Maxing Out Your 401(k) Is A Choice On An Average Income: $55K In D.C.

6:42 AMAfter Sam published his article, Achieving Financial Freedom On A Modest Income In Manhattan, I was fascinated to observe some of the no-can-do responses he received from his readers.

Instead of focusing on Sam’s message of cutting down housing costs, distracting yourself from spending temptation by working more than the average American, and building extra side income while you are young, the naysayers could not accept that he saved 30% of his $40,000 salary even when he did.

They said people making a similar income in today’s dollars would have no chance. Well I make a similar income in today’s dollars and I save an even higher percentage.

There’s a great saying: whether you think you can or you can’t, you’re right. It seems like no matter how much you demonstrate what’s possible, people don’t believe in themselves.

I used to be very salty against those who earned more than I did too. My parents didn’t pay for college, so I had to work ~15 hours a week during school and 30 hours a week each summer to afford my public school tuition. I also lived at home for the first two years of college as well to save money.

But when I graduated from George Mason University in December 2016, I didn’t have any debt. Tuition averaged only about $10,000 a year for my four years there so I handled it like a boss.

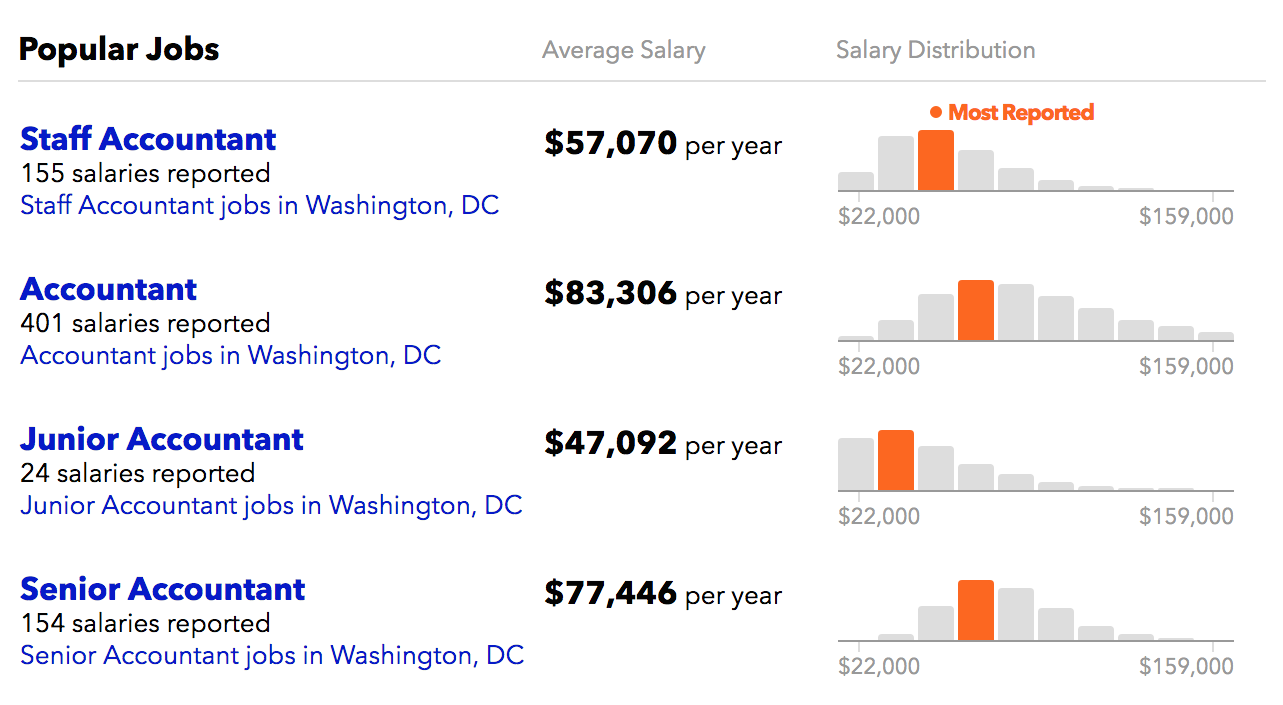

I studied accounting, the most boring major in the world. But I knew the chance of getting a decent paying job out of school was high.

I did not have the luxury of studying History or English like my rich private school friends who went to American, George Washington, or Georgetown.

A Decent Job Offer

I got two job offers after college, one for $45,000 and the other for $50,000. I took the higher one. It’s not like crunching numbers suddenly gets more exciting if you work for a major entertainment company versus an international hotel chain.

Over time, I will make more money as I gain more experience. My ultimate goal is to make $100,000 within 10 years after graduating from college if not sooner. Not unreasonable by any stretch of the imagination.

At the age of 25, I now earn $55,000 a year – 10% higher from when I first started two years ago. $55,000 feels like a healthy amount to me, but I’m a simple guy with simple pleasures.

In 2017 and 2018, I contributed the maximum $18,500 to my 401(k). For 2019, I plan to max out my 401(k) again with $19,000. $19,000 is equivalent to 35% of my gross income and I don’t find the amount a burden.

Instead, I find the idea of working for the next 40 years as an accountant to be the biggest soul-crushing burden of them all! Hence, I save and save some more.

Maxing Out My 401(k) While Earning $55,000 In Washington D.C.

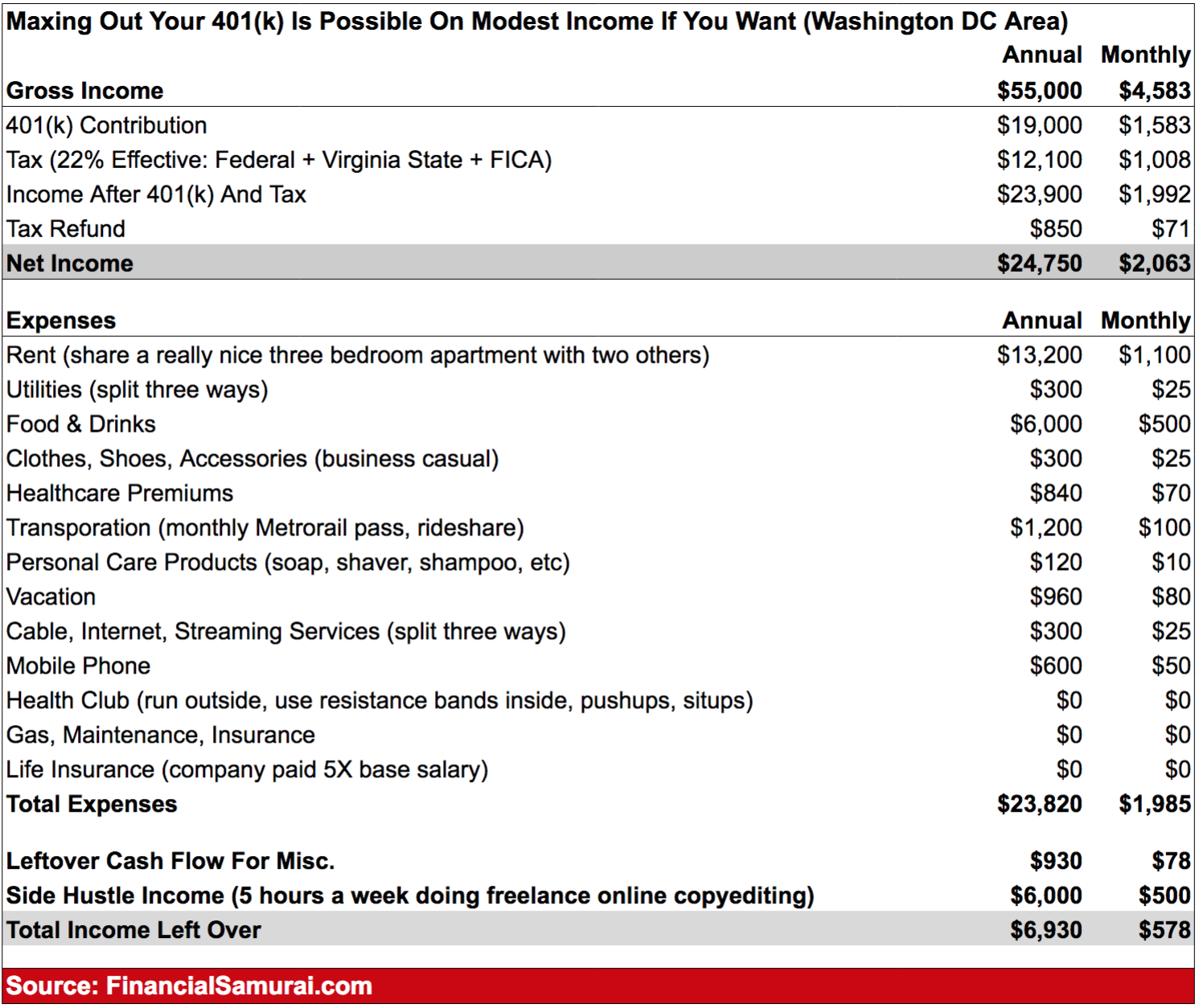

Here’s my budget for those curious to see how I’m able to have about $40,000 in my 401(k) in only two years.

It’s nice that my employer matches up to $3,500 a year. Seeing the money pile up in my 401(k) is addicting and I don’t plan to stop.

With a $55,000 salary, I earn $2,115 gross every two weeks. Therefore, in order to max out my 401(k), I instructed my firm to take 35% ($740) out of each paycheck for my 401(k) contribution.

My asset allocation split is 90% stocks, 10% bonds. I plan to stay with this asset allocation until my 30s.

With $740 taken out, I’m left with $1,375 in gross income. I’ve got to pay $70 pre-tax in healthcare premiums, FICA tax of 7.65% (6.2% Social Security + 1.45% Medicare), 12% Federal income tax, and 5% Virginia income tax.

When it’s all said and done, I’m left with about $1,000 every two weeks to spend how I will. $1,000 in spending money isn’t a lot, but it’s enough for me to live a comfortable life. It feels great knowing that even if I spend the entire $1,000, I’m still aggressively saving for retirement.

Also, I’m guessing I’ll be getting a ~$3,000 tax refund back given the standard deduction is $12,000 and my taxable income is only $36,000. We shall see.

My job is not exciting, but it’s fine. I like the people I work with and I only average 40-45 hours a week. Things will get busier during Feb – April, but overall, the work hours are reasonable.

I get in about 8:30am and leave by 5:30pm for nine months of the year.

Housing Costs ($1,150/month)

I rent a nice three bedroom, two bathroom apartment in Arlington, Virginia with two other roommates for a total of $3,600 a month. The location is great. We have a nice balcony, fancy kitchen appliances we never use, and a small gym with a sauna in our building. Given my room is a little smaller, my share of the rent is $1,100 a month.

My share for cable, internet, and utilities comes to $50 a month, which isn’t bad given it’s being split three ways. We love to have friends over to watch football and basketball during the weekends. Obviously, we use a friend’s Netflix account for free to watch Ozarks (money laundering accountant) and other shows.

When you can share costs with other people, it feels like you’re getting great value.

Everything Else ($835/month)

Given I only make about $1,000 each paycheck, you can see how I’m spending almost 100% of each month’s salary. But again, that’s fine with me because I know that my 401(k) is getting maxed out.

Paying yourself first truly is the best thing ever. As a result, I hardly ever feel guilty about spending any money.

I’ve got my Metro monthly pass that gets me everywhere I want to go around the city.

I’ve also budgeted about $1,000 a year to go on a couple weeks of vacation. Nothing fancy, but enough to have a good time.

I don’t have a gym membership because I hate being cooped up in a room exercising. Running and biking outside feels so much better. I try and do 150 sit-ups and 60 push-ups every other day as well.

Side Hustling (+$500/month)

Given I only work 40-45 hours a week, I spend another five hours a week on average doing copyediting for a tax and financial website. I can easily bang out a couple hours of work in one evening or do a little bit of work in the morning before heading off to my day job.

They pay me $25 / hour, which comes out to $52,000 a year based on a 40 hour work week.

I use the $500 a month in extra income to build my after-tax Wealthfront account, which I opened two years ago. I’ll be able to contribute at least $6,000 each year in this account while also saving $19,000 in my 401(k) each year.

In 20 years, my after-tax investment account should grow to about $300,000 using a moderate 6.5% annual growth rate and a $6,000 annual contribution rate, giving me the opportunity to do new things if I want.

Given my side hustle income isn’t very high, I don’t have to pay estimated taxes. My goal is to ultimately generate $10,000 a year in extra income mostly by raising my rate, to save for my future. I strongly feel $300,000 in my after-tax account in 20 years is a conservative estimate.

There are so many ways to make extra income online now, you just have to look. I have the capacity to regularly work 60 hours a week without feeling burned out. I might as well take advantage while I’ve still got the energy.

Everybody is able to earn some side hustle income if they want to. But not everybody wants money bad enough to do something extra about it.

Financial Freedom On An Average Income

A $55,000 a year salary might not sound like that much to you, especially in the expensive Washington D.C. area, but it’s plenty enough for me.

A $55,000 a year salary might not sound like that much to you, especially in the expensive Washington D.C. area, but it’s plenty enough for me.

Within five years, I’m confident my salary will increase to $70,000+. By then, I will have enough for a down payment on my own place so that I can rent out rooms to other people to help pay my mortgage.

In another five years, I expect my salary to surpass $100,000. If I’m lucky enough to find the love of my life, we’ll have an even higher combined salary so we can live alone. I’ve got to imagine life will be even more affordable as a unit.

Who knows, but with enough dedication, maybe I can grow my side hustle income to $20,000 a year for a combined gross income of $120,000 a year by age 35.

I know I’m lucky not to have crushing student loan debt. But I also made a decision to go to my hometown state school while also working on the side. The vast majority of my friends didn’t work regularly while in school. Instead, they took vacations during the summers and winters and partied every week.

Be honest with yourself regarding how much you’re spending, how much you’re saving, and how much you’re hustling. If you’re coming home each night binging on Netflix or going out to the bars with your friends on a regular basis, you’re not maximizing your earnings potential.

Financial freedom is all about making choices. My choice is to have a lot more choices by the time I turn 40. – Young Samurai

Readers, do you think maxing out a 401(k) on a modest income is a choice? If so, why don’t more people aggressively save for their financial future? If not, what is going on? Why do some people have a no-can-do attitude even when they see others in a similar situation make things happen?

Related Posts:

Save For A Down Payment Or Invest In My 401(k)?

Explaining Why The Median 401(k) Balance Is So Low

When Earning $1 Million A Year Isn’t Enough To Retire Early

The post Maxing Out Your 401(k) Is A Choice On An Average Income: $55K In D.C. appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments