Loyalty Is Dead: Transfer Your Capital For Free Cash And Rewards

2:10 PMI love people who are loyal. They’ll stick with you through good times and bad. Unfortunately loyalty is dead when it comes to business. Firms will spit you out at a moment’s notice. Banks just move on to the next win once they’ve got you as a customer.

There is no loyalty when it comes to capital. Your goal should be to allocate your capital in as efficient a manner as possible. The more efficient your capital allocation, the greater your chance at financial freedom.

One of the reasons why I like to keep the comments section open despite the massive amount of spam I’ve got to wade through each day is that there are often nuggets of wisdom to be learned.

After publishing the educational post, how online brokerages make money if they cut trading fees to zero, one reader mentioned that Charles Schwab has a promotion where you’ll get $2,500 free if you move $1 million over to their platform. Not bad!

Then another reader chimed in that TD Ameritrade had an even better offer. So I had to take a look.

TD Ameritrade New Account Promotion Bonus

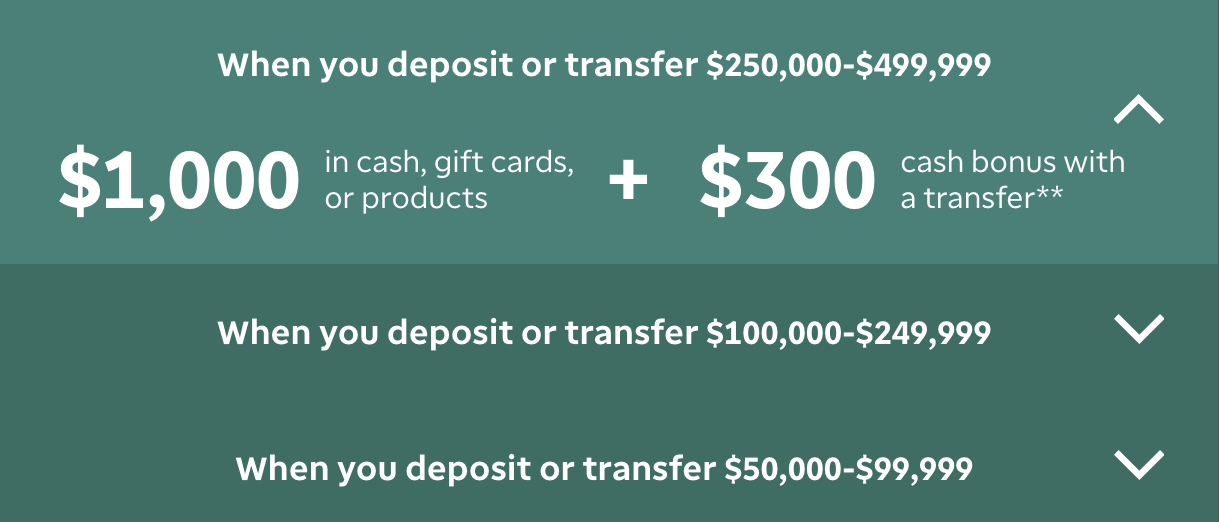

According to the website, TD Ameritrade will give you $12,000 in cash, gift cards, or products + $700 cash bonus with a transfer by 11/8/2019. Sweet!

There’s just one problem, I don’t have a spare $5 million lying around. Do you?

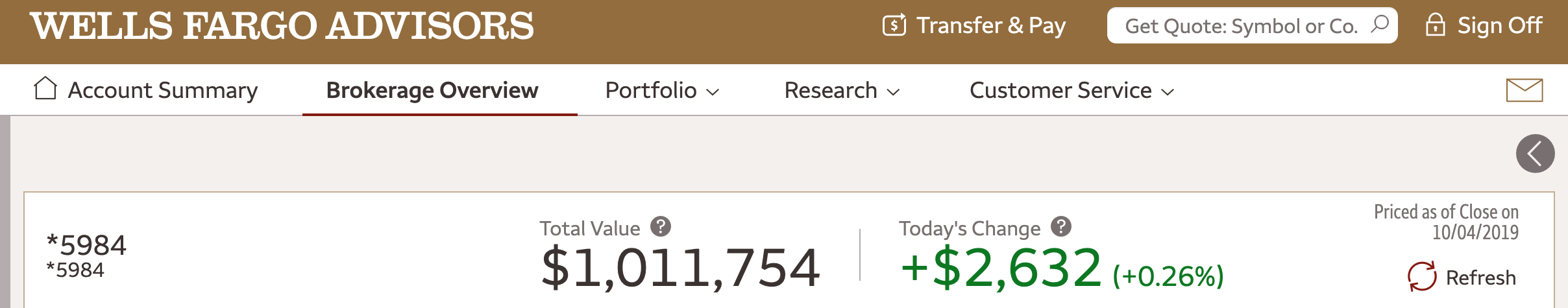

But it turns out, I just so happen to have a little over $1,000,000 available after transferring $1,000,000 to Wells Fargo to take advantage of its relationship pricing for a lower mortgage rate.

If I retransfer the $1,000,000 from Wells Fargo to TD Ameritrade by 11/8/2019, I’ll make $3,000 in cash, gift cards, or products + $500 cash bonus. Better than a poke in the eye!

A $3,500 bonus would be great given that it would almost pay for two months of preschool. I’m on a mission to make an additional $2,200 a month to cover our new preschool + higher healthcare insurance costs.

By transferring over $1,000,000 to Wells Fargo, I was able to reduce my mortgage rate from 3% down to 2.625% on a $701,000 loan. That’s a $2,629 a year interest savings. If I end up holding the loan for seven years given it is a 7/1 ARM, I’ll end up saving around $17,000 in interest.

Therefore, the entire process of transferring $1,000,000 to Wells Fargo and then retransferring $1,000,000 from Wells Fargo to TD Ameritrade would net me a handsome $20,500 in free money!

If you know of any even better online brokerage introductory rewards program, please share.

Start Small And Work Your Way Up

The process of transferring funds to get sign-up rewards is very similar to signing up for a new rewards credit card to take advantage of its bonus rewards.

For example, if you sign up for the Capital One Quicksilver Cash Rewards card, you earn 1.5% cash back on unlimited spending plus, 0% APR for the first 15 months, plus a one-time $150 cash bonus if you spend just $500 on purchases within the first three months of signing up.

I know people who sign up for a rewards credit card every 3 – 6 months to take advantage of all the introductory offers. They’ll end up with dozens of cards to keep track of, but at least they’ll get lots of free cash and points. I use to do this in my early 20s, but I stopped once my company gave me an AMEX corporate card to spend on entertaining clients.

Transferring capital is next level rewards hunting because the dollar amounts are greater and you don’t have to spend any money to get any rewards.

Just the fact that you have money allows you to earn free money. It’s like finally getting recognized for exhibiting sound saving and investing habits.

Capital Transferring Tips For Free Money

Getting free money for having money is always great. It’s like getting invited to the Oscars and then getting a bag with even more free goodies. This fact alone should incentivize you to save more aggressively.

However, here are some things you should consider before proceeding with transferring your capital:

1) Calculate how much time you’ll need to spend. It takes time to call an online brokerage and open up a $1,000,000 account. If you are transferring less than $1,000,000, TD Ameritrade says you can open the account up online. The online brokerages are incentivized to get your money over as easily as possible.

According to the financial regulator, FINRA, individuals wanting to transfer their securities account from one broker-dealer to another must initiate the process by completing a Transfer Initiation Form (TIF) and sending it to the firm to which they want to transfer their account. The firm a customer is transferring the account to can provide the form to facilitate the transfer. Once the receiving firm receives the TIF, it begins the process by communicating with the current or “delivering firm,” via ACATS.

The entire process generally takes about a week. I’m guessing you’ll spend about 3 – 4 hours on the phone or online opening up the account, checking to see if the funds made it, learning how to use the new platform, setting up a link to your checking account so you can transfer future funds, and understanding where to get your tax documents.

Let’s say you transfer $251,000 to TD Ameritrade. You’ll get $1,300 in cash. If you end up spending four hours to transfer your funds and understand the new platform, you’ve earned an effective rate of $325/hour. Do the math because time is money.

2) Make sure you are aware of all the terms. When I transferred money to Wells Fargo to get the better mortgage rate, I knew that as soon as the mortgage closed I could transfer my money elsewhere. For TD Ameritrade’s new account bonus program, I think you need to keep your funds with them for one year. Read the fine print.

So far, I’ve heard crickets from my Wells Fargo wealth manager. She hasn’t explained to me how much trades cost. She hasn’t told me about any innovative new financial products. Nor has she reached out to have a deep dive conversation about my goals for my capital. Therefore, I have no problems transferring away the $1,011,754.

Consider matching your capital’s investment style with the holding period required to get the rewards. In other words, if you must keep your capital with the new institution for a year, consider transferring only your long-term assets where you seldom make any trades. The holding period will feel less painful if the new institution someone isn’t up to expectations.

3) Make sure the receiver has your cost basis for all securities. The cost basis is important for tax purposes if you ever want to sell a security. Transferring over the cost basis is normally a standard operating procedure, but again, best to double-check.

There was one year I received an erroneous $800,000 tax bill from the IRS because I had sold over $2,200,000 in stock and had forgotten to enter my cost basis for each trade! That was a stressful couple of months as I struggled to provide the IRS with the required information!

4) Make sure the benefits of the new online brokerage are just as good if not better than the old one. The last thing you want to do is transfer money over and then have higher trading costs, poorer cash yields, higher expenses, worse customer service, less research, poor trading execution, and a slower platform. If you are an active trader, this stuff matters.

I’m an inactive trader who is almost always 100% invested. I learned my lesson over a decade ago that it’s better to buy and hold for the long term. Therefore, I don’t care how snazzy the new platform is, just so long as it works. Besides, to stay competitive, all the platforms are getting better.

We’ve already got free online trading. Now we’re going to get higher cash yields and likely better new account bonuses. It’s a war for assets!

5) Keep track of your capital. Those of you who are willing to engage in capital transferring likely have more complicated net worths than the average person. Therefore, it’s important to update your net worth tracker accordingly. The only way to make proper financial decisions is if you know your entire net worth composition.

I’ve personally got over 30 accounts to track. Before leveraging the internet, I would sometimes forgot to update one line item in my Excel spreadsheet or forget to add or subtract an account when needed. As a result, I’ve made suboptimal financial decisions.

6) Ask your existing institution for any deals. Presumably, over the years, you’ve been able to develop some goodwill with one or two institutions. If so, they’ll probably want to keep you from moving your capital elsewhere. Ask to see if they have any freebies they can give you just for staying. If so, that might be an even better capital hack.

If not, then move just enough capital where you still remain at a desirable customer tier. You don’t want to downgrade yourself to the bottom of the rung again. You always move your capital back to your favorite online brokerage once the conditions have been met.

Never Turn Down Free Money

Ever since buying my first property, I’ve always told myself to always put in the effort to refinance if I could get at least a 0.25% lower mortgage rate with all costs baked in. The process is a PITA, but in the end, I’ve ended up saving over $150,000 in interest expense over 16 years.

Transferring assets to a new online brokerage for free money is a much easier process. We’re talking 2-4 hours of effort and one week of waiting on average versus 6 – 12 hours of effort and 2-5 months of waiting to refinance a mortgage nowadays.

If you walk by a $20 bill on the ground, you’re not going to ignore it. You’re going to pick it up, count your blessings, and buy loved one something nice. The same thing goes for taking advantage of introductory offers from online brokerages.

If you are investing for the long term anyway, you might as well optimize your capital to get you there quicker.

Readers, why don’t institutions do more to retain their customers given how easy it is to transfer capital? What are some ways you’ve used your capital to make free money? Are you taking advantage of any introductory online brokerage offers?

The post Loyalty Is Dead: Transfer Your Capital For Free Cash And Rewards appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments