The Average Net Worth For The Above Average Married Couple

2:25 AM One of the most popular posts on Financial Samurai is The Average Net Worth For The Above Average Person.

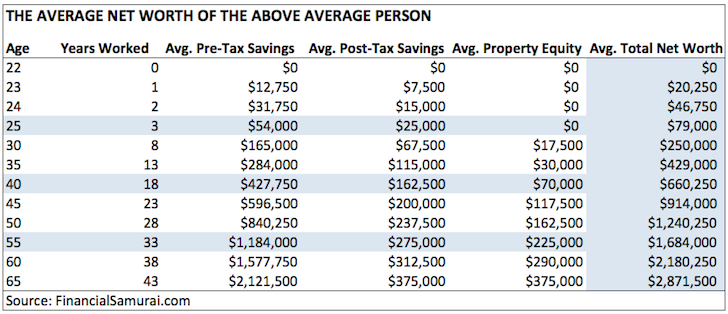

One of the most popular posts on Financial Samurai is The Average Net Worth For The Above Average Person.

The “above average person” is loosely defined as someone who graduated from college (35% of the American population), works hard, plays well with others, takes full advantage of their pre-tax retirement plans, saves additional disposable income, stays on top of their finances by utilizing free financial tools, expects nothing from their parents or the government and is not delusional. If you were a “C student” and expect to live an “A lifestyle,” you’re definitely not the above average person!

Depending on the source, the average net worth in America is somewhere between $150,000 – $200,000. But the median net worth in America is closer to $80,000.

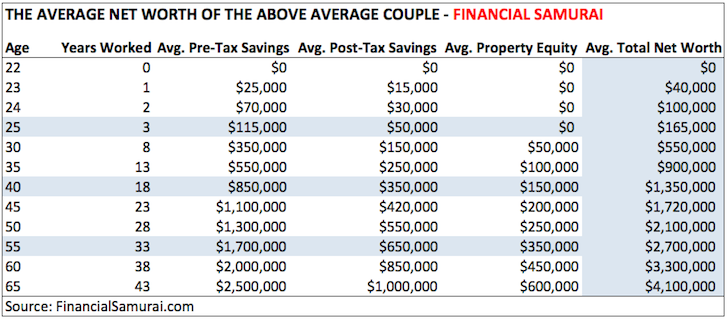

Take a moment to study the above average person’s net worth chart again. Somewhere between the ages of 45-50, the above average person’s net worth reaches over one million dollars.

We can all agree that thanks to inflation, easy monetary policy, a roaring bull market and a recovery in real estate, becoming a millionaire by the time we retire is fast becoming the rule, rather than the exception.

It’s important to note the figures in my chart are for individuals and not for couples. For those of you who combined your household net worth to see where you stand, so sorry. That’s cheating. At the same time, not everybody can find someone they love, hence why I initially created a per person chart.

It would be presumptuous to assume we can all live in marital bliss. Further, not everybody is even allowed to get married thanks to the government telling us who we can and cannot be with. For simplicity’s sake, I will refer to “married couples” as anybody who is in a long term relationship.

This article comes up with reasonable “above average couple net worth” charts based on what I think, what the government thinks, what you think, and the realities of life. One can also define “above average” as one standard deviation beyond the midpoint of the normal distribution curve (top 16%). Not every couple can be above average. But every couple can certainly try.

The Average Net Worth For The Above Average Couple

Everybody knows that married couples who stay together have a financial advantage over single people. For example, couples can split a $2,500 a month two bedroom apartment instead of each pay a full $2,000 a month for a one bedroom. It’s much more efficient and cheaper to cook for two. Meanwhile, there are probably plenty of buy one get one free specials too. The economies of scale are everywhere for couples.

Before we go about the exercise of figuring out the net worth of the above average couple, let’s take a moment to define an above average couple:

* Stays together for the long term.

* Discusses long term financial goals e.g. retirement age, retirement number, succession planning.

* Does not keep financial secrets.

* Knows their monthly budget like the back of their hand.

* Makes sure their net worth risk exposure is aligned with their goals.

* Shares expenses in a fair way.

* Supports each other’s careers and endeavors.

* Works together as a team to get things done.

* Seeks to understand the other side of a story during conflicts and always comes to a compromise.

* Plans for the financial expense of children even if they don’t have any.

* Each spouse can financially support themselves if the relationship ends.

* Only has children if they’ve run the numbers and know they can afford them.

Related: How To Retire Early As A Couple

Various Net Worth Calculation Methods For Couples

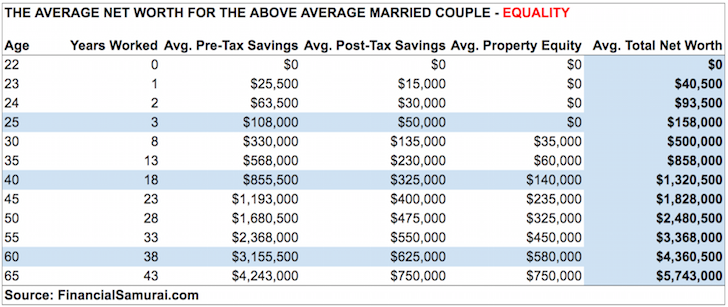

The Equality Method

The equality method basically states that a man and a woman are equal. Given both sexes are equal, it is only logical to conclude that both spouses study hard in school, work, save, and invest for the future before and after meeting each other. One simply has to double the amounts in my above average person net worth chart to get to the Equality Net Worth chart.

Some of you argue that men and women are not equal and will therefore disagree with how high the figures are in the Equality Net Worth chart. I’m not sure which century or country you are living in, but males and females are equal here in America at least. If they are not equal in your country please share in the comments section why.

Meanwhile, some of you will argue that the figures are too low because there are tremendous financial synergies in a relationship. Since you can’t have synergies before you actually meet, it’s better to simply double the above average net worth per person figures to stay conservative. Independence is a core part of Americana, except for grown adults who still live with their parents.

Discrimination and sexism is wrong therefore I am a strong proponent of the Equality Net Worth method.

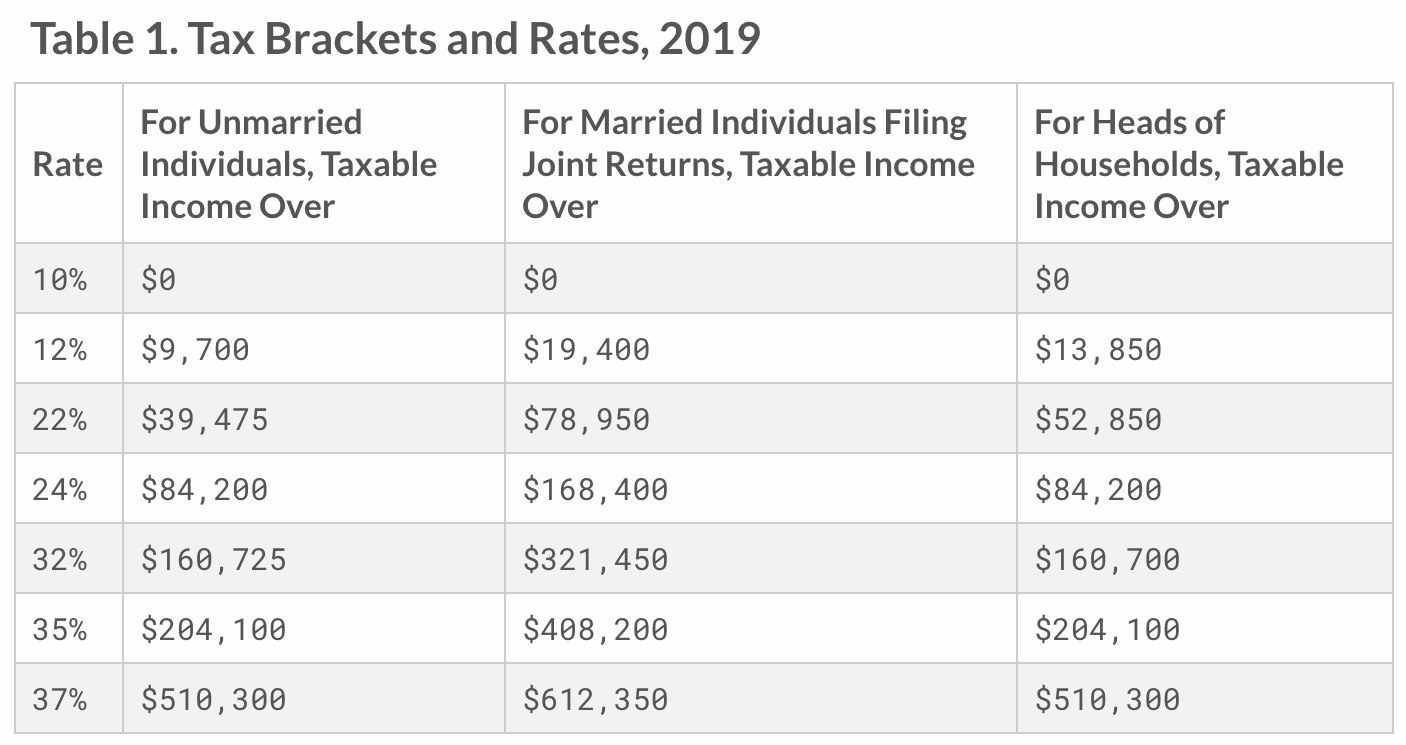

The Government Taxation Method

Despite tremendous federal income tax improvement after Trump became president, there is still a marriage penalty tax. Notice how an individual pays a 37% marginal federal income tax bracket after $510,300, but a married couple starts paying a 37% marginal federal income tax above $612,350.

In other words, 1+1 does not equal 2. Instead, 1+1 = 1.21. Therefore, it’s not a good idea for two high income earning people earning more than $612,350 to get married. The government believes 1+1 = 1.21 because it is sexist. Most people in congress are men. Therefore, they just assume that one spouse, mainly the woman, stays at home to raise children.

Of course there are tremendous benefits of having a stay at home spouse take care of the kids. Your children get more love from the person you trust the most, you save on daycare costs, and more. But for goodness sake, let the American people decide whether one spouse should stay at home or not. Don’t punish us with higher income taxes if we don’t!

A combined income of $612,350 provides only a 20% greater threshold until the top 37% tax rate kicks in. Therefore, we’re going to essentially only increase the combined net worth by a marginal amount as well using the government’s logic.

If you love the government, are very traditional, and believe one spouse should probably stay at home, then you are a proponent of the Government Taxation Net Worth method.

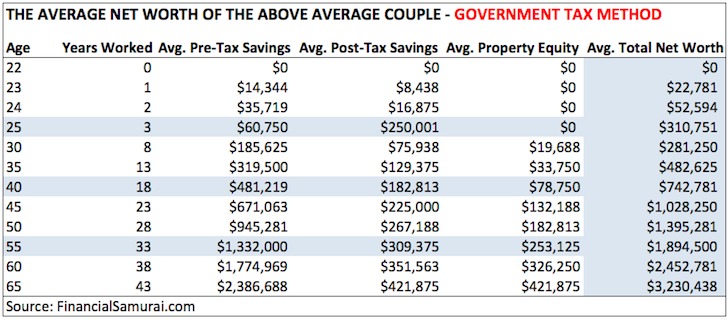

The Financial Samurai Method

By now I’m sure I’ve upset many couples with my various conjectures about the Equality method and the Government Taxation method of figuring out the net worth for above average couples. What you are really upset about is the revelation of your own beliefs.

The Financial Samurai Net Worth method provides a recognition there are financial synergies for being a couple. At the same time, the Financial Samurai method denounces government policies to its core for its sexist and discriminatory ways. Besides the ludicrous 20% increased allowance for married couples, the government only provides child tax credits, student interest deductions, and IRA contributions to those who make below a certain amount.

It’s shameful to discriminate against hard working Americans who live in higher cost of living areas. The government should treat everyone equally and not pick and choose who gets to thrive and who gets to suffer.

I am a strong believer that each spouse should save and invest as an independent man or woman. Breakups happen all the time so it is imperative we count on nobody, not even the present love of our lives for financial survival. A

t the same time, there is no need to have double the property size presumably because a couple is sharing a room, a kitchen, a bathroom, a living room, a dining room, a garage, and a backyard. Let’s have a look at the chart.

Assumptions

* The average pre-tax savings (401k/IRA) and post-tax savings amounts double every year until age 40 and then only increase by 25% every five years after.

* After age 40, the savings rates increase by only 25% a year to account for early retirement of one spouse, if not both spouses.

* The average property equity increases by 25-50% every five years instead of 100% given you don’t need double the space to live together.

* The cost of kids is accounted for by the decrease in the increase of pre-tax savings, post-tax savings, and property equity increases.

* The above average married couple are millionaires by the time they reach 40 years old. They develop the optionality for one spouse to retire or find a different career that may not pay as much if so desired.

* By age 50 chances are high both spouses can retire provided they have sufficient passive income streams to cover all expenses.

The Average Net Worth Of Couples Is Higher Than Singles

The above average couple is based upon my assumptions for the above average person, not the average American who wakes up 10 years later hating his job, but who forgot to save and invest all this time. The average American who cannot come up with a $1,000 emergency is not the example you want to follow.

If you haven’t reached my suggested net worth figures yet, don’t worry. Just the fact that you are reading this article means you are serious about supercharging your finances for a better life. Now you will have some clear financial goals as a couple. Give your savings and investments some time to compound.

Not only do couples have roughly a 70% higher combined net worth than single folks, life is also more enjoyable when spent with someone you love. Just make sure to keep track of your finances and have open dialogues throughout the years.

Recommendation For Couples

One of the best thing couples can do to grow their combined net worth is stay on top of their finances by signing up with Personal Capital. They are a free online platform which aggregates all your financial accounts in one place so you can see where to optimize.

Their 401K Fee Analyzer tool is saving me over $1,700 a year in fees I had no idea I was paying. They’ve also got an amazing Retirement Planning Calculator that uses real data and Monte Carlo simulations to produce realistic retirement results. It’s the best planner out there.

Open financial communication is very important as a couple. By having a free financial tool online or through your mobile app to keep track of your combined finances, you improve your chances of building your combined net worth quicker and minimize financial stresses and arguments.

Is your retirement on track? Sign up to find out!

Updated for 2020 and beyond. It’s now more important than ever for couples to have an open dialogue about their finances and manage their money properly.

The post The Average Net Worth For The Above Average Married Couple appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments