How To Make Lots Of Money During The Next Downturn

2:30 AM During the last downturn, I lost about 35% of my net worth. I don’t plan on doing that again.

During the last downturn, I lost about 35% of my net worth. I don’t plan on doing that again.

Losing 35% is not as bad as the S&P 500 losing ~60% during its worst period, but it still hurt like hell due to the speed and absolute dollar amount of the loss.

Realistically, my target scenario during a recession is to stay flat – neither make nor lose money. But my blue sky scenario is to actually try and make lots of money as the world collapses all around.

Here’s how I plan to do it and how you might too.

How To Make Money During The Next Downturn

1) Be OK with no longer making money.

The first step to making money during the next downturn is to be OK no longer making money during an upturn. In other words, you must methodically sell off risk assets like stocks and real estate the longer we go in the cycle.

It hurts to miss out on gains, but missing out on gains is the only way to not lose money. Your goal is to time your asset allocation so that you have the least amount of risk exposure when the cycle turns. The problem, obviously, is that nobody knows when the cycle will turn.

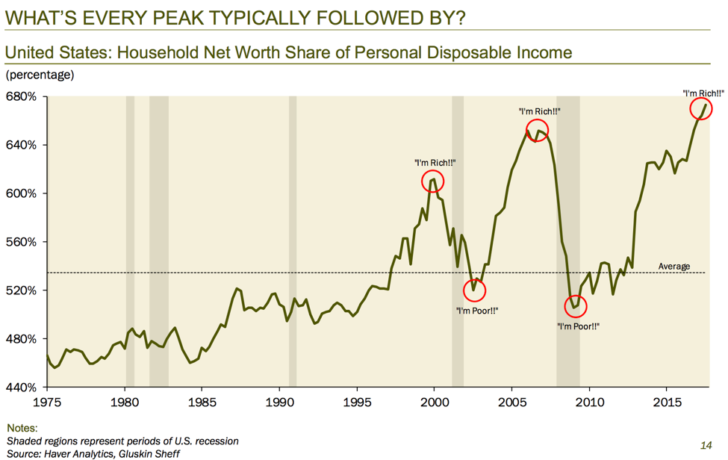

To get a better idea of where we are in the cycle, it’s important to study history and make an educated guess.

Bull markets last on average about 97 months (8 years) each and gain an average of 440 points in the Standard & Poor’s 500 stock index. By comparison bear markets since the 1930s have an average duration of only 18 months (1.5 years) and an average loss in value of about 40 percent.

If we are to say the recovery began in 2010, then 2018 is the 9th year of the current cycle. With the Fed starting to tighten, valuations close to all-time highs, and earnings growth slowing down, we can conclude that it’s logical to start taking some risk off the table.

Related: How Much Investment Risk To Take In Retirement

2) Be at least neutral when the cycle turns.

It seems likely there will be a recession before the end of 2020 (11-year cycle). Therefore, you want to move mostly to cash and CDs before then or have short positions that outweigh your long positions at the very end of the cycle.

Remember, even if you move to 100% cash or CDs, you are still going to make a guaranteed ~3% on your money each year based on today’s risk-free rate. You must weigh your guaranteed return against the possibility of missing out on further gains or the possibility of losing money.

If you have already made over a 200% return in the stock market since 2010, is it so bad to only make 3% a year instead of 8% a year if you have to take more risk? If your property equity is up 500% since 2012, do you really want to pay three more years of property tax, mortgage, and maintenance expenses if prices might stay flat or go down 20%? These are some of the questions you should ask yourself.

See: Always Calculate Opportunity Cost When Making A Major Investment

3) Take some risk and go net short.

The only way to make a lot of money in a downturn is to take risk. This means losing money if the downturn never comes.

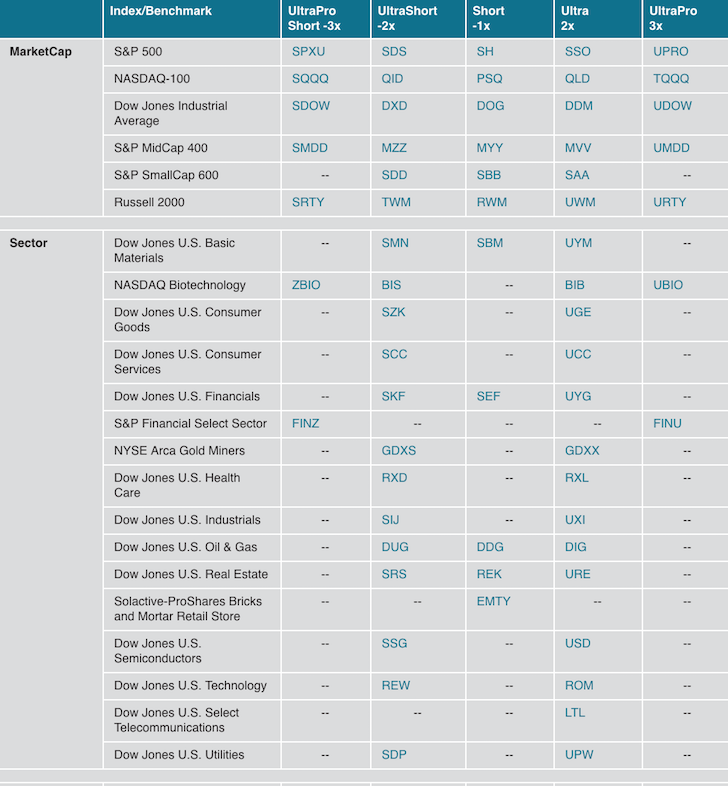

The easiest way to short risk is to buy an ETF that goes up when the underlying index it tracks goes down. Here’s a list from ProShares which includes leveraged short and long ETFs to really juice your returns or blow yourself up.

You can also short individual stocks as well if you feel you have an edge and want more direct exposure. The stocks that usually get hammered the most during a downturn are high beta stocks with weak balance sheets and no earnings.

In other words, small cap names in the biotech and tech sectors often go down the most because their valuations are all based on speculative terminal values. Such companies will be relentlessly attacked on the short side as speculation grows they will go out of business. If you’re a loss making company with no moat, you will die if the downturn lasts long enough because the capital markets will be shut to any fundraising. This is why shorting the Russell 200 small cap index (TWM) is quite popular in a bear market.

On the other hand, cash-rich, mega capitalization companies that have a long history of paying a dividend tend to go down the least. Think about names in the utilities space and consumer staples space like AT&T or Proctor & Gamble. They are not only highly profitable, but also have enough cash to last them through years of unprofitability. Thus, given we know the average recession lasts only 18 months, many investors seek relative safety by buying utility or consumer staple stocks.

Beware, if you short a high dividend yielding sector or stock or treasury bond ETF, you will be forced to pay that dividend.

Related: The Proper Asset Allocation Of Stocks And Bonds By Age

Go Long Volatility

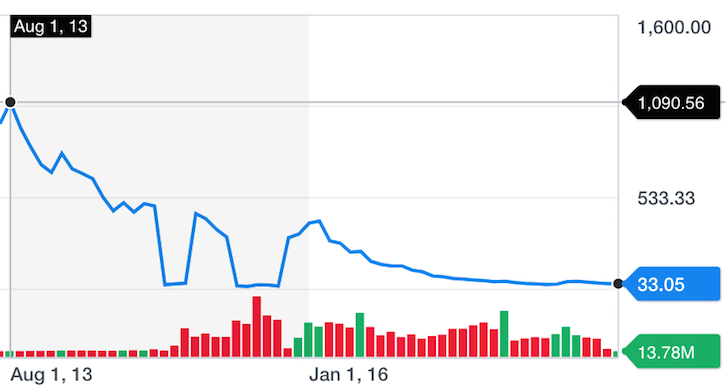

You can also go long volatility by buying a volatility ETF such as VXX. During the early 2018, 10% sell-off in the S&P 500, the VXX doubled from $25.68 to $50. Just beware that going long volatility for the long term is a losing proposition due to a thing called “decay.”

The chart below is a 5-year history of the VXX. Notice how the price was $1,090 back on August 1, 2013. Today it’s only at $33 for a 97% loss! In other words, you can only go long volatility for brief periods of time (less than a couple of months) before the structure of the investment drags you down.

Go Long US Treasuries

When the world is collapsing, investors tend to seek the safety of US Treasury bonds. Two of the most common ETFs to buy are IEF (iShares 7+ Year Treasuries) and TLT (iShares 20+ Year Treasuries). Buying TLT will give you more upside and volatility given longer duration bonds are more sensitive to interest rate changes.

Notice how TLT spiked from $92.83 on Oct 1, 2008 to $119.35 on Dec 1, 2008 (+28.6%) during the depths of the financial crisis. There have been several more 20%+ trading opportunities since 2008 due to geopolitical risk, policy risk, and further stock market sell-offs.

It’s interesting to note that even if you had bought TLT at its high during the crisis, you’re back to even today while earning a steady ~3% annual yield.

Related: The Case For Buying Bonds: Living For Free And Other Benefits

Go Long Gold

Gold is a hard asset that also tends to do well during a downturn. Even though gold generates no earnings and provides no dividends, it’s a commodity that can be traded. The more dire the economic situation, the more valuable hard assets become.

The largest, most popular gold ETF is GLD, followed by IAU. As you can see from the GLD historical chart below, it did phenomenally well from Oct 1, 2008 up until early 2012 (+170%) before fading as the bull market took off.

If you invest in gold for the long-term, it’s important to understand global demand and supply dynamics, and take a view on the US dollar since gold is denominated in US dollars. Gold is an imperfect hedge.

Go Long Yourself

The people who don’t lose their jobs in a recession are those who are too valuable to their firms. Therefore, build enough skills, client relationships, and internal goodwill to be forever employed. You are likely your largest money maker.

Going to business school part-time was one of my best money makers because not only did I build new skills, my firm felt they had invested too much in me by paying 85% of my tuition to just let me go. They wanted their three years of indentured servitude in return for tuition assistance.

Besides getting more formal education, you should put some time aside each week to exercise your creative mind. Maybe you’ll write a counter-cyclical book, or come up with a song that earns royalties, or start a website that earns advertising revenue about your favorite hobby. These extra engines could blast you off into financial space.

Thanks to Financial Samurai, my overall net worth has outperformed the S&P 500 and San Francisco real estate since it began in 2009.

The Easiest Way To Make Money In A Downturn

Shorting the market long term is a losing proposition due to population growth, ever-growing demand, dwindling supply, and inflation. It’s the same concept as renting long term.

If you want to short the market, you must be disciplined to short for only a short duration of time. It could be only one week if you are buying volatility or at most two years if you are shorting the S&P 500. During this shorting time period, you will likely lose money as your timing will be imprecise.

As a result, many investors looking to hedge against a downturn build a portfolio of longs and shorts and rebalance their net exposure whenever they feel more bullish or bearish. But in such a scenario, you might lose on your longs and shorts as well.

Given you can mistime the market in both directions and none of the investments above are perfect hedges, the easiest way to make money during a downturn is to go long cash or cash equivalents like CDs. Making a 3% guaranteed return while risks assets go down 30% feels just as good as making a 37% return when your peers are only up 4%.

If you can concurrently build outside income sources while you de-risk, then all the better.

For those of you who are under 40 or who have at least 20 years of work left in you, you might as well keep taking risk based on a more traditional asset allocation model. Long term, investments such as the S&P 500 and real estate tend to go up and to the right. When you combine not spending money with long-term compounding, you will get rich beyond expectations.

For those of you who have enough money to be happy, taking excess risk is unnecessary. Once you’ve made your money, the key is to keep it.

My plan is to continue de-risking until I have no more than 30% of my net worth in risk assets by 2020. Sounds conservative, but I can happily live off 3% a year without ever touching principle.

Related: It Feels A Lot Like 2007 Again: Reflecting On The Previous Peak

Readers, what are some ways you plan to make money during the next downturn? When do you think that next downturn will be?

The post How To Make Lots Of Money During The Next Downturn appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments