The Average Single-Family Home Size Is Declining: Positive Sign For Investors

2:22 AM

Some tantalizing news for real estate investors and potential homeowners! I found another reason why 2020-2021 might be a great time to buy real estate.

I used to think the average square footage size of an American single-family home would keep getting bigger, just like my waistline. After all, once something starts in motion, it’s often hard to stop.

However, as of the third quarter of 2019, the average (mean) square footage for new single-family homes in America has declined to 2,464 square feet from a peak of around 2,700 in 2015.

This data is from the Census Quarterly Starts and Completions by Purpose and Design report and the National Association of Home Builders.

The Median And Average Size Of New Single-Family Homes

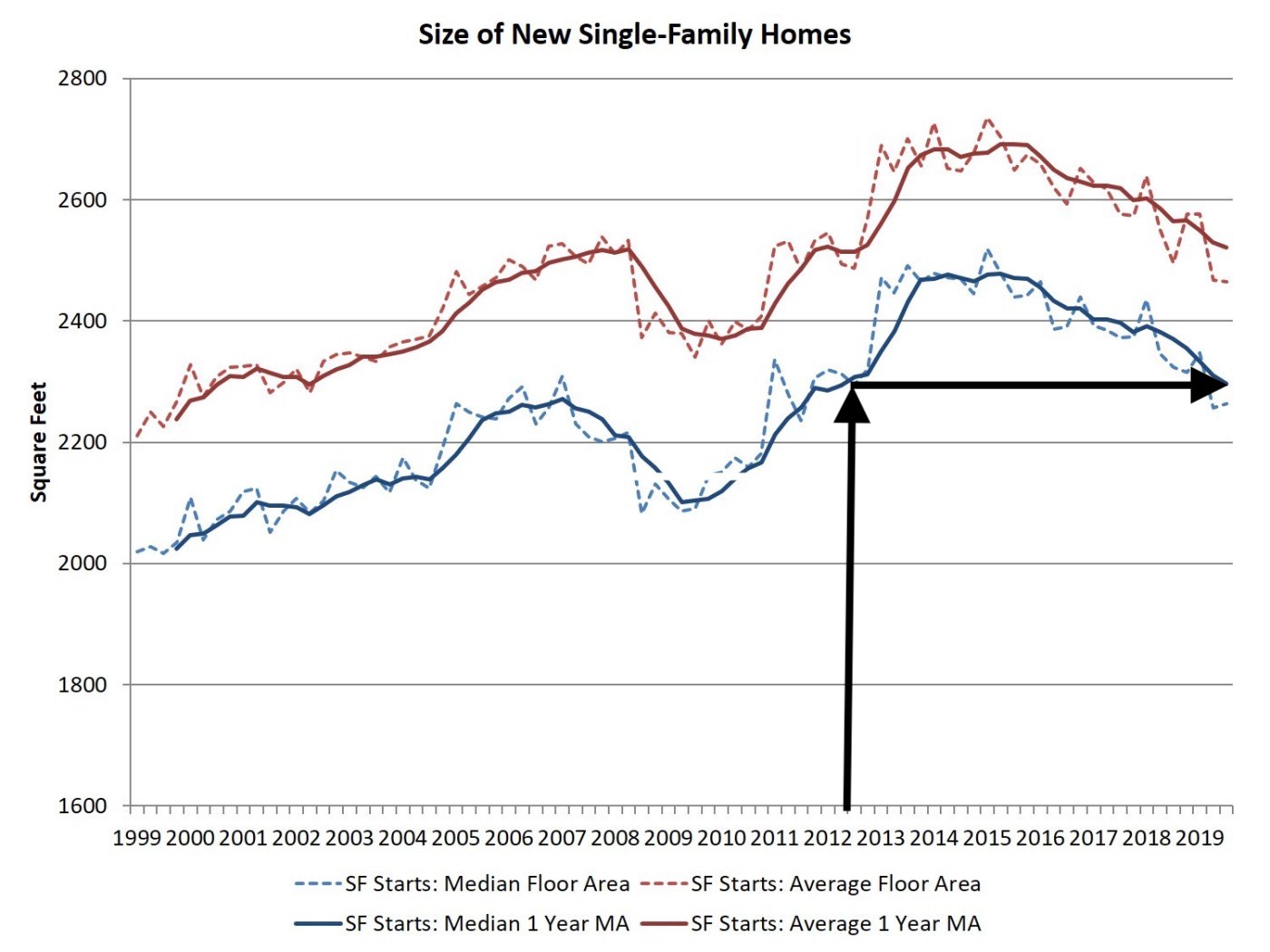

The chart below shows the average and median sizes for new single-family homes on a one-year moving average. As you can see from the chart, homes sizes peaked at the end of 2015 and have been steadily trending downward. The average and median home size is now back down to 2012 levels on a one-year moving average basis.

2012 is an important year because 2012 is when real estate prices took off across many parts of the country.

The cycle home size low was during the financial crisis in 2009 as homebuilders cut back and homebuyers realized they didn’t need as much space. When the world is falling apart, you don’t mind sharing a bathroom and not having a family office. Instead, you would probably prefer to rent the smallest shack possible in order to survive.

Since cycle lows, the average size of new single-family homes on a 1-year moving average is now just 6% higher at 2,521 square feet, while the median size on a 1-year moving average is 9% higher at 2,296 square feet.

A Bullish Sign For Prospective Homebuyers

Since 2015, there’s been an underlying weakening demand for new single-family homes. From a real estate investor’s perspective, four consecutive years of home size declines should be seen as a bullish sign. You want froth to have escaped the system before you buy.

If the decline in average and median size homes continues at their respective paces until 2021, we would be right back to the average and median sizes being built during the bottom of the size cycle in 2009. In my opinion, this is unlikely to happen because America is much richer today.

The previous home size peak was in 2007. Home sizes then declined for 2.5 years before rebounding in 2010. Thus, after four years of home size declines, homes have been declining for 1.5 years longer than during the previous cycle. It is my belief that the end is near for home size declines.

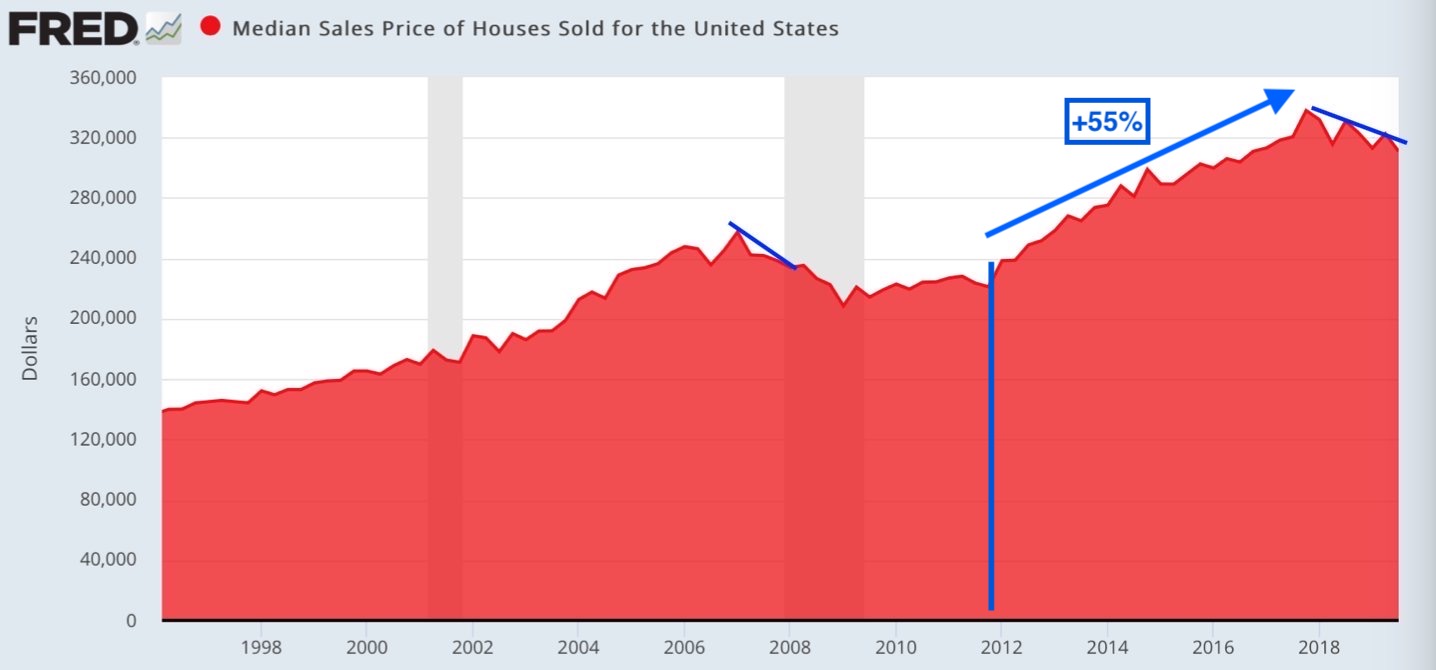

But here’s the thing. Home prices didn’t immediately start taking off in 2009 when home sizes bottomed. Instead, home prices stopped going down in price around 2009, flatlined for a couple of years, and then started to rise towards the end of 2011. What ensued was a 55% increase in median sales prices until 2017.

In other words, home prices started rising about one year after home sizes bottomed. If we believe that the cycle bottom for home sizes is here after four years, then we should anticipate national home prices to start rising by 2021.

Real Estate Looks Attractive

There’s always a lag in real estate prices based on fundamentals because the real estate market isn’t as efficient as the stock market. It takes time to go through inventory. It takes time for homebuilders to recognize opportunity and build until completion as well.

The correlation between home size and home price isn’t an exact science. But we can make a logical conclusion that there is a correlation based on history and microeconomic and macroeconomic fundamentals.

Home sizes could absolutely continue to go down for a 5th or 6th year as Americans embrace frugality and minimalism. But I doubt it due to the incredible wealth that has been generated in the stock market since 2009, the rise in national wages, the decline in mortgage rates, and the human condition of always wanting more.

As a prospective homebuyer, you want prices and home sizes to be declining for at least as long as the previous cycle declined before you buy. You might be able to time the bottom of the next cycle, but even if you don’t, if you have a 10+ year ownership horizon you’re probably going to do pretty well.

Of course, there are no guarantees when it comes to investing. Every real estate market is different. Do your due diligence before spending a fortune on physical real estate.

Readers, what are your thoughts on the average home size in America trend? Do you think the average home size will go back to its 2009 low? Do you believe the average American will go back to his or her weight from 2009? Any other insights you can gather from home sizes and home prices?

Related articles:

Focus On Trends: Why I’m Investing In The Heartland Of America

Buy Utility, Rent Luxury: The Real Estate Investing Strategy To Follow

The post The Average Single-Family Home Size Is Declining: Positive Sign For Investors appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments