The Proper Geoarbitrage Strategy: First Your City, Then Your Country, Then The World

2:32 AM One of the most common pushbacks I got from my post, “Why You Need To Earn $300,000 A Year To Live A Middle Class Lifestyle Today,” is: why the hell don’t I just leave expensive San Francisco if I’ve truly got enough passive income?

One of the most common pushbacks I got from my post, “Why You Need To Earn $300,000 A Year To Live A Middle Class Lifestyle Today,” is: why the hell don’t I just leave expensive San Francisco if I’ve truly got enough passive income?

Believe me, I’ve been thinking about relocating out of San Francisco for years now because of the high cost of living, the increased population density, the growing homogeneity, the obsessive money culture, and the growing boredom of living in one place for almost 20 years.

My number one geoarbitrage destination is Honolulu, Hawaii, a place where stress simply melts away. My stress level averages about a 5 out of 10 in San Francisco, but immediately goes down to a steady state 3 when I’m in Hawaii.

Although Honolulu isn’t cheap, it’s about 20% – 30% cheaper than San Francisco in terms of housing. If you can save money and live in a nicer climate, that’s a win in my book.

But relocating takes time when you’ve grown accustomed to living in one place for so long. There are friends to say goodbye to and assets to unwind. Then there’s the small, but highly significant issue of raising a first child.

We figure we’d provide our son with a stable home environment up until he is 2.5-3 years old, and then consider relocating for preschool.

Geoarbitrage Already Happened

What I didn’t realize until recently is that I’ve already taken the first step in geoarbitraging in order to our lower costs and live more freely.

I move slowly with big life decisions because I’m more like a supertanker rather than a speedboat. Think of me as the classic late-stage technology adopter.

Everybody thinks about geoarbitraging as moving to the heartland or to Southeast Asia or Eastern Europe to save big bucks on living expenses. The reality is, such big moves are not necessary.

One can simply geoarbitrage within one’s own town or city.

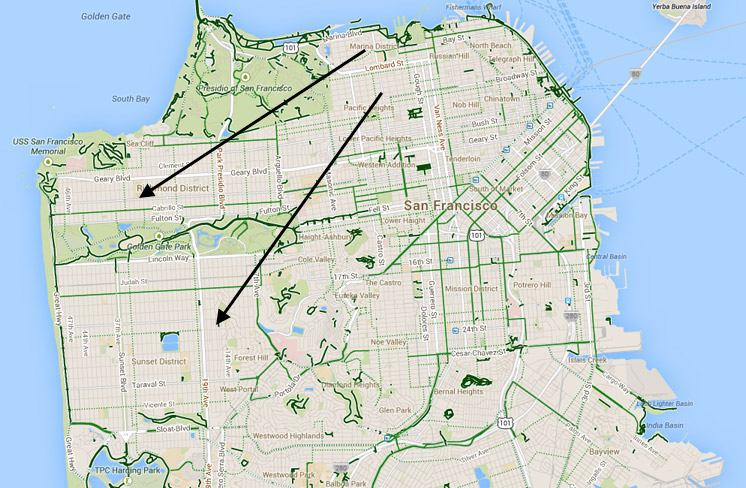

Move 5 miles west, save 40% on rent or purchase price in SF

By moving out of our single-family home on the north end of San Francisco in 2014, renting it out, and buying a single family home just five miles west allowed us to save roughly $4,200 a month, or 50%.

I don’t know about you, but when you and your partner don’t have stable jobs, saving $50,000 a year after-tax sure alleviates a lot of financial pressure.

We’ve been hearing so much about a housing affordability crisis in cities like San Francisco and New York. Yet if people decided to not live in the most expensive parts of the city, their affordability would go way up!

For example, instead of paying $4,500 a month for a two-bedroom in Pacific Heights, you could have a nice two-bedroom in the Outer Richmond district for $2,700. A $1,800 a month cost savings is significant if your goal is to be financially secure ASAP.

Related: Housing Expense Guidelines For Financial Freedom

The Sacrifices Are Not That Big

Moving five miles west means being five miles further from downtown San Francisco, where most of the jobs are located. If we had to work downtown, the extra commute time would be 15 minutes on average each way.

15 minutes is nothing given we all have phones to nourish our minds with Financial Samurai articles. It is simply amazing how quickly we can kill time once we’re allowed to surf the web, listen to music, text with friends, play games, or watch some Netflix.

The cost to take the bus downtown from the north end where I used to live and the Muni downtown from the west side where I currently reside costs the same $2.5 each way, or $78 for a monthly commuter pass. Meanwhile, the invention of Uber pool and Lyft Line has lowered car service by 60-70%.

Further, if you move to a less densely populated area, there are benefits such as less traffic, less litter, less crime, more diversity, more parks, and cheaper goods and services.

Where I live, you can get a haircut for $12 pre-tip and eat a nice dinner for $15 a person. Where I used to live, the same haircut costs $26 pre-tip and you’d never be able to escape a restaurant for under $30 a person.

Don’t Let Your Ego Get In The Way

If you want to accelerate your path to financial freedom, you’ve got to squash your ego for that big fancy house in a prime neighborhood. You might also have to even relinquish your desire to live in an international city like Washington D.C. or Los Angeles.

During my late 20s, I felt I needed to live in the best neighborhoods because that’s where all my colleagues lived. It was a similar pressure to buying nicer clothes than I was accustomed to, to look the part.

But once I extricated myself from the workplace, there was no longer any peer pressure. Sure, living in a fancy neighborhood was nice, but I wanted a change of scenery 13 years later.

Lowering my expenses by 40% since 2014 while concurrently growing my passive income by 50% in the same time period has done wonders for our financial well-being.

Our monthly cost to live has now plummeted to well below 5% of our gross income as a result. Growing this gap is the key to financial freedom.

We used to feel a little guilty being away from our house for more than two weeks because that meant we were paying double living costs for that particular time period. Nowadays, our housing costs can hardly be felt, so we feel much freer.

If people arrogantly tell me, “Wow, you live so far away from downtown,” I think to myself: are you really justifying paying a premium in rent or purchase price just so you can live closer to work to work longer? You mindless fool!

Of course, I play dumb, nod and tell them it must be nice to live so much closer to work.

Start Small, Work Your Geoarbitrage Way Up

It’s always good to start small when testing new things. Instead of relocating to a different country, try relocating to a different part of your city first.

Once you understand the challenges and get comfortable with the new environment, then consider relocating to a cheaper part of the country. If living in a cheaper part of the country isn’t enough, then you can rip off the band-aid and go international.

The last thing you want to do is uproot your entire life in a completely new environment and feel like you made a mistake.

One family of five I know paid $200,000+ in real estate commission fees to sell their house in order to relocate to Florida where the wife’s family is from.

They ended up hating Florida because their adopted kids from Africa were being bullied and they are white. So they decided to move back to San Francisco seven months later and buy and remodel a new house for multiple millions.

Try before you buy folks.

Being able to work from home definitely helps with geoarbitrage no doubt. But even if you had to go to an office with bright fluorescent lights that burn your skin and accelerate your aging process by 20%, having to commute an extra 10-30 minutes each way to save big bucks isn’t much of a sacrifice.

Instead, it’s a blessing to be able to enjoy your same city and breathe in the same fresh air while saving so much money every day.

If you think you deserve to live in the best area, then be happy paying higher prices. If you aren’t happy with the cost, please relocate to a different part of town.

Nobody is saying you need to move to polar vortex country to achieve financial independence!

Related:

Buy Utility, Rent Luxury: The Real Estate Investing Rule To Follow

How To Invest Your Down Payment If You’re Planning To Buy A House

Readers, have you geoarbitraged in your own city or area before? Why aren’t more people willing to move to save on housing costs?

PS: I’ve started a Moving To Honolulu thread in the FS Forum. For those of you who live in Honolulu or are knowledgable about life in Honolulu, I’d love to hear your thoughts. My next geoarbitrage moving is coming up soon and I plan to do a meetup.

The post The Proper Geoarbitrage Strategy: First Your City, Then Your Country, Then The World appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments