Common Financial Blind Spots On The Road To Financial Independence

2:32 AM If there’s a car in your blind spot and you swerve suddenly to the right, there’s a good chance you’ll get into an accident. Your accident will not only cost time and money to fix, you might also suffer an injury or even die. If you have a financial blindspot, the consequences can be just as severe.

If there’s a car in your blind spot and you swerve suddenly to the right, there’s a good chance you’ll get into an accident. Your accident will not only cost time and money to fix, you might also suffer an injury or even die. If you have a financial blindspot, the consequences can be just as severe.

I can’t teach you how to be a better driver except to encourage you to slow down. But I can point out some financial blindspots to allow you to live a better life.

Here are five of the most common reoccurring misses that I’ve observed over and over again.

Common Financial Blindspots

1) Comparing someone’s middle to your beginning. Some of the most clueless people about money are in their 20s. Yet ironically, some of the most vociferous people who think they know it all also happen to mostly be in their 20s. Fascinating! They rage against the people who bought their own house by 28, accumulated a million dollars in after-tax investments by 35, and started making over $100,000 a year after going to graduate school.

Yet, they haven’t given their life enough time to compound. It’s as if they want to get ahead but refuse to work more than 40 hours a week. If you want to be average, work the average number of hours a week and be happy. But if you want to be above average, you just might have to put in more time.

I’ve noticed through thousands of comments over the years that this rage starts dying down after someone hits 40. By 50, there is much more harmony and agreement with posts such as, Here’s How Much You Should Have In Your 401(k) By Age. See for yourself by reading how the angst fades the older the commenter gets.

Repercussions: Resentment, anger, and bitterness towards a large swath of people. With so much resentment, you end up going to your local hardware store and buying a pitchfork to stab anybody who has more than you. Instead of taking action to improve your financial situation, you use your negative energy to attack others and try to bring them down to your level. It hardly ever works folks!

2) Thinking parenting is easier and cheaper than it is. For those suffering from this blind spot, they either don’t have kids or are a parent working outside the home.

Being a full-time parent is harder than almost any job I can think of because it is 24/7 and the stakes are so high. One look away could mean a bloody bonk on the head or a drowning, the #1 cause of death for children under four. As a result, when looking after a child, you can never mentally or physically relax 100%. Over time, your nerves will begin to fray without relief.

For 13 years I worked in finance, including three years where I also attended business school part-time. I can state unequivocally that being a full-time parent is harder than working 80 hours a week in one of the most cutthroat industries.

I’ve met so many working dads who think raising a child is easy simply because they don’t take care of their kids most of the day. It’s either their spouse or daycare that takes care of the child. The working spouse tends to take the stay at home spouse for granted, and then the relationship begins to break down.

I’ve also encountered childless couples who criticize stay-at-home parents for hiring help. They think it’s nuts for a stay-at-home parent to hire relief for several hours a week so the parent can take a shower, exercise, and spend time quality time with friends and loved ones.

Repercussions for having this blind spot: Resentment, fighting, unhappiness, neglected kids, rebellious kids, divorce, financial ruin, and many more years of work. Think about it. Despite loving their kids more than anything in the world, parents still get divorced, even though they know that having two supportive parents is better than one. They didn’t anticipate or appreciate the strains kids put on a marriage and on their finances. If you can’t comfortably take care of yourself, consider postponing having kids until you can.

3) Thinking everybody can just move to a lower cost area of the country and be happy. Everybody knows the Midwest and South are lower cost areas of the country than the coasts. Investing in non-coastal cities is a no-brainer in my opinion. Therefore, one of the key blind spots happens when some people who have no problem blending in tell people in HCOL areas to just relocate.

Here are some responses from a couple readers who are minorities addressing one reader who had asked, “Do people really care about diversity?” after I discussed one of the positive attributes of living in LA.

Mercury: Yes, not just diversity of race, sexual orientation, etc, either. Diversity of thought, travel, differentiated industries, food, cultural options, hobbies, etc. I lived in the midwest most of my childhood. Almost the entire male population spends its weekends only watching sports. Live in NYC now and don’t have to deal with that, can find plenty of people doing interesting things outside of watching other men play sports because there is a diversity of viewpoints.

A large amount of the increased real estate prices in places like Manhattan or SF are actually due to diversity. In my case, I’d rather pay $5k per month for a 1-bedroom in a large vibrant coastal city than live for free in the midwest.

Lilia: YES, that is a big part of why I live where I live!

I used to live in Central Ohio where the #1 and #2 hobbies seem to be drinking and watching football. I don’t enjoy either of those activities.

With greater diversity, you’re more likely to meet people who have interesting hobbies. More likely to meet people who were born in other countries and share their experiences and perspectives.

Also, being non-white, you’re less likely to get the “But where are you REALLY from?”, “Where did you learn to speak English?”- type questions. Because even the white people around here are used to more diversity.

Not saying people from racially homogenous areas are inherently bad or racist. They were just raised where everyone looks the same, which is part of the problem.

Repercussions: Uprooting your entire life to save on costs only to move back because you couldn’t comfortably assimilate. Racial tension online and offline. Homogeneity in the FIRE community where the majority comes from low cost areas and all looks the same. A widening cultural gap between HCOL and LCOL residents. Bigger and bigger echo chambers.

The best way to understand what it’s like to be a minority is to live for several years in a foreign country whose main language is not English and whose dominant racial lineage you do not share. Hopefully, most of your experiences will be positive, but there will also surely be some bad experiences which may be great for better understanding.

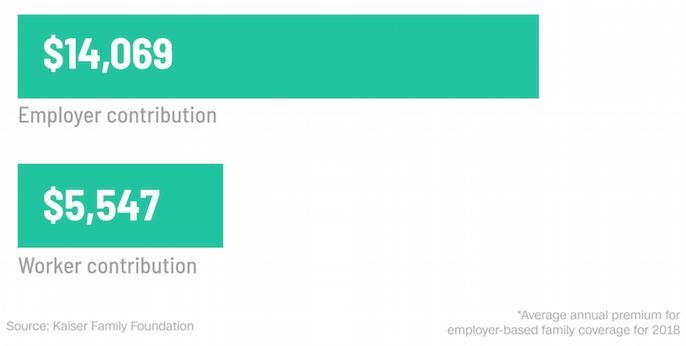

4) Underestimating health care costs in retirement. Because employers subsidize most and sometimes all of their employees’ health care costs, employees either don’t know what their true health care costs are, or they take these benefits for granted.

It’s the same reason why so many freelancers get into trouble when it comes time to pay their taxes. When they were working as full-time employees, their employer facilitated the payment of an estimated tax from each paycheck. If the government didn’t require this practice, it would have difficulty collecting the majority of its tax revenue.

Here’s one reader’s questionable response to my article, Why $5 Million Is Barely Enough For A Family Of Three To Retire Early On where he criticized the featured couple’s budget:

“Our healthcare costs are a rounding error and not even worth mentioning, we are both healthy young 30s.”

Commenter Sean and his wife are 31, don’t have kids, and think the profiled couple’s budget is ridiculous. Sean does not seem to realize that his healthcare costs are a rounding error because his employer pays for most of the cost!

Sean also seems to have a double blind spot. One, he does not recognize that healthcare costs rise with age and family. Two, he erroneously equates better health with lower premiums. In America, the richer and healthy subsidize the poorer and less healthy. This is the law.

Repercussions: Having to go back to work with your tail between your legs because you underestimated the cost of health insurance. $20,000 a year is at least $25,000 in gross income that must be earned to pay for such cost. Alternatively, you need $625,000 in retirement capital at a 4% rate of return to pay for this cost alone. Needing over $1,000,000 in after-tax investment accounts to live comfortably in retirement doesn’t seem as far-fetched anymore.

5) Believing the only path to financial independence is through a high income. Obviously the higher your income, the more you can save. Just don’t tell this to the countless high income earners who have blown away all their money and have nothing to show for decades later. It’s often harder to stay disciplined financially if you have a higher cash flow. Why do you think the majority of Americans are overweight? It’s because when the cookie jar is in front of you, you tend to eat more cookies.

If you believe the only way to wealth is through a high income, then you’ve already defeated yourself. You’ll believe working on a side hustle, like driving a car, assembling furniture, or flipping burgers is beneath you. You probably won’t be willing to put endless hours in an online entrepreneurial endeavor because you think only special people with money can do something unique.

Besides building more income streams through entrepreneurship or side-hustles, you’ll also neglect the extremely obvious method of building wealth through investing or real estate. Risk must be taken to receive reward.

Repercussions: Not living your best life.

Curing Blind Spots Is Hard

Nobody’s situation is the same. Some will have more financial difficulties than others based on their abilities and circumstances. However, I firmly believe we can all make financial progress, no matter where we start off. If we have the opportunity to help others, all the better.

The easiest way to shine light on a blindspot is to listen to those who’ve been there before. Plenty of people have achieved financial independence before, so you might as well taken in what they have to say.

Recently, I learned about one of my many blind spots from a reader. Against the herd, he felt the budget for the LA couple with $5 million in after-tax- investments was not only fair, but even a little modest.

He wrote, “No matter how disciplined you are, you always want the best for your children. It hurts to see other kids have more than yours and get to experience better things in life. This is much more so when you have $6,000,000+ in the bank. You know you can ‘afford’ to give your kid anything. You are choosing not to. It seems selfish at times even if you know in the long run it may be the right thing to do.

For men, this is also true for our wives. I know many on this site have frugal spouses and they don’t ‘want’ the finer things in life. Mine is certainly willing to live without. But, I don’t like seeing my wife do without, knowing I have millions in the bank. All within reason of course.”

I replied, “It’s interesting, but I’ve never thought about it being painful to not get my wife the finest XYZ because we have money. It’s probably because she’s thrifty and hardly ever shops or wants anything.”

He responded smartly, “It might be that your wife wants more than you think, but she loves you and wants to support you in your FI goals. Her desire to make you happy may easily outweigh her desire to spend money. Took me awhile to figure that one out. Doesn’t necessarily mean she wouldn’t prefer the finer things in life if she genuinely believed it wouldn’t bother you. Could also be she is wired exactly like you. In that case, congrats on winning the spouse lottery.”

Ah hah! I’ve known my wife for 20 years now and I’ve always assumed she was super frugal and thrifty just like me. She tells me she doesn’t like shopping, and her favorite store is Target and not Gucci. But I also notice her glee when she shops for little things online like a childhood Swatch she once had and lost.

My wife is definitely suppressing some of her consumption desires because she knows as the one in charge of our family investments and keeping us from not having to go back to work with the continued operation of this site, life can sometimes get stressful.

Life is so much better when we’re able to listen to what other people have to say, and then share our own thoughts and solutions. So long as we have an open mind, I don’t see why we all can’t keep progressing.

Related: Achieving Financial Independence On A Modest Income: $40,000 In Manhattan

Readers, what are some financial blind spots you’ve encountered on your road to financial freedom? Why do you think these blind spots exist?

The post Common Financial Blind Spots On The Road To Financial Independence appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

0 comments