A Bond Yield Table Makes It Clear Which Duration You Must Choose

2:30 AM Hopefully, everybody has been building a CD Step Stool or a Bond Step Stool (not a ladder) in this rising interest rate environment. A Step Stool is the smarter approach because the short end of the yield curve has been rising faster than the long end.

Hopefully, everybody has been building a CD Step Stool or a Bond Step Stool (not a ladder) in this rising interest rate environment. A Step Stool is the smarter approach because the short end of the yield curve has been rising faster than the long end.

The Fed Funds rate is the shortest of the short end, given it is the overnight interbank lending rate. The idea is that the more the Fed Funds rate increases, the higher yields should rise for longer duration lending rates due to the time value of money.

But the market controls longer term lending rates, and the market is currently telling the Fed to bugger off. Investors have found comfort in longer term bonds because their risk appetite has diminished. They don’t see inflation on the horizon nor do they see rosy good times.

To understand why buying shorter duration bonds and certificates of deposits is the optimal financial move for your cash, let’s take a look at a simple bond yield table.

Bond Yield Table Shows Why Shorter Is Better

First of all, can we give a moment of thanks now that we can generate a reasonable return on our cash? We’ve been able to grow our net worths tremendously since the 2008 – 2009 recession. Now we get to protect our net worth with higher guaranteed rates. Pinch me silly!

The key is to create multi-generational wealth so that our kids never have to work again. With no student loans after college and one of our many fine homes to inhabit for free, their lives will be set. We just need to make sure we never tell them how financially savvy we really are, lest they turn into unproductive early retiree bloggers.

Take a look at this bond yield table. You will see that riskier bonds pay more at every duration and longer durations pay higher yields than shorter durations.

Source: Fidelity bond yield table as of Dec 5, 2018

Let’s zero in on U.S. Treasury bonds, the safest of the safest bonds you can buy. Unless you think the United States is going to default on its debt obligations, you will get your money back. Remember, the United States can simply print more money.

Based on the chart, you can lock your money up for one year and get a 2.74% return, state tax free. Alternatively, for 0.22% more, you can lock your money up for 10 years and get 2.96%. The 10-year bond yield is usually considered the risk-free rate of return, but the reality is that any of these Treasury bond durations can be considered the risk-free rate of return.

You would have to be a moron to tie your money up for 10 years for such a tiny premium. And you would be a fool to own a 3-year or 5-year bond when you can own a 2-year bond with the same yield.

None of us can accurately predict where will we be 10 years from now. You might move for a job or want to buy a house during this time period. Some of us might even be dead, which would be such a waste of money. Further, even a slight uptick in inflation several years from now will wipe away any real returns you may have.

The savvy investor’s best move is to build a Bond Step Stool consisting of only 12-month duration bonds or shorter. For example, every month you can purchase a 6-month bond yielding 2.56%. After six months, you will always have liquidity to reinvest every month.

When the Fed is in the process of raising rates, you’ll maximize your cash returns because you’ll be able to more quickly take advantage with shorter lockups. The value of optionality increases in a rising interest rate environment full of uncertainty. When the Fed is in the process of lowering rates, you want to own longer duration bonds with higher yields to delay the inevitable drop.

Cash Is Now A Wonderful Asset Class

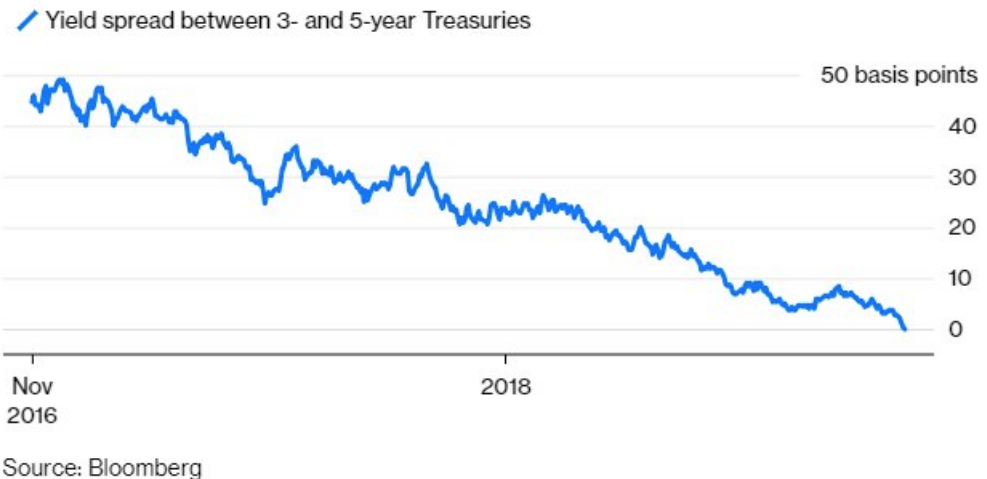

It is my hope the yield curve (10-year minus 2-year bond or shorter) does not invert, even though the 5-year minus 2-year curve already has. An inversion would likely bring a recession within 12 – 18 months if history is any guide. Instead, I hope the yield curve slightly steeps so that equities don’t have to face such a headwind and the return on cash can continue to increase.

You’ve got to ask yourself after making so much money since the financial crisis: Does the peace of mind that comes with earning 2.5% – 3% risk-free outweigh the benefits of potentially making 10% or losing 10% in the stock market?

If the answer is yes, then overweight bonds or cash in your public investment more portfolio. If not, then overweight equities and get accustomed to volatility and potentially losing money. It will help if you use real numbers.

Let’s say you have a $1,000,000 portfolio using the above return assumptions. You must compare earning $25,000 – $30,000 from your portfolio risk-free versus making $100,000 or losing $100,000. Is the extra $70,000 – $75,000 worth the risk of potentially losing $100,000? Only you can decide.

I would be surprised if the S&P 500 can make a 10% annual return any time over the next five years. A more reasonable return assumption is probably closer to +/- 5%, which makes owning Treasury bonds that much more attractive. The equity risk premium is simply not high enough to take on too much risk at this point.

Decide your financial fate with impunity. I’m happy with slow and steady returns as an unemployed person with a son to raise. A 3% – 4% risk-free return on my entire net worth each year sounds sweet to me. When you have the option of eliminating financial stress, make it so.

Readers, why are some investors buying long-duration bonds? Do you think the Fed will relent to the market and stop raising rates as often in the future? Why would anybody think an inverted yield curve doesn’t foreshadow a recession? If you’re looking for a high yielding money market account that can be withdrawn at any time, check out CIT Bank at 1.85%.

The post A Bond Yield Table Makes It Clear Which Duration You Must Choose appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments