The Recommended Split Between Passive And Active Investing

2:29 AMWe know from the data that investing in passive index funds over active funds over the long run is the way to go. Over the long run, no rational person would keep on investing in an active fund that regularly underperforms its benchmark, especially if it charges a higher fee.

Yes, despite the logic, active equity funds still account for about 50% of the entire assets under management of all funds. The simple reason is that a minority of active equity funds do outperform their benchmarks. And when they do, there’s hope. We, humans, live on hope.

In this post, I’d like to review the percentage splits for retail investors and passive funds and active funds/individual stocks. I’ll discuss what type of person is appropriate for each of the four splits.

Please do not confuse the percentage split between passive and active investing with asset allocation between stocks, bonds, and other risk assets.

Recommended Split Between Passive And Active Investing

100% Passive / 0% Active: 100% passive is for those of you who don’t care about outperforming the benchmarks and who are happy getting rich slowly. You are unwilling to take any chances outperforming the benchmark if it means risking underperforming the benchmark.

You could give two craps about where the portfolio manager and analysts went to school and their investment track record. Further, you’re a busy professional and/or parent who has no interest or time in following the stock market. Your expertise in making money lies elsewhere.

You love the K.I.S.S. motto when it comes to investing because you’d rather never think about your money. You have so many more important things you want to do with your time. You believe the primary way you will reach financial independence is through steady investment contributions over time.

75% Passive / 25% Active: You want to get rich quicker than the average person and are therefore willing to take more risks. You believe you can choose the right funds and the right stocks that will help give your overall investment performance a boost each year.

You are a rational investor who also enjoys following the markets. You’re willing to recognize market trends. You may have a slight edge in a particular sector due to your occupation. If an emerging trend seems obvious, you’re willing to invest in a sector fund or invest in individual stocks that should benefit from said trend.

At the same time, you also realize that consistently outperforming your target benchmarks over the long run is impossible. Therefore, you keep three times more assets in passive index funds. Your active investments are in mostly sector ETFs instead of individual stocks.

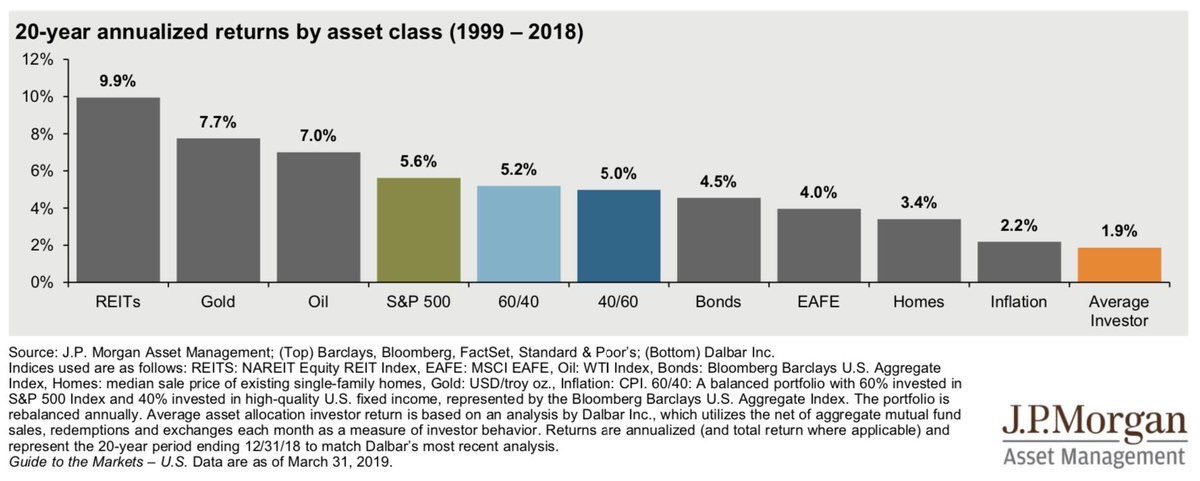

50% Passive / 50% Active: A 50% active percentage is the highest percentage I recommend for all equity investors. We know that the average investor only returned 1.9% a year between 1999 – 2018, according to J.P. Morgan Asset Management. The average investor trades too much, buys too high, and sells too low. The average investor is an emotional wreck. As a result, the average investor would do best to protect oneself from oneself by investing in mostly passive index funds.

Despite the data, we all suffer from a little Dunning-Krueger (delusion). For those of you who have at least 20 years of investing experience, who have at least beaten your target benchmark for at least 10 years, and who simply love the process of investing, a 50/50 split may be appropriate for you.

A 50/50 split might also be appropriate for younger investors (<30 years old) who don’t have as much to lose. It’s best to learn with less money whether you are a good active investor or a bad active investor. If you find yourself to have investing acumen, you can gradually build up the absolute dollar amount and percentage.

<50% Passive: You’re a professional money manager who picks stocks for a living. You’re also required to have skin in the game by investing a percentage of your bonus or salary into your fund. This way, you feel the pain of your losses and the glory of your wins. Many hedge funds require its employees to invest this way.

You’re also someone who loves everything about the stock market. Investing doesn’t give you stress. It brings you joy. Investing actively is also helped if you are financially independent or have another means of generating a regular amount of cash flow way beyond your living expenses. For example, you might operate a highly profitable lifestyle business or have a massive trust fund.

Since most of us are not professional money managers, trust funders, or have highly profitable lifestyle businesses, I don’t recommend having less than 50% of your investments in passive index funds.

My Active / Passive Investing Split

Since 1996, when I opened up my first online brokerage account with Ameritrade, my greatest wins and my greatest losses have all come from investing in individual stocks. As a young man, I didn’t mind my big losses because the absolute dollar amounts lost weren’t very big.

From 1996 – 2009, I predominantly invested in individual securities. After all, I worked in international equities business at two major investment banks. My income was growing and I felt I had an edge.

But after the financial crisis, my desire to make money quickly dissipated because I had lost so much money. My desire to protect my capital and avoid experiencing as much financial pain came to the forefront. Further, I had started thinking about ways to escape finance since it was no longer fun.

Today, my split is roughly 75% Passive / 25% Active. I continue to own a bunch of individual tech stocks for the past 10+ years. Owning Bay Area real estate and tech stocks were my main two ways of participating in the tech boom because I was too untalented to get a job at a growing tech company.

After all these years, I still enjoy following all the economic, political, and company-specific news that could affect share prices. However, as a dad to a toddler now, I no longer have the time to analyze cash flow statements and get onto quarterly management conference calls.

I like the combination of having a core S&P 500 index fund, some sector ETFs, and individual stock names. It’s my “Passive Plus” strategy.

I also sold my actively managed SF rental property in 2017 that was giving me nightmares. 35% of the proceeds were invested in dividend ETFs, 35% was invested in California municipal bond funds, and was invested 30% in real estate crowdfunding. It feels great to earn income passively.

My main financial goal in my 40s and beyond is to protect the capital I’ve accumulated. I also want to buy as much time as possible. If I can grow our net worth by 5% a year without any stress, I’ll be happy. To do so, I’ve been more focused on the appropriate asset allocation split between stocks, bonds, cash, and alternative investments.

I know there’s a lot of talk about passive investing being in a bubble. But the vast majority of people should still have the vast majority of their investments in passive investments. There will eventually be another correction and I’m sure the majority of actively run funds will correct even more when the time comes.

Investing mostly in passive funds doesn’t mean you should be a zombie and just invest 100% in a particular passive equity index fund. You’ve got to diversify your investments to match your specific financial goals and risk tolerance. You should also review your investments at least once a quarter.

Find a way to get rich slowly through passive investing and find multiple ways to get rich slowly through active investing. You can and will be able to accelerate your wealth by taking actions. But it’s up to you to find the right balance.

Readers, what is your split between passive and active investing and why? What are your investment goals?

The post The Recommended Split Between Passive And Active Investing appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments