Three Things I Learned From My Estate Planning Lawyer Everyone Should Do

2:37 AM My estate planning lawyer said something interesting before I decided to hire her. “People who aren’t rich might need estate planning more than rich people because they might not be able to afford to pay probate fees in the case of an untimely death.”

My estate planning lawyer said something interesting before I decided to hire her. “People who aren’t rich might need estate planning more than rich people because they might not be able to afford to pay probate fees in the case of an untimely death.”

Leave it to the US court system to make the distribution of your assets upon death, cumbersome and costly. Without a will or a Revocable Living Trust, beneficiaries will pay anywhere from 3% – 8% of the assets in fees in probate and could take potentially a year or longer for all assets to be properly distributed.

Probate fees include: personal representative fees, court fees, attorney’s fees, accounting fees, appraisal and business evaluation fees, bond fees, and other miscellaneous fees.

In comparison, settling a Revocable Living Trust on average “only” costs between 1% – 3% of assets. But in addition to a clear directive of where your assets are to go, another benefit of a Revocable Living Trust is privacy. As a Stealth Wealth practitioner, the last thing you want is everybody to see what you had and what you’re giving.

Think about the type of infighting that may happen amongst your beneficiaries if they deem your gifts unfair. Think about all the scrutiny your child might get if people find out she gets a large sum of money before adulthood. She just lost a parent or two for goodness sake. As a parent, the last thing you want is for your children to be judged by others.

Estate Planning Realizations

Once you have a child, creating a clear will and setting up a Revocable Living Trust is the responsible thing to do. Privacy, clarity, cost savings and succession planning are all important benefits.

Here are three other realizations that came out of my estate planning session all of you should probably follow. I already paid the lawyer thousands of dollars in fees, so you might as well take advantage.

1) You must forecast your death. Time is our greatest asset. This truth is no more apparent than when you’re talking to a lawyer about death. In my 20s and 30s, I thought that if I could live a healthy life until 60, I’d die a satisfied man. Leaving the workforce at age 34 was my way of maximizing the probability of living life with as little regret as possible. I kept thinking how horrible it would be to work at a job I no longer loved until 60 and then dying soon thereafter.

Now that I’m a father, I wish to prolong my mortality until at least 75. My new goal is to live long enough to see my 19-month-old son grow up to be a wonderful, independent man with a life partner. Leaving this world knowing someone loves him as much as his mother and I do will let us die in peace. As a result, my wife and I are taking more action to live healthier lives.

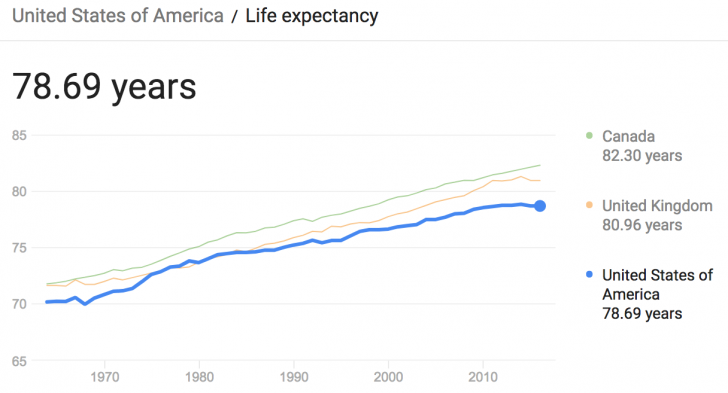

The average life expectancy for those born in 2018 in the United States is 76 for males and 81 for females. Although we are living longer, you’ll soon find out that life is not nearly as long as you want it to be. At my age, I’ll be damned if I waste a single day doing something I don’t absolutely don’t want to do.

2) You must forecast your wealth and estate tax laws. Time is also our greatest asset for creating wealth due to the power of compounding. You will be pleasantly surprised by how much you can accumulate over an extended period of time through diligent savings and reasonable returns. Once you’ve made your best assumptions on how much wealth you will have accumulated by the time you die, you must then forecast the lifetime gift tax exemption and the death tax rate at the time of your passing.

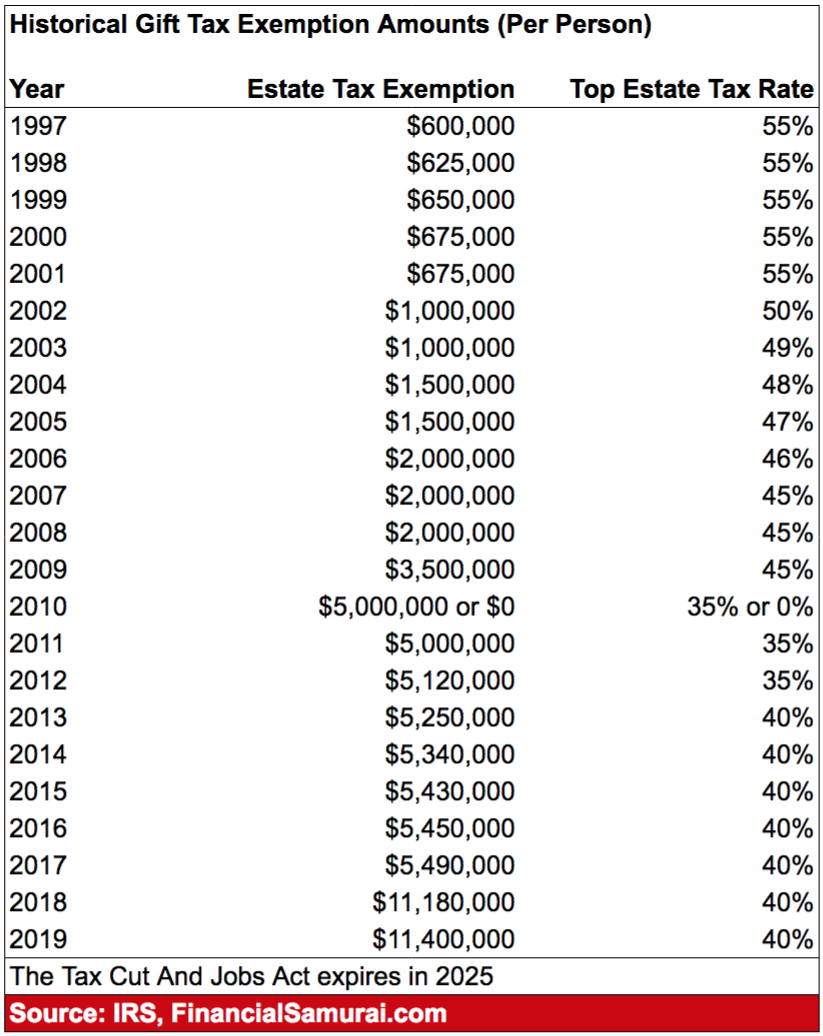

For example, in 2019 the lifetime gift tax exemption is $11,400,000. The top marginal tax rate remains at 40%. If you die in 2019 with $21,400,000 in wealth to pass on, your tax bill will be $4,000,000 ($21.4M – $11.4M = $10M X 40%).

On the other hand, if you die in 2030 with $20,000,000 when the lifetime gift tax exemption has declined to $5,000,000 and the death tax rate has risen to 50%, then your inheritor’s tax bill will be $7,500,000 ($20M – $5M = $15M X 50%). That is a shocking amount of taxes to pay on top of the taxes you already paid to accumulate such wealth.

Based on history, you can see from the chart that currently, we are at the highest estate tax exemption with the lowest death tax rate since 1997. It may be logical to assume a continued increase in the estate tax exemption and a continued decrease in the estate tax rate given the 22-year trend.

However, the doubling from 2017 to 2018 is an outlier. Therefore, it is also reasonable to anticipate an estate tax exemption decline and/or estate tax rate increase after the Tax Cut And Jobs Act expires in 2025.

3) You must give and spend more while living. In the scenario above where your inheritor must pay a $4,000,000 tax bill, unless your inheritors are already wealthy, they may be forced to sell some of your assets to pay for the tax liability. If part of your estate is your business that you want to continue long after you’re gone, then you may have some problems.

Would you rather pay a $4,000,000 tax bill to the government on assets you already paid taxes on or donate the same $4,000,000 to charity while you’re still alive and see how much good your gift will do?

Would you rather pay a $4,000,000 tax bill or spend more money on yourself and loved ones? If there is a high likelihood your estate will be worth more than the lifetime tax exemption amount, it seems obviously better to utilize your wealth while living, rather than after death.

Let’s say it takes 20 years to get to a $21,400,000 estate from $5,000,000 currently using $200,000 annual contributions and a 5% compound annual growth rate. In 20 years, the estate tax exemption is still $11,400,000 at a 40% death tax rate.

A better strategy would be to not save $200,000 a year, but spend $200,000 a year on charity and loved ones for the next 20 years. Without saving a single penny every year, you would still end up with $13,266,000 at a 5% compound annual growth rate. Therefore, your death tax would be a more reasonable $746,400.

One common strategy to utilize for estate tax liability is life insurance. You can even set up a life insurance revocable trust so it doesn’t count toward your estate exemption amount. If a large part of your estate includes a business you don’t want to sell to pay for estate taxes, then using life insurance or other liquid assets is a solution.

Estate Planning And Consumption Smoothing

People who have been saving and investing for so long often overestimate how much they’ll need to feel comfortable. I firmly believe the vast majority of financially savvy people will die with too much. This lack of financial clarity is the reason why everyone needs to do a better job at forecasting their wealth so they can consume it more smoothly while still alive.

If the estate tax exemption amount decreases or the death tax rate increases or both, then there’s even more reason to spend your money now while living. Unless you’re incredibly stingy, hoarding much more than the estate tax exemption limit upon death makes zero sense.

My estate planning lawyer really opened my eyes to how overly frugal I am. From driving an economical car for 13 years to downsizing our home in 2014, our expenses are where they were in our 20s. Yet, our income has grown. Based on our forecasts, there is a high likelihood that we will have to pay estate taxes at our current rate.

To figure out how much more we could spend today in order to avoid paying estate taxes, I simply logged onto Personal Capital and ran a Retirement Planning calculation after inputting some income and expense assumptions.

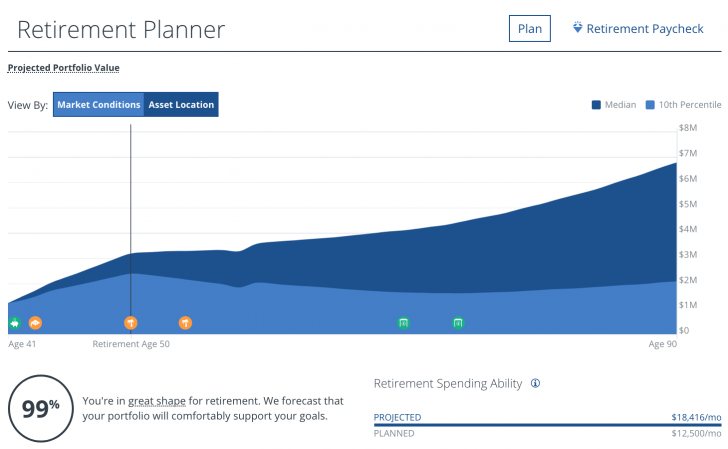

For illustrative purposes, the output shows that using a $1,225,000 investment portfolio, I have a 99% chance of reaching my planned monthly retirement spend of $12,500 starting at age 50. The portfolio has a projected spending ability of $18,416 a month based on its current asset allocation.

With almost a $6,000/month overage on how much I can spend starting at age 50 in retirement, I plan to up my spending by $1,500 a month starting next year, so long as the economy doesn’t go into a recession. If our wealth increases the following year, we’ll up our spending even more, but still maintain a comfortable buffer based on what the retirement planner spits out.

This additional spending budget may help us get over our reluctance to pay for private school tuition if our son doesn’t win the SF public school lottery. Just doing this estate planning exercise makes me feel much better about spending more money overall. I’m confident that once you run your numbers, you’ll be able to start spending more freely as well.

If you have dependents, please write out a will and/or create a revocable living trust. Not only will you better protect your loved ones, but you’ll also learn a lot more about yourself in the process.

For those of you who’ve gone through the estate planning process, what else did you learn about yourself and about estate planning laws? Why do people hoard so much more than the estate tax exemption amounts? Wouldn’t it be better to spend and give while alive than after death?

The post Three Things I Learned From My Estate Planning Lawyer Everyone Should Do appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments