Great Things To Buy With Your Massive Investment Gains

8:05 AMAfter about 13 years of diligently saving 50% – 75% of my income, I started to lose steam. No longer was I obsessed with growing my wealth as large as possible. Instead, I wanted to find ways to start spending money for a better life. I was 35 years old in 2013 and tired of living so frugally.

It’s hard to spend money when you’re so used to saving and investing aggressively for so many years. In a big way, growing your money pot gets addicting, especially since the estate tax exclusion amount is now $11.58 million per person for 2020. But it’s important to consumption smooth, otherwise, you’ll likely die with way too much.

The main way I’ve forced myself to increase my spending is to review my investment gains for the year and take some profits on positions I think have limited upside potential. I then use these profits to pay for a better life.

One idea is to follow my 10X Investment Consumption Rule, which states that if you want the latest $1,000 iPhone, then you best make at least a $10,000 return on an investment to pay for that unnecessary item.

Another way to go about spending your money is to take 10% of your annual investment returns and blow it on whatever you want. This way, you’ve still got 90% of your investments hopefully working for you, you’re not paying a lot of taxes, and you’re rebalancing your portfolio.

If you tether consumption to investment returns you will never go broke. You will also likely eradicate any money guilt you have for spending money. Finally, if you want to spend more money, you will be motivated to invest more money for hopefully greater returns.

Your Massive Investment Gains

With the S&P 500 up ~25% and the NASDAQ up ~35% in 2019, a lot of investors have made a ton of money in stocks. Just think about the absolute dollar amounts for a bit.

If you had a $250,000 S&P 500 portfolio at the beginning of the year, you’re up $62,500. Using 10% or $6,250 to pay for some goodies sounds great.

If you had a $500,000 S&P 500 portfolio at the beginning of the year, you’re up $125,000. 10% of $125,000 is $12,500 for holiday shopping.

If you had a $2,000,000 S&P portfolio at the beginning of the year, you’re up $500,000. Why not spend $50,000 on some great experiences and things you want for you and your family? Your portfolio is still worth $2,450,000!

Then, of course, there are the gains you’ve made from all your other investments. But if we start calculating those, things might get out of hand.

You can decide to take profits to pay for a better life or you can just use your cash savings or cash flow to spend an amount equal to 10% of your paper profits. I personally like to take profits to pay for things because it feels like I’m getting something for nothing. Further, just in case my investments depreciate, at least I’ll have bought something longer-lasting.

Given the massive returns in stocks, I’m confident the 2019/2020 holiday shopping season is going to be robust! Not only is the consumer going to spend handsomely this season on things we really don’t need, I also believe there will be renewed interest in buying real estate in 2020+ as well.

Things To Buy With Your Investment Gains

I know the most frugal of you will scream at the lavishness of some of these purchases. But don’t forget, they are all to be bought with just 10% or less of your annual investment gains. So relax and live a little!

Depending on your returns, here are some things to buy with your investment profits that will improve your life.

1) The perfect mattress. ($1,000 – $5,000) We sleep on our mattresses 6 – 8 hours a day on average. If you want to be productive while you’re awake, a good mattress should help facilitate a good night’s sleep. Mattresses should be changed about once every 10 years for optimal performance and hygiene. If you have allergies or don’t like bed bugs, changing your mattress every 10 years should help, along with an allergen cover. We bought Four Seasons Essentials mattress encasements for all of our mattresses to help extend their life and reduce allergens.

2) A humidifier ($50 – $500). The air gets dry during the winter. As a result, your throat and nasal passages can also dry out. Get a high-tech humidifier to help regulate the humidity in your room to allow you to breathe better. Dyson makes a fancy one that costs about $500 full price, that you can try to snag for under $300 on sale. James Dyson is worth over $10 billion because his products are next level. If you want a way more budget friendly option, the TaoTronics Cool Mist 4L Ultrasonic Humidifier is a popular choice.

3) A Nest thermostat ($200 – $300). A Nest thermostat is great for controlling the temperature of a room, floor, or entire house from an app. The thermostat will learn about your temperature preferences throughout the day and automatically adjust itself accordingly. You can also easily program temperatures throughout the day and week with your phone. The 3rd Gen Nest Thermostat comes in a bunch of colors now and works with 95% of 24-Volt heating and cooling systems. We own three of them across two properties.

4) A Dyson vacuum cleaner ($200 – $800). After we got the Dyson Animal V7, I began to love vacuuming the house every week. Not only is the Animal powerful, it’s cordless, saves your back, and it’s very gratifying to see all the dust and debris collect in the see-through canister. Those old, loud, and heavy vacuum cleaners are so passé! I loved mine so much that I bought my parents one too.

5) A Coway air purifier ($200 – $1,500). The air quality in your home can often be worse than the air quality outside. Why not purify your air of excessive bacteria, dust, and other impurities, especially if you work from home, have allergies, have asthma, and/or have little ones? I like the Coway Airmega line of Smart Air Purifiers which automatically adjusts fan speed based on the amount of pollutants in the air in real time. They come in a range of sizes with or without wifi/app functionality too.

6) A full body massage ($60 – $200/hour). One of the best investments I’ve made over the past five years is getting a monthly massage at home. The masseuse will come to you with a massage table and knowledge of what type of massage you like. You can always get a chair massage at the mall as well for $1/minute.

7) A hot tub ($5,000 – $25,000). Several years ago, I bought a Sundance Altamar hot tub for about $13,000 after tax. It has been the best $13,000 I ever spent! I spend about three hours a week in the hot tub to relax, read, and think of new post ideas. Just know that if you want a hot tub, you’ll also need to pay an electrician to run the wires into your electrical main. You will likely also have to pay for shipping and maybe even a crane to get it over your roof. I gotta say though, some of my best work was written in the hot tub.

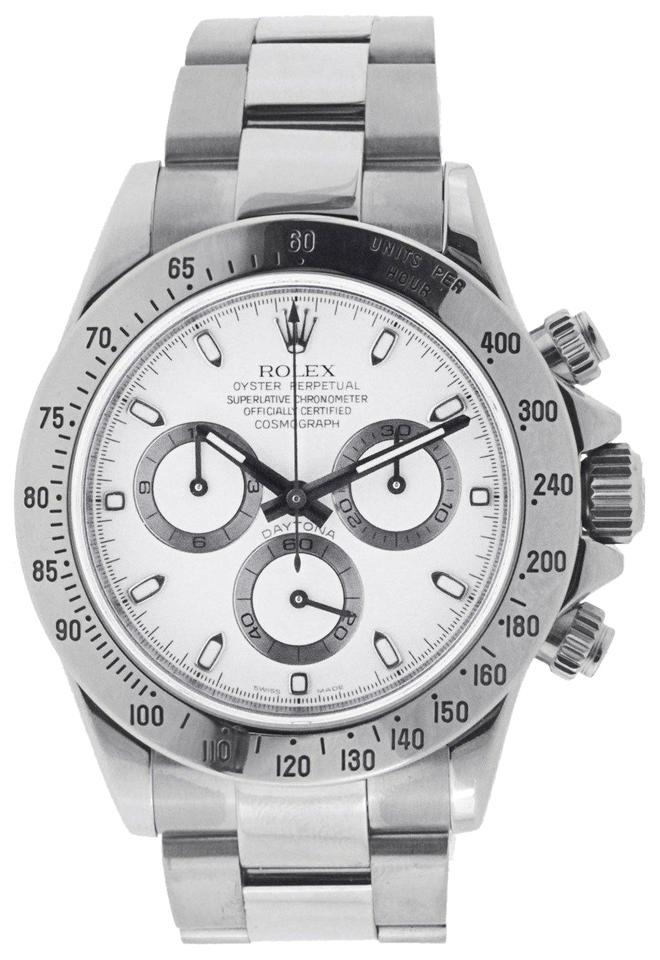

8) A rare stainless steel watch ($7,000 – $20,000). There’s no limit to how much you can spend on watches, which is why I focus on stainless steel watches to keep costs reasonable. You don’t want to buy a watch that is available at the store. Instead, you want to buy a watch that is a limited production or that can only be bought after you spend X amount. This way, your watch will more readily appreciate in value and also be more unique. A classic example of a rare stainless steel watch the continues to appreciate in value is the Rolex Daytona. You can’t buy one for list price unless you’re on the dealer’s special list. For more info on buying and selling watches, you can read about my side hustle as a watch dealer.

9) A safer car ($30,000 – $100,000). According to the National Safety Council, there were over 40,000 car accident deaths in America in 2018. The main causes of death are drunk driving, speeding, and cell phone use. If you drive often and/or or often have multiple passengers, it’s worth ponying up for the safest car you can afford, even if it violates my 1/10th rule for car buying. Here are some of the safest cars to choose from.

10) A Toto bidet ($400 – $1,500). My other favorite household item is a Toto Washlet electronic bidet with heated seats, automatic opener, automatic cleaner, and warm air blow dryer. Having lived in Asia for 13 years, I still don’t understand why Americans just use toilet paper to clean themselves like humans did 200 years ago. If you don’t have an electrical outlet close to your toilet, then get a non-electric bidet like the Luxe Bidet. It’s only about $35 bucks and can be easily installed yourself. Spraying yourself with cool water is better than no water!

Enjoy Your Shopping Spree

As for what I plan to spend money on this holiday season, here’s my list:

- $300 for two full-body massages

- $250 for house cleaning

- $200 for gardening

- $200 for a new Wilson Clash tennis racket (first upgrade in 3 years)

- $120 for a new sports jacket with zipper pockets (unless my high school gives me one for free this Feb)

- $6,000 for new blinds

- $11,000 for new windows (undecided)

- $500 for extra childcare help over two months

- $200 for a year-end celebratory dinner for two

- $400 for a year-end celebratory dinner for four as my parents are coming to town

- $500 to test out a new customized meal delivery service

- $300 for a secret gift

The total comes to $19,970 if I include new windows or $8,970 excluding windows. Whatever I do spend, it feels great knowing that everything will be had for free with investment gains.

I no longer get much joy buying material things. My spending is now mostly focused on services, experiences, and replacement items. Once you own a car you enjoy, a home you love, and a reliable phone and computer, everything else is either unnecessary or affordable.

Let’s hope the bull market continues. And if it doesn’t, at least we took some profits to pay for a better life!

Readers, what’s on your list of holiday shopping? If you suffer from frugality disease, what are some tips and tricks you use to force yourself to spend more money?

Related: The Best Credit Cards For Online Shopping

The post Great Things To Buy With Your Massive Investment Gains appeared first on Financial Samurai.

from Financial Samurai

via Finance Xpress

1 comments

Good day everyone!

ReplyDelete--

Do you need a loan to start up business? pay off bills? we offer all kinds of financial assistance to every individuals Such as:

*Business loan

*Personal loan,

*House purchase loan.

*Student loan,

*Investment Loan

*Debt consolidation and House purchases Etc. We Offer is affordable at an interest rate of 2%.

Note: These offer is for serious minded honest and sincere people Only.

Email: andersonraymondloanfinance@gmail.com

Text or call: +1-205-5882-592. (Calls.)

Office Address is 68 Fremont Ave Penrose CO, 81240.

CEO: Mrs Helen Albert