What Income Level Is Considered Rich?

8:11 AM Obama considered single people making over $200,000 to be rich. He specifically called for raising taxes on singles making over $200,000 and couples making $250,000 every year he was in office.

Obama considered single people making over $200,000 to be rich. He specifically called for raising taxes on singles making over $200,000 and couples making $250,000 every year he was in office.

At the end of 2012, there was a compromise in Congress for raising income taxes for those making $400,000/$450,000 and above. Why $400,000 + $400,000 doesn’t equal $800,000 for a married couple to pay more taxes, I’m not sure. The government still harkens back to its old days of believing one spouse should stay at home.

With the new tax plan that started in 2018, the Trump administration now views individuals making $500,000 and married couples making $600,000 as rich, because those are the income thresholds that now pay the top federal marginal income tax rate of 37%. Further, the estate tax threshold doubles to $11.4 million per individual and $22.8 million per couple.

There are two aspects of monetary wealth we can focus on: Income and Capital. Some make a lot of income, but have only a little amount of capital since they are either starting off in their careers, or haven’t saved and invested an appropriate amount. That’s not going to happen to you because you read Financial Samurai and will follow my savings guide to ensure capital accumulation.

Meanwhile, there are those with a tremendous amount of Capital, with little income given they may have inherited their wealth but have no income generating skills. Capital heavy people may have invested skillfully over the years, built great companies, or were incredibly disciplined in their savings. There are many different types of folks in the Capital heavy category. It’s not a bad place to be at all.

Ideally, it’s best to have both high income and a large capital base. This is my goal, and therefore my goal for all of you as well. In this post, we’ll focus on the income side of the equation and what to strive for just in case we don’t have a trust fund from mom and dad.

How Much Income Do You Need To Be Considered Rich?

Instead of just saying what I think, I’m going to share my thoughts on various income levels per person for populations living in coastal cities such as San Francisco, New York City, Los Angeles, Boston, and Washington DC and work out the answer.

The idea is to focus on the more expensive parts of America, which can therefore translate into living in other expensive countries in the world such as Paris, Hong Kong, London, Tokyo. Of course, if you move to much cheaper places, you’ll be considered that much wealthier.

Various Household Income Levels

$50,000: Not rich, but middle class to lower middle class. After contributing $10,000 to your tax-deferred 401(k), you are left with $40,000 in gross income to live. With an effective tax rate of about 15%, you have about $34,000 left after taxes. $34,000 or $2,833 a month is enough to live a frugal lifestyle, however, you’ll probably want to find a partner who makes at least $25,000 a year to be comfortable with a family.

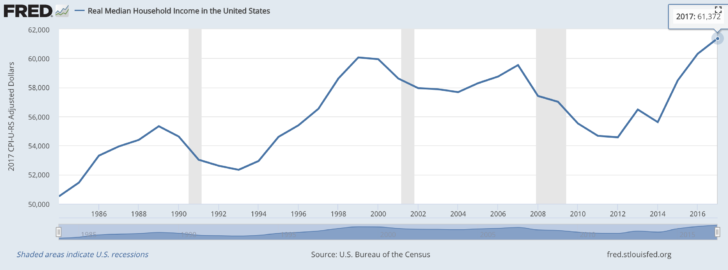

The median household income in America is roughly $62,000 as of 2019.

$100,000: Not rich, but middle class to upper middle class. After contributing $19,000 to your tax-exempt 401k, you are left with $81,000 a year in gross income, and ~$60,750 net income based on a 25% total effective tax rate. The income limit where you can no longer contribute to an IRA is $73,000.

$200,000: Upper middle class. After retirement contributions, you are left with $177,000 in gross income, leaving you with roughly $125,000 in after tax income. You boost your after tax savings rate to roughly 30%, leaving you with about $87,500 left.

By the time you are making $200,000 in your career, you’re probably in your 30s or older and have a mortgage and kids to consider. Kindergarten/daycare may run $15,000-$20,000 a year, followed by $30,000-$40,000 in shelter costs for a reasonable home. You’re left with $20,000-$40,000 to spend on food, travel, groceries, gifts, lessons, and so forth. Not bad.

$350,000: Still upper middle class. After retirement contributions, you’re left with $332,000 in gross income, or roughly $250,000 in after tax income. With a 30% after-tax savings rate, you have $175,000 left to spend. Your family has grown to 4, and you seek a bigger home. An average 3 bedroom, 2.5 bath home in a good area in San Francisco will run you about $1,300,000 to $1,700,000. We’re not talking anything super fancy at 1,800-2,800 square feet. Your mortgage at 3.5% on $1.1 million will therefore cost around $60,000 a year + $15,000 a year in property taxes.

I choose $1.1 million because that was the maximum level for mortgage interest deductibility before Trump came to office. As a result, you’re left with about $100,000, or $8,333 a month in after tax income for school for two, travel, food and so forth. You’re doing well, and if you are frugal, you can certainly save more than $75,000 a year in after tax money along with the $18,000 401K contribution.

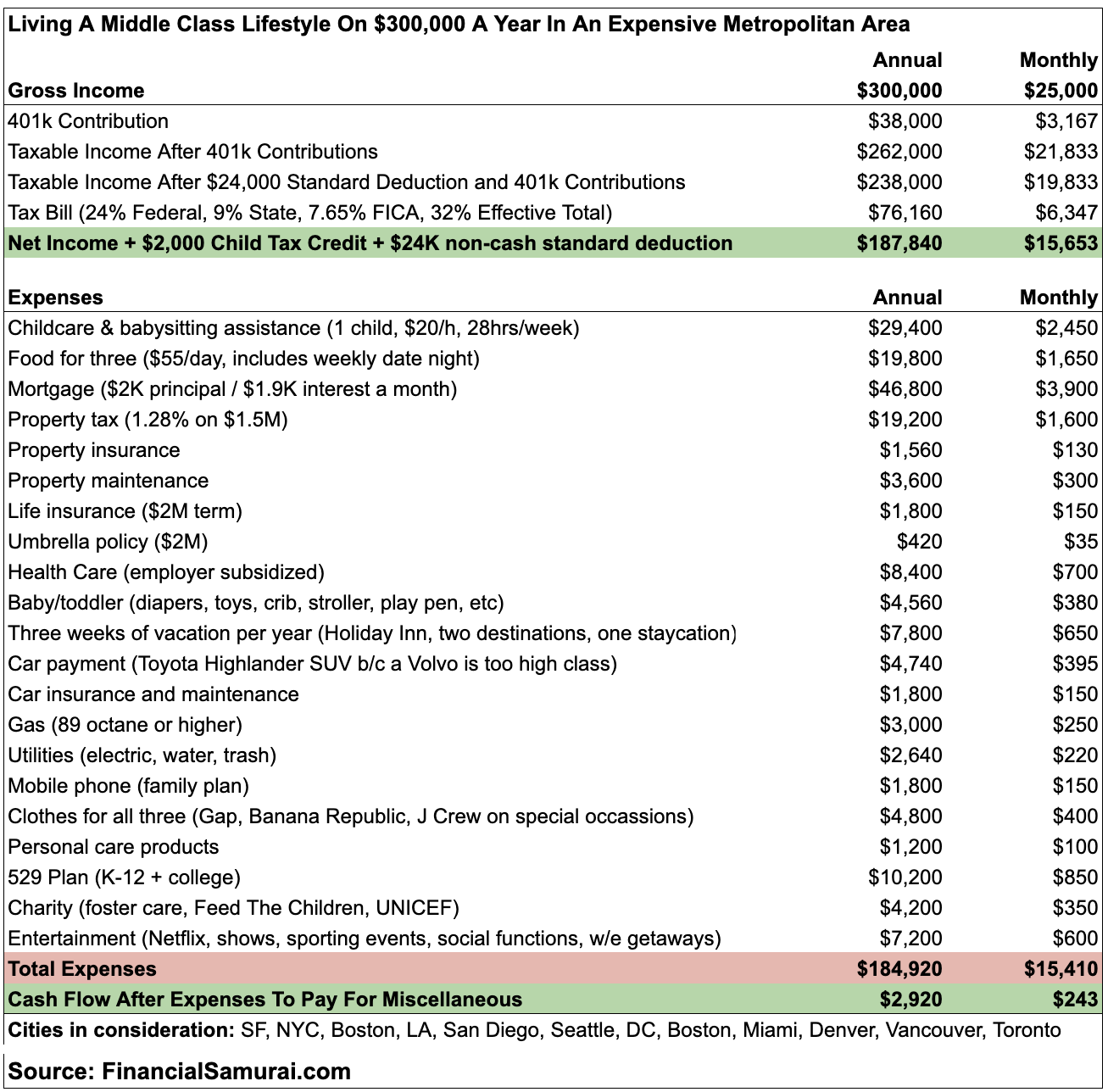

See: Why Households Need To Make $300,000 To Live A Middle Class Lifestyle Today

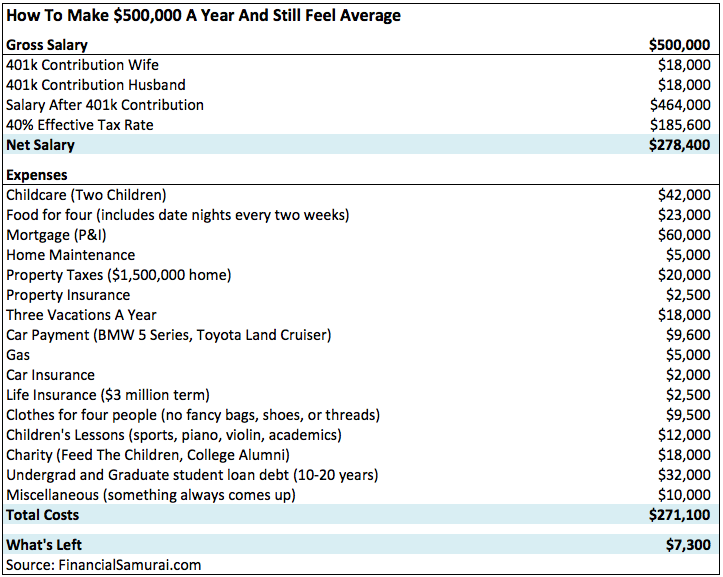

$500,000+: You are rich! With $481,000 in gross income after contributing the current $19,000 maximum to your 401(k), you have about $300,000 in after tax income (effective at 35%, which includes 10% state). That’s right, you are paying around $183,000 in taxes alone, yet the government still wants to take more from you! Undeterred, you crank up your savings to 35%, and put away another $105,000, leaving you with $195,000. Subtract $70,000 for annual mortgage/property tax leaves you with $125,00. Then subtract another $40,000 in tuition for two.

With around $7,000 a month in money available for travel, food, entertainment, goods, gifts, you are sitting pretty, especially since you are putting away away $122,000 a year in savings. That said, there are couples still struggling to get by on $500,000 a year!

The Alternative Way To Know You Are Rich

You don’t have to work for a living: You are also considered rich! If you have passive investment income that can cover your desired daily living expenses, then you have all the freedom in the world to do whatever you want.

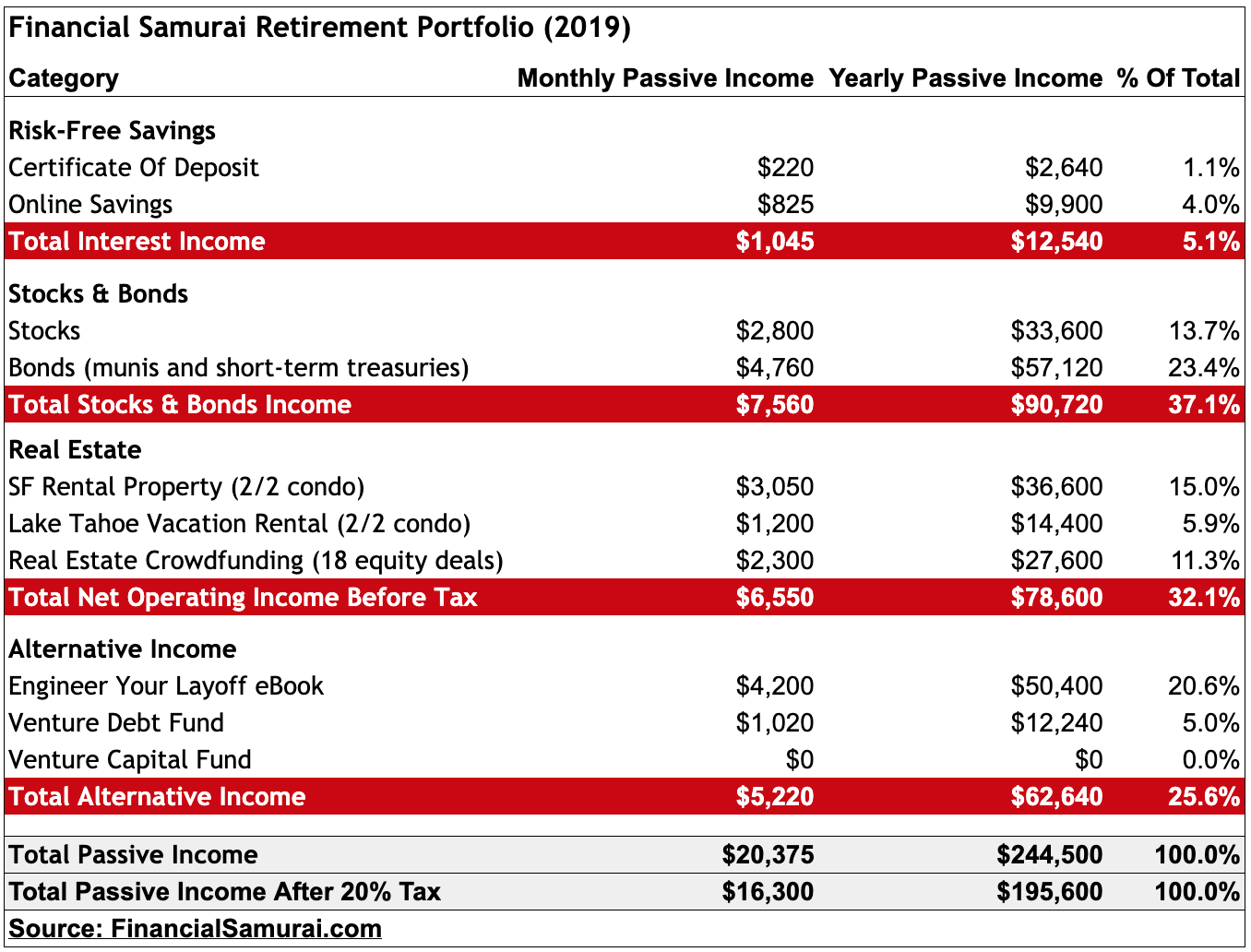

I left full-time work in 2012 at the age of 34. Even though I went from a multiple six-figure salary to $0, I felt incredibly rich because I was 100% in control of my time. I had about $80,000 a year in passive investment income that could provide a simple life for my wife and me in San Francisco.

For five years, we lived a care-free life and traveled the world. Then in 2017, we were blessed with a baby boy. The desire to earn more money took a jump higher. We needed to make enough so that both my wife and I could continue taking care of our boy full-time before he goes off to kindergarten in 2022 and never wants to hang out with us again.

Therefore, we’ve been 100% focused on building enough passive income. Below is our latest non-401(k) retirement portfolio income streams.

The most exciting passive income source right now is real estate crowdfunding. To simplify life, we sold an expensive SF rental property for 30X annual gross rent and a 2.5% cap rate, and reinvested $550,000 of the proceeds into real estate crowdfunding across the heartland of America.

Now we don’t have to deal with maintenance and tenant hassles, while earning a much higher cap rate of ~12%. If you’re interested in diversifying into real estate, check out Fundrise for free. It is my favorite real estate crowdfunding platform with the most innovative and highly vetted deals.

The Rich Person’s Game Plan

* Depend on yourself. Earning a high level of income is a choice, no matter what the naysayers tell you. It is up to each of us to further our education to develop a skill-set that enables us to earn more. It is up to us to work longer than our peers, so that after 2 more hours of work a day, we’ll have made over 600 more hours of progress a year. Don’t you think you could develop something amazing with 600 hours of time? You know you can.

* Get a mentor. If you want to learn how to become wealthy, learn from someone who is already wealthy, not someone who tells you how to get wealthy without being wealthy. Those folks are charlatans, and some do it very well, which is why they are wealthy. Instead, seek out a mentor and do everything possible to ingratiate yourself into their circle. Successful people want to give back. It’s the way they are hardwired.

* Remove disabling beliefs from your mind. Wherever you go, there you are. You mind is either like a power plant of positivity, or a cesspool of negativity. You must believe in yourself, otherwise nobody else will. I am so internet/computer illiterate that I thought there was no way I could start a website, until one day in 2009 I said ,”fuck it” and got it done. I’m only slightly more literate than a doorknob now, but at least things are running and I can just do this full-time if so desired.

* Go the traditional route. Earning six figures and saving millions of dollars is straightforward. It just takes time. When you are incredibly rash, you do stupid things and screw up your financial goals. Save and invest even 10% of your income over 30 years and you will likely have more money than you will ever need.

* Be your own boss. Time and time again, you stumble across stupid things that turn out to be big hits. Twitter, for example, was one cockamamie idea that has revolutionized the way we communicate. Airbnb is another idea that has helped lower costs in the hospitality industry. Everybody should at least own their brand online by starting a website. I started FinancialSamurai.com in 2009, and by 2012, I was making enough to live a good life in expensive San Francisco. Now, I never have to go back to work again! Not a day goes by where I’m not thankful for starting this site.

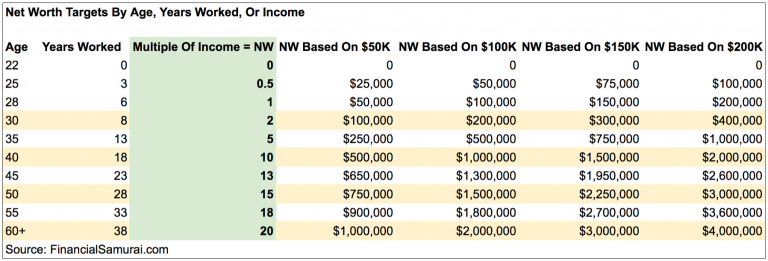

Here’s a good net worth target to follow. After all, it’s not so much how much you make, but how much you keep. To be truly rich, you should aim for a net worth equal to 20X your average annual gross income or more.

Suggested net worth targets by age, income, work experience

Wealth Equalization Factor

Some of you who live in other parts of the country can live on much less than the amounts above. Meanwhile, public school systems are good enough where you are, so you’re willing to send the kids without fear of long-term failure. Hence, if it pleases you, take a 30%-50% discount to the above numbers.

The great thing about these income levels is that we’re only considering one individual. If you have a partner who earns even just $30,000 more a year, it goes a long way to helping out the family.

I’m of the mindset that we should maximize our income, so we can maximize our capital base, so we can sooner do what we really want and never have to worry about money again! Methodically saving money is the foundation of personal finance.

But the rich get rich by deploying their savings into assets that have the potential to increase in value. Decide to take action and watch your net worth grow beyond your wildest dreams over time!

Track Your Net Worth Like A Hawk

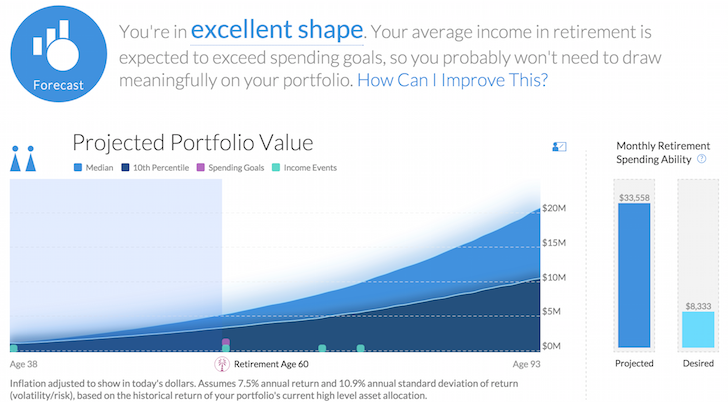

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. You can use Personal Capital to track your spending, manage your net worth, and make sure you are not paying excessive investment portfolio fees with their award-winning Investment Checkup tool. I discovered I was paying $1,700 a year in fees I had no idea I was paying until I used Personal Capital.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely check to see how your finances are shaping up as it’s free. There is no rewind button in life, so you might as well do the best you can now to make sure your finances are in good shape.

Updated for 2020 and beyond.

The post What Income Level Is Considered Rich? appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments