Should You Have Life Insurance If You Don’t Have Children?

4:23 AMThe following is a sponsored partnership with Aflac. All opinions are 100% my own.

Lately, I have received many emails from readers about life insurance.

One of the most common questions I hear is, “Should I consider a life insurance policy before I have children?”

No matter your age, the necessity of life insurance can be a hard topic to consider. However, while the subject might be difficult to reflect on, it is also an insurance option that can benefit your loved ones significantly, regardless of whether you have started a family.

Whenever I am asked the above question, my answer is always the same. Regardless of your family situation, life insurance is still a product to consider.

However, I understand the hesitation — you might think there is no reason to take out a life insurance policy if you don’t have children. September is Life Insurance Awareness Month, so it is the perfect time to talk about Aflac life insurance and why you may want it!

What is life insurance?

Before we begin, you may be wondering what exactly life insurance is.

Life insurance is a policy that pays money to a beneficiary you designate in the event of death. Naturally, if you are the sole or primary wage earner in your family, then there are a lot of people who rely on you financially, meaning life insurance may be a necessity.

The cash benefits can be used to help pay for funeral costs, personal expenses, payment of debt and so on.

The primary reason to get life insurance is to help your loved ones or anyone who depends on you in the event of a sudden loss of income after a death.

This way, they still have help paying the bills and grieve without having to worry about their immediate source of money.

When do you need life insurance?

Life insurance is not only for individuals who are the primary income earners of their household. Even if you are young, single and have no children, life insurance can still help support your loved ones. For example, a life insurance policy can support your family if you have co-signed loans with your parents (such as student loans), taken out a loan to start a small business or if you are financially responsible for another family member.

If you have co-signers on your debt, you should consider getting life insurance.

If something were to happen to you, you don’t want your co-signer (your parents, partner, siblings, friend, etc.) to be responsible for paying off your personal debt unexpectedly.

I can’t help but think of an article I read about a young adult who did not have life insurance. They passed away suddenly, leaving behind their student loan debt to their parents who co-signed the loan. They were suddenly responsible for monthly student loan payments of around $2,000 and had to entirely restructure their finances as a result.

If you have a partner, it is also important to consider the benefits of life insurance. If you have credit card debt, student loans, or if your partner relies on your income for rent or mortgage payment, a life insurance plan can help relieve those you care about from unnecessary financial burden.

Perhaps most importantly to note, life insurance is often cheaper while one is younger. By enrolling in a life insurance policy before you have children, you can typically secure a policy with lower premiums than when you are older.

If you plan on getting life insurance anyway, enroll early to ensure a more affordable rate.

Where do I find life insurance?

One popular life insurance company to look into is Aflac.

Aflac is a Fortune 500 company that provides supplemental insurance, including life insurance, to more than 50 million people through its subsidiaries in Japan and the U.S., where it is a leading supplemental insurer, by paying cash fast to help with the expenses health insurance doesn’t cover.

For consumers who place a premium on corporate ethics, Aflac is also a socially responsible company. For 25 years, Aflac has contributed over $146 million to help children facing cancer and their families, including establishing the Aflac Cancer and Blood Disorders Center in Atlanta.* If this interests you, then you can go to ESG.Aflac.com to explore how Aflac is dedicated to being a good and decent company.

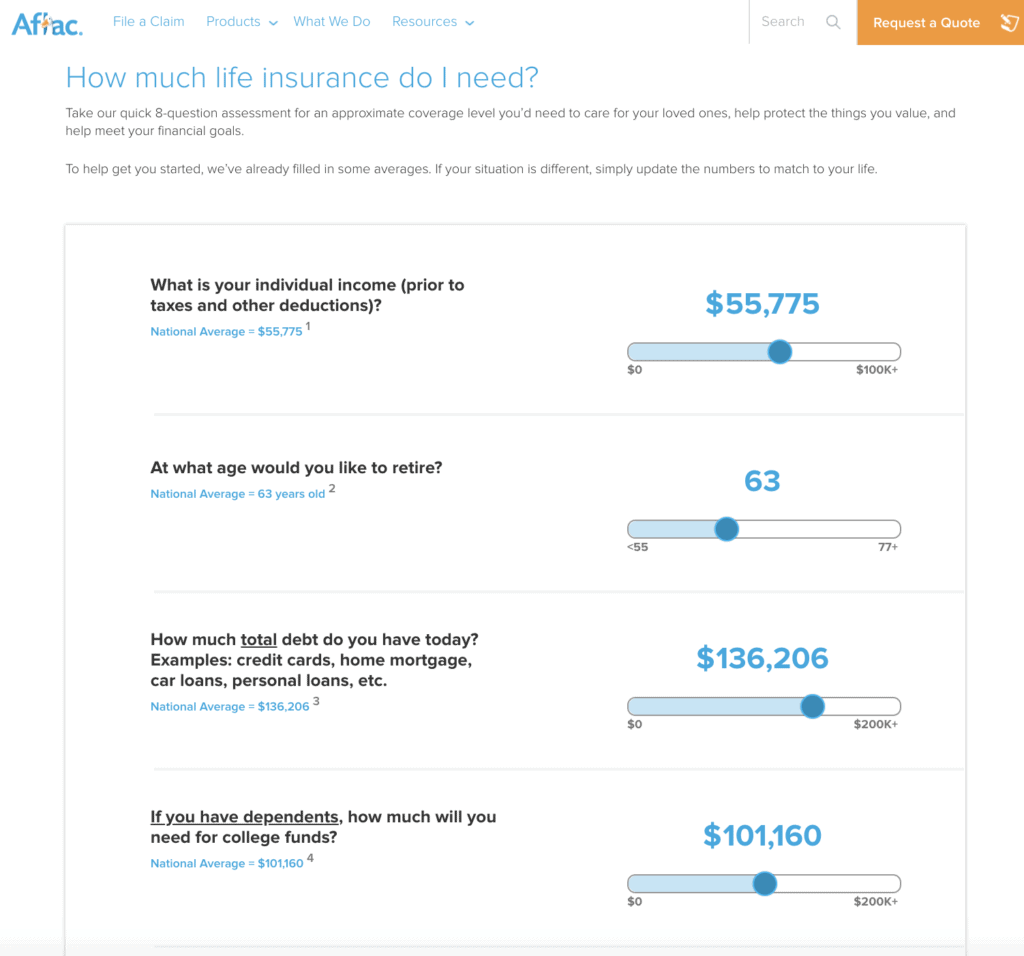

If you are interested in learning more about insurance options that are available to you, I recommend heading to Aflac’s life insurance calculator, which allows you to identify how much coverage you need. You can see a screenshot of some of the questions below. It only took me about two minutes to answer the questions, and it offered a holistic overview of my personal benefit options.

Once you’ve answered the questions, it is easy to request a life insurance quote.

According to a 2019 Insurance Barometer Study by LIMRA, a worldwide research, consulting and professional development trade association, consumers think that life insurance is more costly than what it actually is. The study asked people to guess how much a $250,000 term life insurance policy costs for a healthy 30-year-old.

More than 50% estimated that it would be over $500 per year.

However, that’s very far from the truth.

The average cost of a life insurance plan is actually only around $160 a year, or $13 a month.

If you are interested in opting into a life insurance plan, $13 a month may make it an easy choice.

There are a lot of reasons why you may want to apply for life insurance, but remember that it makes sense to take one out early and save money in the long term.

I’d love to hear from you. Do you have life insurance? Why or why not?

*Aflac company statistic, 2020.

This is a brief product overview only. Coverage may not be available in all states. Benefits/premium rates may vary based on plan selected. Optional riders may be available at an additional cost. The policy/rider has limitations and exclusions that may affect benefits payable. Refer to the specified policy/rider form(s) for complete details, benefits, limitations, and exclusions. For availability and costs, please contact your local Aflac agent

Coverage is underwritten by Aflac | WWHQ | 1932 Wynnton Road | Columbus, GA 31999 | In New York, coverage is underwritten by Aflac New York | 22 Corporate Woods Blvd, Suite 2 | Albany, NY 12211

Z200625 Exp. 9/21

The post Should You Have Life Insurance If You Don’t Have Children? appeared first on Making Sense Of Cents.

from Making Sense Of Cents

via Finance Xpress

0 comments