Thoughts On Buying Property Ahead Of A Potential Recession

2:14 AM

When I sold a key SF rental property for 30X annual rent in 2017, I was both ecstatic and sad. On the one hand, I was pumped someone was willing to pay 59% more than what I would have sold it for when I first tried to sell it in 2012. That was the year I retired and I thought it prudent to reduce costs. Thankfully, nobody wanted to buy back then.

My wife and I had lived in that house since early 2005. Our long-term vision was to raise a family there and live happily ever after. But our child never came, so in 2014, we downsized by buying 40% cheaper house and rented our old property out. We contemplated a simpler life without children. Then, as fate would have it, my wife got pregnant in 2016, and our son was born in early 2017.

After his birth, we really considered moving back to our previous house, which was in a much busier part of the city. However, we just couldn’t bring ourselves to pack our things again and relocate so soon. So I set up a race between myself and a real estate agent. I was to find a new set of tenants and she was to find a qualified buyer. Whoever found new occupants first would win. I lost.

The SF real estate market continued to do well up until 1H2018. It dipped in 2H2018, came back in 1H2019, and is now fading again in 2H2019.

There is inventory building in many parts of the country as buyers take a wait and see approach.

With so much talk of an impending recession on the horizon, why buy real estate now? Let’s discuss some key points to help potential buyers make better decisions.

Buying Property Ahead Of An Potential Recession

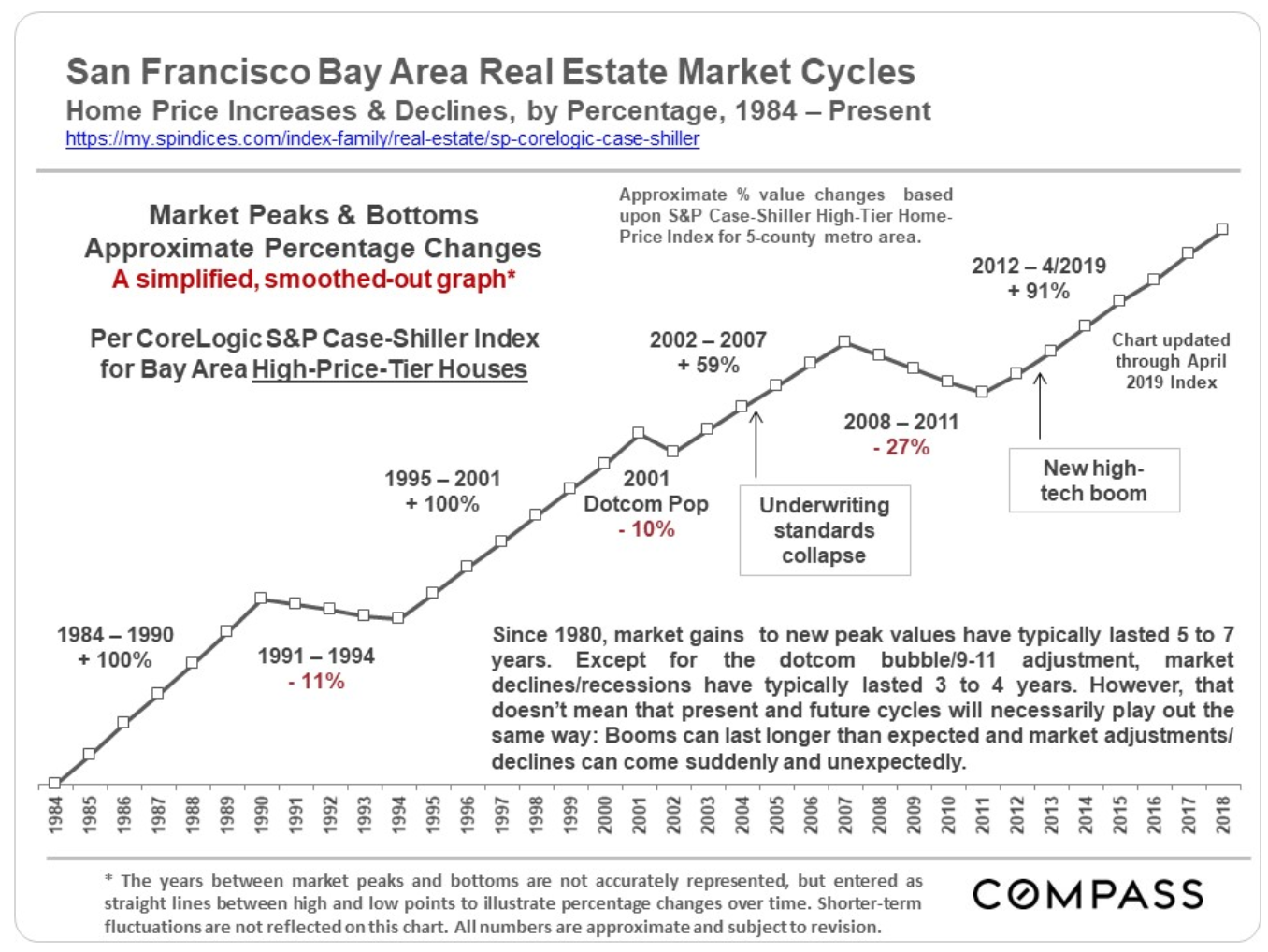

1) Real estate is cyclical. From New York City to Seattle, it is very clear to me that real estate markets across the country have softened. Some markets started softening as early as 2017, while other markets are starting to soften now. If you end up buying property in a softening market, expect real estate prices to stay flat or go down for the next 3 – 5 years.

It takes 3 – 5 years for the market to work through inventory and find price stability. There are always delusional sellers in the first couple years who believe they can still get peak prices. It’s only after seeing their property sit on the market for months that they finally acquiesce to cutting prices.

Below is a simplified chart of the SF Bay Area real estate market cycles.

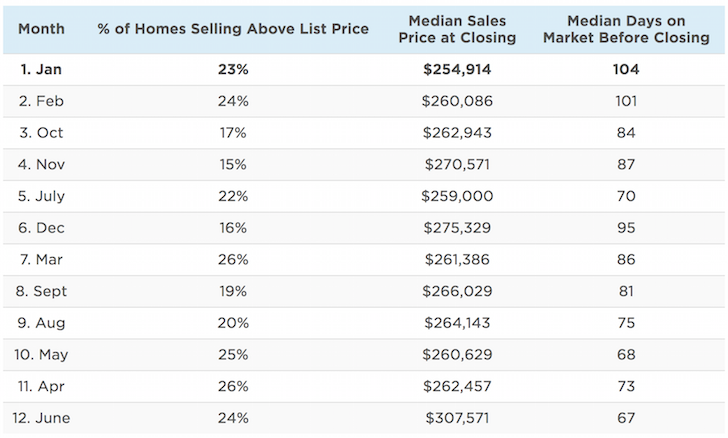

2) Real estate is seasonal. The best time to buy property is in October, November, December, and January. The weather is generally terrible during this time of year, nobody wants to move during the holidays, and any seller listing during this time period is more motivated to make a deal.

As the weather gets better and people get paid their bonuses, the real estate market heats up in Spring.

Take a look at some housing data from the Federal Reserve, the Census Bureau, and Zillow. If you want to buy a house despite a potential recession, the fourth quarter of each year is your best bet.

3) Hope springs eternal. Why does the real estate market seem to always heat up in the first half? It’s the same reason why Financial Samurai gets more traffic in the first half than in the second half. Hope and goal setting!

This is the year we will buy property might be as common a thinking as This is the year I will workout and lose 10 pounds. As people come back from the holidays and get paid their bonuses, they get motivated to make positive changes in their lives.

The government also knows about human nature, which is why it makes us pay our takes by April 15th before we run out of money.

Given owning real estate is one of the best ways to build long term wealth, buying real estate is always one of the most popular financial moves people want to make.

If you want to sell property, it’s best to list in the first half of the year when more people have more money and are looking to buy.

4) Follow a conservative home buying rule. The homeowners who suffer the most during a recession are those who’ve simply bought too much house and lose their main source of income. It’s important to follow the 30/30/3 rule of home buying.

Cash flow. Spend no more than 30% of your gross income on your monthly mortgage payment.

Down Payment. You should have at least 30% of the value of the home saved in cash. 20% is for the downpayment to avoid PMI insurance, and the other 10% is for a healthy cash buffer.

Value of the home. Cash flow affordability is a function of the price you pay. If you are able to meet the first two hurdles of cash flow and down payment, then you can tie it all together with a proper multiple of your yearly gross income to see what you can afford. I recommend buying a property no greater than 3X your annual gross income. However, with interest rates so low, stretching up to 5X may be reasonable for some.

Remember, you can always refinance your home, but you can never change your initial purchase price!

5) Pay cash for a house. If you can pay cash for your house and can comfortably cover all the ongoing maintenance expenses and taxes, then you’ve got the best house buying scenario if we enter a recession.

Being a cash buyer also helps you get the best price possible. Not having to depend on a bank to give a buyer a loan can easily shave off 1% – 3% from another buyer’s offer who requires a loan.

It is much more stressful being a property seller than a property buyer. Each day a house goes unsold after an offer due date hurts the value of the house. Cash buyers can also offer quick closes that can also help get them a lower price.

If the property market proceeds to decline by 20%, a cash buyer is only down 20%. Having a paper loss of -20% won’t feel pleasant, but it will feel much more pleasant than if a buyer put down 20% and lost 100% of his or her equity.

See: How To Pay All Cash For A Property Without Having All Cash

6) Buy property to fit your life. I used to often wonder why anybody would get into a bidding war and overpay for a property, especially after an already massive appreciation in prices. But overbidding happens all the time because people have needs that are even more important than wants.

When couples have their first child or another child, they’ll often want to buy a larger home. Sometimes, parents and in-laws need to move in to be cared for. These type of buyers can’t wait until the perfect time to buy a house. They need to live their lives today.

I’d like to get a larger house for guests to stay longer term. Besides, I’m very bullish on single family homes with panoramic ocean views in San Francisco.

7) Prime locations will suffer less. The farther you have to commute to a major job center, the more your home price will drop during a recession. Vacation properties will likely suffer the most, so please avoid buying a vacation property until there is really blood in streets.

Heartland real estate with already high cap rates may outperform coastal city real estate with low cap rates. However, no area will be immune to a recession. The only difference will be the magnitude of declines. Please carefully study the demographic trends, job growth figures, upcoming inventory, and health of the major industries in the area you want to buy.

If you must buy now, focus on the best location possible. If you want to save money and get a deal by buying a property farther out, then you’ll have to wait until you can’t go a day without seeing a bearish real estate headline.

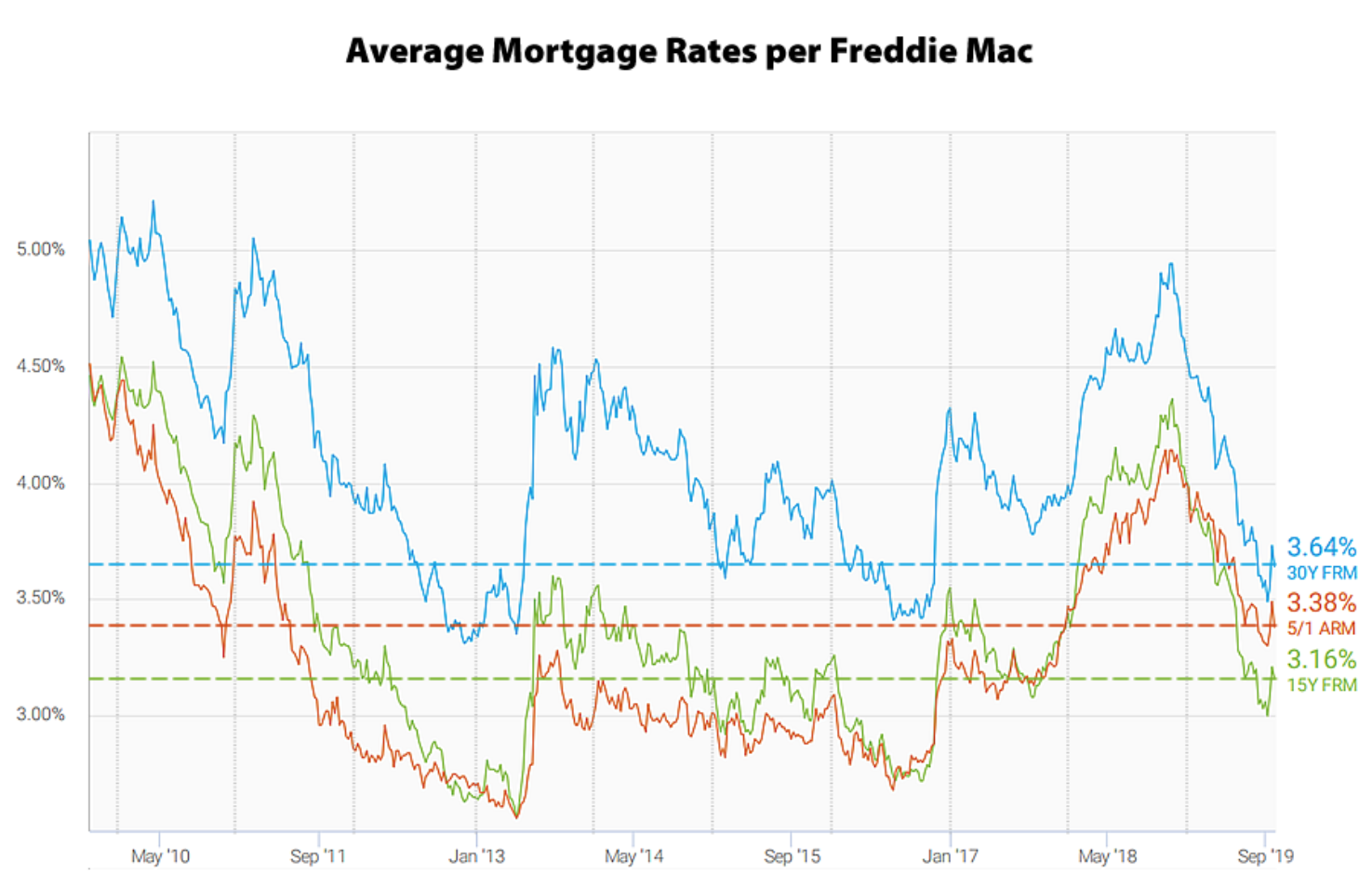

8) Lower mortgage rates will create a soft landing. The 10-year bond yield going from a high of 3.2% in 2018 down to a low of 1.45% in 2019 helps affordability since mortgage rates have come down by a similar magnitude as well.

With rising inventory, softer prices, tough lending standards, strong employment, and lower mortgage rates, it’s hard to see prices collapsing by more than 15% – 20%.

I just finished refinancing my mortgage and my payment is going from $3,920 down to $2,820 a month. A $1,000 increase in cash flow is significant. Thousands of other homeowners across the country will experience similar types of cash flow boosts as well that will enable them to more comfortably afford their homes.

Make Sure You Buy And Hold For The Long Term

If you buy property and a recession hits, you’ll be fine so long as you keep paying your mortgage and property taxes. If you buy your property with cash, you probably don’t have anything to worry about unless the property took all the cash you had.

Life goes on as usual during a recession. Recessions generally only last between 6 – 18 months anyway. Sometimes, by the time you realize you’re in a recession, it’s already over.

Before you buy a property, please discuss and follow all the items in the post above. If you’ve crunched the numbers, are OK with taking a 15% – 20% hit, and plan to own your property for 10 years or longer, chances are high you’re going to be fine.

Start looking at homeownership as a way to improve your lifestyle. If you end up making money over the long run, fantastic. Most people usually do. If not, it’s OK because you were too busy making great memories.

Readers, anybody planning to buy now? Anybody bought recently? What was or is your thought process? Where are you buying and how much has the market gone down? How much do you think your real estate market will go down, if at all?

Related: Buy Utility, Rent Luxury (BURL): The Real Estate Investor’s Rule To Follow

The post Thoughts On Buying Property Ahead Of A Potential Recession appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments