their home remodel while putting them up in a nice temporary housing condo in Honolulu.

Other than these things, there’s really nothing more I’d do with the money except investing it in passive income generating investments. When you are already free to do whatever you want, having more money doesn’t move the happiness needle much.

6) Will you regret not selling if the market turns south. Fantastic selling opportunities open up only so often. If you pass, can you live with your decision that you could have gotten so much more if you sold earlier? Do you have the patience to wait for another 10 years for the next fantastic selling opportunity?

For example, Yahoo was once once worth over $100 billion and eventually sold itself to Verizon for only $5 billion. The good times don’t last forever.

My thoughts: I’m sure I’ll regret not selling today if I could only get 95% less years later. Meanwhile, however, I will have gotten a priceless amount of joy building Financial Samurai. It’s cool to have a web property I can click on from anywhere in the world.

It’s the same type of pride and joy you get as a parent when you look at your kid and think proudly, I helped make that. If you truly love your kid, you would never sell him or her. The same goes with your business, sometimes to your detriment.

I also am pleased with the steady growth of the Financial Samurai Forum. It feels like a new website with different offerings I will help nurture. I’m sure it will grow into a tremendous destination if I can manage it well over the next five years.

7) Will the new buyer be a good steward. You don’t want to sell your business to anybody. Instead, you want to sell your business to someone who believes in your vision and carries out many of the things you’d like to do, but don’t have the ability or energy to do on your own.

Consider selling your business similar to giving away your daughter or son’s hand in marriage. You’re definitely not going to let your daughter or son marry a scum bag.

My thoughts: After several conversations, I finally warmed up to someone who I think could really grow Financial Samurai and improve the user experience. Like me, he is a father, but to three boys. He has a team of hundreds of writers and developers who could create a lot more value. Let’s see where this relationship takes us. I’m definitely going to take my time finding a proper suitor.

Enjoy Your Business For As Long As Possible

The joy you get from creating something out of nothing far outweighs any joy you get from making a lot of money. Yes, there will be difficult times when you’ll just want to sell and quit. Do your best to keep on going.

I know of several people who sold their online businesses for the money and later became depressed because they didn’t have a purpose anymore. Many in the online media space tried to re-create the magic and failed. They became irrelevant.

Money really doesn’t bring much more happiness once you’re earning enough to have all your basic needs met. Some say that number is $75,000 a year, while others believe $300,000 a year is more likely in a HCOL area.

If you feel the end is near for your business, definitely try and sell. If someone gives you a crazy offer way outside average valuation multiples and you’re burned out, then accept their offer with open arms.

But if you continue to enjoy what you do and see growth potential, then keep on going. The legacy you leave will be wonderful. Just remember to always keep an open mind as there is a price for everything.

Not a day goes by where I’m not thankful for launching this site in 2009. It has given me more joy and purpose that I ever thought possible. Thank you!

Related posts:

How To Start A Profitable Website

Real Estate Versus Blogging: Which Is A Better Investment?

Bankers, Techies, And Doctors You’ll Never Get Rich Working For Someone Else

Readers, any entrepreneurs out there who have sold their business? How did you feel when you sold and how did you feel once you reached the payback period? What are some other considerations entrepreneurs should consider before selling? Graphic by kongsavage.com

The post Things To Consider Before Selling Your Business (Baby) appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments